Quiz Summary

0 of 80 Questions completed

Questions:

Information

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading…

You must sign in or sign up to start the quiz.

You must first complete the following:

Results

Results

0 of 80 Questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 point(s), (0)

Earned Point(s): 0 of 0, (0)

0 Essay(s) Pending (Possible Point(s): 0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- Current

- Review

- Answered

- Correct

- Incorrect

-

Question 1 of 80

1. Question

Consider an exposure with a value of $30.0 million. In L(+)/P(-) format, its expected loss is 4.0% with volatility of 15.0%; i.e., μ(L/P) = +4.0%, σ = 15.0%. Conveniently, the exposure happens to have a normal distribution. Which is nearest to the single-period 97.5% expected shortfall (ES)?

CorrectIncorrect -

Question 2 of 80

2. Question

Among its financial positions, Zapex Financial Corporation has written a call, entered into an interest rate swap, and written a credit default swap. Among these (the following) four positions, which is the BEST example of wrong-way risk?

CorrectIncorrect -

Question 3 of 80

3. Question

In December 2017, the Basel Committee (BCBS) made several revisions to the Basel III framework. This included revisions to both the standardized approach to credit risk (“Credit risk accounts for the bulk of most banks’ risk-taking activities and hence their regulatory capital requirements. The standardized approach is used by the majority of banks around the world, including in non-Basel Committee jurisdictions,” wrote the Committee) and the internal ratings-based (IRB) approaches to credit risk (“The financial crisis highlighted a number of shortcomings related to the use of internally modeled approaches for regulatory capital, including the IRB approaches to credit risk. These shortcomings include the excessive complexity of the IRB approaches, the lack of comparability in banks’ internally modeled IRB capital requirements and the lack of robustness in modelling certain asset classes,” wrote the Committee).1

In regard to these December 2017 revisions to credit risk approaches in Basel III, which of the following statements is TRUE?

1 “High-level summary of Basel III reforms,” (Basel Committee on Banking Supervision Publication, December 2017)

CorrectIncorrect -

Question 4 of 80

4. Question

An asset that is not very liquid is quoted bid $89.00, offer $96.00. Which is nearest to the proportional bid-offer spread?

CorrectIncorrect -

Question 5 of 80

5. Question

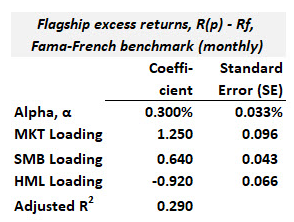

Richard conducted a factor regression for his firm’s Flagship Portfolio. He used the three-factor Fama-French specification where the factors are MKT (the market), SMB (small stocks minus big stocks), and HML (value stocks minus growth stocks). His factor regression results are displayed below.

Please note the regression is based on monthly returns. Each of the following statements is TRUE about these factor regression results EXCEPT which is false?

CorrectIncorrect -

Question 6 of 80

6. Question

The riskfree rate is 5.0% while the current stock price is $80.00. Two most liquid options both have a strike price of $70.00 such that the ratio K/S(0) = 0.90. In addition to the same strike price, both options have the same maturity of three months, T = 0.25 years. The implied volatility of the call is 30.0%, and the implied volatility of the put is 38.0%. What is the trade that exploits this scenario, if any?

CorrectIncorrect -

Question 7 of 80

7. Question

Consider a netting set with two derivative positions: an interest rate swap (IRS) with a marginal CVA of -1.450 and a cross-currency swap (CCS) with a marginal CVA of -1.550. If the first transaction is the cross-currency swap (CCS) and its incremental CVA is -2.100, then what is the incremental CVA of the IRS?

CorrectIncorrect -

Question 8 of 80

8. Question

The central feature of Basel III’s first pillar is the regulatory capital (i.e., CET1, Tier 1, and total capital) requirements which require minimum fractions of risk-weighted assets (RWA). In addition to these minimums, as of early 2019 (when the buffers were fully phased in), Basel specifies three buffers: the capital conservation buffer (CCB), the G-SIB buffer, and the countercyclical buffer (CCyB). This is all very confusing, so you ask your colleague Mary to summarize these additional buffers and their motivations. She makes the following five points:

- For all three, the additional buffer must be CET1

- For all three, breach of the buffer requirements implies the bank’s ability to pay dividends will be restricted

- The CCB requires an additional 2.5% of CET1 capital and is meant to ensure that banks have an additional layer of usable capital that can be drawn down when losses are incurred.

- The additional G-SIB requirement includes five buckets {1.0%, 1.5%, 2.0%, 2.5%, or 3.5%} https://www.bis.org/fsi/fsisummaries/g-sib_framework.htm and is meant to reduce the likelihood and severity of the failure of a global systemically important financial institution

- The CCyB requirement varies between zero and 2.5% and is meant to protect the banking sector from periods of excess aggregate credit growth that have often been associated with the build-up of system-wide risks

Is Mary correct in her summary?

CorrectIncorrect -

Question 9 of 80

9. Question

A portfolio holds 100,000 shares of a stock and this single position has a value of $3.0 million. The stock is quoted bid $29.00, offer $31.00. The stock’s daily volatility is 1.43% or 143 basis points. For purposes of value at risk (VaR), we will assume the stock’s arithmetic returns are normally distributed (aka, normal VaR) and the expected daily return rounds to zero (under these assumptions absolute VaR is identical to relative VaR). Which is NEAREST to the position’s one-day 99.0% confident liquidity-adjusted value at risk (LVaR)?

CorrectIncorrect -

Question 10 of 80

10. Question

According to Grinold, typical or illustrative information ratios (IR) include: 0.500 is good, 0.750 is very good and 1.00 is exceptional. In regard to risk aversion, λ, 0.150 is restrained, 0.100 is moderate, and 0.050 is aggressive. Patricia is a manager with a “very good” information ratio of 0.750 and a “moderate” risk aversion of 0.10. If she shifts from this moderate risk aversion to an aggressive risk aversion of 0.050, what is the impact on the optimal level of active risk?

CorrectIncorrect -

Question 11 of 80

11. Question

For his term structure model, Peter considered the Vasicek model, but on reflection, he prefers the Cox-Ingersoll-Ross (CIR). In regard to the CIR, which of the following statements is TRUE?

CorrectIncorrect -

Question 12 of 80

12. Question

Jason is a small business owner specializing in the wholesale of steel. Jason worked hard on his business, so he purchased insurance to help safeguard his company on January 4th, 2023. Later that month, on January 31st, he made a significant payment to secure a shipment of steel that will arrive on February 2nd, 2023. Jason delivered the steel to two clients on February 8th and 9th; however, he did not receive payment from the clients until February 13th. After receiving the proceeds Jason deposited the money at ABC bank.

Among these transaction dates, on which did Jason increase his credit risk?

CorrectIncorrect -

Question 13 of 80

13. Question

Peter is studying for the Financial Risk Manager (FRM) exam, and he thinks the historical evolution of the Basel regulations is confusing. In particular, he wants to better understand the difference between the original Basel I accord (aka, the 1988 Basel Accord that was implemented by 1992) and Basel II, which was finally published over ten years later in 2004. His colleague Mary explains that, in comparison to the original accord, Basel II contained four significant innovations. Specifically, in comparison to the original Basel I accord (which do include the 1995/1996 Amendments) that came before, Mary says that significant innovations in Basel II included the following:

- In addition to credit risk and market risk, Basel II required capital for operational risk

- Basel II eliminated risk weights and risk-weighted assets (RWA) and replaced them with direct calculation of risk charges

- Basel II contained specific requirements for supervision related to capital and risk management (Pillar 2) and required public disclosures (Pillar 3)

- To fine-tune the accord’s design, Basel II made repeated use of Quantitative Impact Studies (QIS) to which banks contributed data (i.e., feedback) that was analyzed by supervisors

Is Mary correct?

CorrectIncorrect -

Question 14 of 80

14. Question

Assume the spot foreign exchange (FX) rate between the US dollar and the Japanese Yen is 110.00 which can be represented as USDJPY 110.00 or JPY 110.00 where USD is the base currency and JPY is the quote currency; aka, quote 110.00 yen per one dollar of the base or “per unit” currency. The USD interest rate is 2.50% and the JPY interest rate is 0.450%. The period is one year, and the compound frequency is annual. If the covered interest rate (CIP) arbitrage framework enforces a perfectly accurate one-year forward exchange rate, then what is the implied one-year “swap rate” which is here simply defined as the difference between the forward FX rate and the spot FX rate; put simply, what is the difference, F(USDJYP) – S(USDJPY), or F(USDJPY) – 110.00?

CorrectIncorrect -

Question 15 of 80

15. Question

Volatility is an important risk factor according to Andrew Ang. The strong negative relationship between VIX changes and stock returns is explained by (at least) two dynamics. The first is called the leverage effect. The “second channel is a time-varying risk premium story and is the one the basic CAPM [capital asset pricing model] advocates,” explains Ang.(†)

Assume the riskfree rate is 3.0% while the equity risk premium (EPR; aka, the market’s expected excess return) is 6.0% because the market’s expected return is 9.0%. According to the CAPM, and consistent with Ang’s theory on the transmission channel between volatility and stock returns, which of the following should cause a DECLINE in a stock’s price?

CorrectIncorrect -

Question 16 of 80

16. Question

An analyst fits a Vasicek model when the current short-term rate is 4.60%. If the theta, θ, parameter is 13.50%, then each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 17 of 80

17. Question

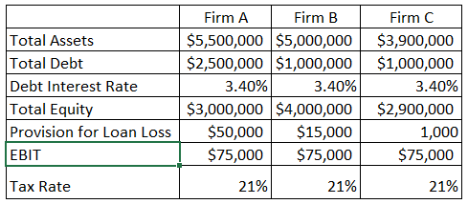

Firm A, Firm B, and Firm C are three companies in the bottled water industry. All companies have a mix of debt and equity in their capital structure. In 2022 all three companies had credit losses that lowered EBIT. Below is a summary of their financial information for the year 2022.

Given the above information, which firm has the higher return on equity (ROE)?

CorrectIncorrect -

Question 18 of 80

18. Question

The three lines of defense model (3LoD) has existed in some variation for over 30 years, although it achieved more visibility in 2013 when the Institute of Internal Auditors (IIA) published its initial position paper on the 3LoD, which it updated in 2021 (The IIA’s Three Lines Model, an update of the Three Lines of Defense). GARP recommends firms refer to this update because the IIA “has refined the model to reflect the evolution of risk management within organizations and aim to foster closer collaboration between business functions including internal audit.”

In regard to the 3LoD model, each of the following is true EXCEPT which is false?

CorrectIncorrect -

Question 19 of 80

19. Question

Liquidity Early Warning Indicators (EWI) can be compared to an automobile’s dashboard signal system where the appearance of a red light points our attention to something that may become a problem if not addressed. Each of the following is a credible red indicator (aka, red flag) in a Liquidity Early Warning Indicator (aka, Liquidity EWI) dashboard EXCEPT which is not a red (red flag) liquidity indicator?

CorrectIncorrect -

Question 20 of 80

20. Question

In factor theory, an asset’s risk premium (aka, expected excess return) is given by E(r_i) – Rf = β(i,m)×λ(m) where the asset’s beta is with respect to the stochastic discount factor (SDF; aka, pricing kernel) and (m) in an index of bad time. Let’s make the following assumptions about an asset:

- The riskfree rate is 3.0% such that E(m) = 1/1.03 = 0.9709

- The variance(m) equals 30.0%^2 = 0.090

- The covariance(r_i, m) equals -0.10680

Which is nearest to the asset’s risk premium which refers to the asset’s expected excess return, E(r_i) – Rf?

CorrectIncorrect -

Question 21 of 80

21. Question

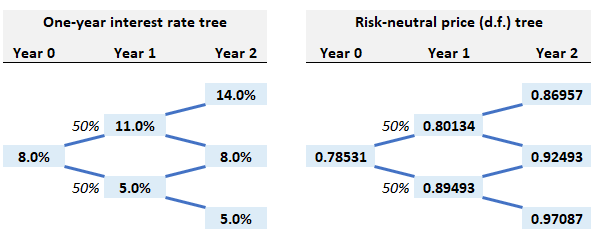

Below (in the left-hand panel) is an interest rate tree for the one-year rate where the initial rate of 8.0% jumps 300 basis points to either 11.0% or 5.0% next year. In two years, the one-year rate will be either 2.0%, 8.0%, or 14.0%.

Next, we will assume a three-year zero-coupon bond. Without a risk premium, for example, the date 0, state 2 price would be 0.877193 = 1/(1+14%). However, we will instead assume a risk premium. Specifically, investors require compensation of 50 basis points for each year of duration risk. The right-hand panel displays the associated risk-neutral (i.e., , assumes the risk premium) price tree for this three-year zero-coupon bond

In regard to the three-year zero-coupon bond, which of the following is true?

CorrectIncorrect -

Question 22 of 80

22. Question

Old Crow Bank had a credit committee meeting yesterday, and the following is a copy of the notes taken during the meeting:

- All members are present Jan (Chief Risk Officer), Eddie (Head of Compliance), Alyssa (Head of Legal), Don (Head of Tax), and Ashton (Chief Financial Officer).

- Jan initiated the meeting by confirming if everyone had received an email containing approval documents from credit officer Doug, who had originated the loan. Everyone confirmed receiving the email with the documents yesterday.

- Jan provided an overview of the loan for approximately five minutes, after which she proceeded to inquire about the opinions of those present. It was the consensus of all individuals, except for Alyssa, that the loan be approved. Alyssa expressed concern regarding the trustworthiness of the counterparty.

- Jan respects Alyssa’s opinion but disagrees and initiates a vote. Two other committee members agree with Jan, resulting in loan approval.

What is the most probable issue with the credit committee’s meeting?

CorrectIncorrect -

Question 23 of 80

23. Question

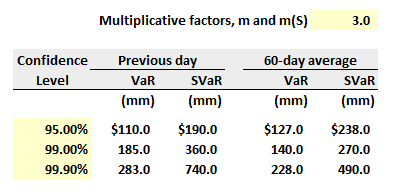

A bank is using the VaR and stressed VaR (SVaR) market risk framework according to the Basel 2.5 guidelines. The bank’s internal models for market risk have generated the following risk measures for the current trading book positions (VaR and SVaR are in USD millions):

The supervisor has set both multiplication factors, m and m(S), to 3.0. What is the correct capital requirement for general market risk for the bank under Basel 2.5? (note: this question inspired by Question 42 of GARP’s 2020 Part 2 Practice Exam).

CorrectIncorrect -

Question 24 of 80

24. Question

If a corporation’s marginal tax rate is 30.0% and it purchases an A-rated municipal bond that offers a 4.20% gross yield (aka, yield to maturity), what is the tax equivalent yield (TEY)?

CorrectIncorrect -

Question 25 of 80

25. Question

Andrew Ang introduces factors and divides them primarily into two types: macro, fundamental-based factors versus investment-style factors. He writes, “Factors drive risk premiums. One set of factors describes fundamental, economywide variables like growth, inflation, volatility, productivity, and demographic risk. Another set consists of tradeable investment styles like the market portfolio, value-growth investing, and momentum investing.” (†)

Ang also claims that the three most important macro factors are growth, inflation, and volatility. His evaluation of these macro factors is based on a long-term historical sample (specifically, 1952:Q1 to 2011:Q4). It is important to qualify the sample window because we cannot be sure that past is prologue; e.g., interest rates experienced two long-term secular trends during this window.

In regard to his historical analysis, each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 26 of 80

26. Question

Below is the price tree for a stylized constant-maturity Treasury (CMT) swap struck at 2.0% with a notional of $1.0 million. The risk-neutral probabilities are displayed, specifically: 80.09% (d = 19.91%) from date 0 to date 1; and 65.20% (d = 34.80%) from date 1 to date 2. Using these risk-neutral probabilities returns an expected discounted value (EDV) of $3,702.11 for the value of the CMT swap. Please notice this exactly matches Tuckman’s Figure 7.8 in his 4th edition value. This is the so-called model value.

Assume the observed market price of this CMT swap is $3,694.81 (as highlighted in purple), which is $7.30 less than the market price. This implies an option-adjusted spread (OAS) of 25 basis points. Which of the following is the best interpretation of this OAS?

CorrectIncorrect -

Question 27 of 80

27. Question

Strongcore Financial Corporation has purchased a long-term at-the-money (ATM) call option from a risky counterparty. The option’s stock and strike price are $25.00 million. The underlying asset’s volatility, σ, is estimated to be 20.0% while the risk-free rate is 3.0% per annum. The European-style option matures in 3.0 years. In regard to the standard normal cumulative distribution function, in this scenario N(d1) equals 0.66750 and N(d2) equals 0.53450.

With respect to its counterparty risk, Strongcore assigns a hazard rate estimate of 6.0% and believes its counterparty could default at any time during the three-year option period; i.e., the cumulative default probability is relevant for this approximation. Further, if its counterparty defaults, Strongcore assigns a conservative recovery rate estimate of 30.0%.

In summary, the assumptions are: S = K = $25.0 million, σ = 20.0%, Rf = 3.0%, T = 3.0 years; λ (i.e., hazard rate) = 6.0%, and LGD = 70.0%.

In this situation, Strongcore does NOT want to compute the standard credit value adjustment (CVA) formula which is the summation of discounted expected exposures, EE(t), over multiple future periods. Instead, Strongcore wants to rely on the simpler “semi-analytical method” that produces an estimate as a function of the position’s current value, the cumulative default probability, PD(0,T), and the loss given default, LGD. Under this simpler approximation, which of the following is nearest to the CVA charge for the long option position?

CorrectIncorrect -

Question 28 of 80

28. Question

Andrew is preparing to make a presentation to the board. The presentation’s goal is to introduce a new, proposed operational risk management (ORM) framework and get the board’s feedback on the way to eventual approval. It happens to be the case that his company is publicly traded with a high cost of capital due to its above-average beta.

The board members are generally more familiar with market and credit risk but less familiar with operational risk. Therefore, his presentation will review several of the features (and nature) of operational risk, including its dynamic evolution. His presentation will briefly explore the skewed, heavy-tailed feature of operational risk. For candidate frequency distributions, he will illustrate the Poisson and negative binomial. For candidate severity distributions, he will illustrate the log-normal and generalized Pareto Distribution (GPD).

In addition to these features (i.e., dynamic, heavy-tailed), which of the following is TRUE about operational risk?

CorrectIncorrect -

Question 29 of 80

29. Question

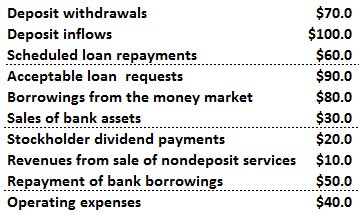

Over the next 24 hours, Greenlux State Bank estimates that the following cash inflows and outflows (all figures in millions) will occur:

What is the bank’s projected net liquidity position?

CorrectIncorrect -

Question 30 of 80

30. Question

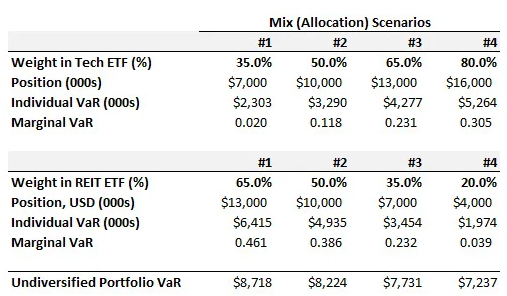

Emily manages a $20.0 million portfolio allocated into two positions (aka, two components): a Technology ETF, and a Real Estate Investment Trust (REIT) ETF. She compares four different allocations, where the weight assigned to the Tech ETF component is either 35.0%, 50.0%, 65%, or 80.0%.

If her goal is to minimize the portfolio’s diversified value at risk (VaR), which of the above allocations is best?

CorrectIncorrect -

Question 31 of 80

31. Question

In comparison to a yield-based DV01 hedge, which of the following is the best argument in favor of a regression hedge?

CorrectIncorrect -

Question 32 of 80

32. Question

Among its financial positions, Zapex Financial Corporation has written a call, entered into an interest rate swap, and written a credit default swap. Among these (the following) four positions, which is the BEST example of wrong-way risk?

CorrectIncorrect -

Question 33 of 80

33. Question

According to the FDIC, model risk management starts with robust model development, implementation, and use (aka, the first element. The second element is a sound validation process. The third element is governance). Which of the following is a TRUE statement about this first element (development, implementation and use) of model risk management?

CorrectIncorrect -

Question 34 of 80

34. Question

Suppose that Acme Bank reports interest-sensitive assets (ISA) of $490.0 million and interest-sensitive liabilities (ISL) of $610.0 million. Recall that the relative interest-sensitive gap (aka, Relative IS GAP) is equal to the Dollar IS GAP divided (aka, scaled) by the size of the bank (where IS assets is a valid measure of size). Respectively, what is the bank’s relative IS GAP; its interest-sensitivity ratio (ISR); and the impact of rising interest rates on its net interest margin (NIM)?

CorrectIncorrect -

Question 35 of 80

35. Question

You work for the Private Client division of an international bank. The bank’s Private Client Advisors work with high net worth (NNW) individuals and families. Your boss has tasked you to perform due diligence on a roster of hedge funds; the funds that survive your due diligence will become candidates for presentation (and recommendation) to suitable customers of the bank who will become investors in the fund(s).

Your boss says that your due diligence should include a careful screen for fraud risk on behalf of the investors. In the case of your due diligence, which of the following is the most important ingredient?

CorrectIncorrect -

Question 36 of 80

36. Question

Which of the following is the BEST summary of the purpose of a copula function?

CorrectIncorrect -

Question 37 of 80

37. Question

Retail exposures include the following: credit cards, installment loans (e.g., personal finance, educational loans, auto loans, leasing), revolving credits (e.g., overdrafts, home equity lines of credit), and residential mortgages. Each of the following tends to be a stronger feature of retail credit risk rather than corporate credit risk EXCEPT which is more typical of corporate credit risk?

CorrectIncorrect -

Question 38 of 80

38. Question

According to the Basel Committee on Banking Supervision (BCBS, 2018), in regard to cyber-security and cyber-resilience metrics, “Some jurisdictions have methodologies to assess or benchmark regulated institutions’ cyber-security and resilience … None of these methodologies produce quantitative metrics or risk indicators comparable to those available for financial risks and resilience; e.g., standardized quantitative metrics where established data are available. Instead, indicators provide information on regulated institutions’ approach to building and ensuring cyber-security and resilience more broadly. Supervisory authorities also rely on entities’ own management information, although this differs across entities and is not yet mature.”(†)

With respect to current cybersecurity and resilience metrics, each of the following statements is true EXCEPT which is inaccurate?

CorrectIncorrect -

Question 39 of 80

39. Question

Venkat explains that “all risk management frameworks start with a governance structure that defines the roles and responsibilities of various bank employees and committees in overseeing risk-related activities,” and effective governance includes the oversight of intraday liquidity risk. In regard to the governance structure of intraday liquidity risk management which of the following statements is TRUE?

CorrectIncorrect -

Question 40 of 80

40. Question

Hedge funds are less regulated than mutual funds. According to the authors (Fung and Hsieh), this lighter regulation of hedge funds offers genuine benefits but also creates unintended consequences. Which of the following is both a negative consequence and a TRUE statement about this relatively light regulation?

CorrectIncorrect -

Question 41 of 80

41. Question

Meissner conducted a detailed study of equity correlations of the 30 stocks in the Dow (DJIA) over 44.5 years (i.e., the 534 months from January 1972 to July 2017) that generated 534 * 30^2 = 480,600 correlations values. In regard to his empirical findings with respect to equity correlations, each of the following statements is TRUE, except which is false?

CorrectIncorrect -

Question 42 of 80

42. Question

Your colleague has drafted guidance for your firm’s computation of the credit value adjustment (CVA). The guidance begins with four principles: risk-neutrality, discounting, proportionality, and inseparability. The principles are summarized as follows:

I. Risk-neutrality: CVA can be computed either with risk-neutral (aka, market-implied) or real-world (aka, historical) parameters

II. Discounting: CVA should be discounted to present value, either via discounted expected exposure (EE) or via explicit discount factors

III. Proportionality: CVA will be proportional to the likelihood of default (PD), the exposure (EE) and the percentage amount lost in default (LGD).

IV. Inseparability: It should be impossible to separate the valuation of a transaction from its counterparty risk as measured by CVAEach of the principles is valid, EXCEPT which of the principles is INCORRECT?

CorrectIncorrect -

Question 43 of 80

43. Question

Acme Financial is a large bank whose Business Indicator (BI), for purposes of operational risk capital under the standardized measurement approach (SMA), is well in excess of EUR 1.0 billion. Therefore, Acme is required to use loss data as a direct input into its operational risk capital calculations. In regard to the general and/or specific criteria recommended by the Basel Committee, which of the following is TRUE about the identification, collection, or treatment of operational loss data?

CorrectIncorrect -

Question 44 of 80

44. Question

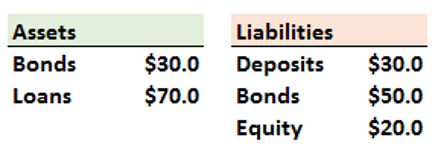

Geofinancial Bank currently has the following (very) simplified balance sheet:

Further, the maturities of these accounts are as follows:

- Assets: The bonds ($30.0 million) expire in one year. In regard to the loans ($70.0), $40.0 million expire in five (5) years, $10.0 million expire in seven (7) years, and $20.0 million expire in ten (10) years.

- Liabilities: In regard to the deposits ($20.0 million), $10.0 million expire in one (1) year, and $20.0 million expire in two (2) years. In regard to the bonds ($50.0 million), $10.0 million expire in five (5) years, $30.0 million expire in seven (7) years, and $10.0 million expire in beyond ten (>10) years.

- Equity ($20.0 million) is presumed to expire in ten (10) years

Consider the following possible term structures of expected cash flows:

Which term structure of expected cash flows is accurate for Geofinancial Bank?

CorrectIncorrect -

Question 45 of 80

45. Question

Acme Industrial Corporation just finished establishing its new financial accounting controls which includes three components: planning, budgeting, and variance monitoring. The company’s next step is to establish a three-legged risk management stool that will analogously include the risk plan, the risk budget, and the risk monitoring process. In regard to the risk plan, each of the following will be an element EXCEPT which is the LEAST likely to be included in Acme’s risk plan?

CorrectIncorrect -

Question 46 of 80

46. Question

Bertha has a view about correlation, and she is evaluating several rainbow (aka, multi-asset) options. Her view is that correlation is going to decrease. Among the following trades, which best expresses her view?

CorrectIncorrect -

Question 47 of 80

47. Question

Julia the analyst is analyzing the credit risk of a contract to which her firm is considering entering into as a party. If true, which feature of her work (among the choices below) most likely signifies or indicates that this is a case of counterparty credit risk rather than (traditional) lending risk or some other type of risk?

CorrectIncorrect -

Question 48 of 80

48. Question

The Basel regulatory framework has undergone several major renovations but started in the late 1980s when the Basel Committee on Banking Supervision published the first Basel accord, which is now called Basel I; this original Basel I was implemented in 1992. According to Carey (GARP Chapter 19), which BEST summarizes the motivation(s) of the original Basel?

CorrectIncorrect -

Question 49 of 80

49. Question

Which of the following types of liquidity is available in the form of the institution’s liquidity asset buffer (LAB) and represents liquidity available to meet general financial obligations under a stress scenario?

CorrectIncorrect -

Question 50 of 80

50. Question

Acme Investment Bank recently finished building the third leg of its three-legged risk management stool, after the risk plan and the risk budget: the bank installed its risk monitoring process. The bank shares a belief with the authors (Rosengarten and Zangari) that “risk is the shadow cost behind returns.” Each of the following is probably an element or plank in the bank’s risk monitoring process EXCEPT which is the least likely to be found in the bank’s risk monitoring process?

CorrectIncorrect -

Question 51 of 80

51. Question

Acme FinGlobal Bank has engaged consultants to redefine the organization’s risk measures. The project includes value at risk (VaR) mapping across several portfolios (aka, asset classes) at the organization:

- A fund that invests in initial public offerings (IPOs)

- A fund that invests in emergent assets but where with there is little historical data

- Small equity portfolio with less than 30 positions

- Large equity portfolio with 1,000 positions

- A portfolio of corporate bonds that carries six different ratings and has maturities of 3, 5, and 7 years

Each of the following statements is TRUE except which is false?

CorrectIncorrect -

Question 52 of 80

52. Question

Freecone Financial LLC entered into an interest rate swap some time ago where it agreed to make semi-annual fixed payments at a rate of 3.0% per annum, in exchange for receiving floating payments on a notional amount of $50.0 million. The floating rate is the six-month secured overnight financing rate (SOFR) and this is also the discount rate used to value the swap. The swap has a remaining life of 1.25 years. The SOFR rate applicable to the exchange in three months was determined three months ago: it was 2.40%. Just as with a LIBOR-based swap, the floating rate is observed at the beginning of each six-month period but paid at the end of the period. Currently, the SOFR term structure is flat at 2.60% per annum with continuous compounding. With respect to its position in this swap, which of the following is nearest to Freecone Financial’s current exposure?

CorrectIncorrect -

Question 53 of 80

53. Question

According to the Guidance on Managing Outsourcing Risk (by the Board of Governors of the Federal Reserve System), with respect to a third-party service provider arrangement, the overall due diligence process by a financial institution should at least include a review of each of the following EXCEPT which is not essential?

CorrectIncorrect -

Question 54 of 80

54. Question

The staff at Umbrella Street Bank, which is a commercial bank (it could also be a savings institution or credit union), produces several liquidity risk reports on a daily, weekly, monthly, and quarterly basis. Among these liquidity risk reports is a deposit tracker report. Among the following metrics, which is MOST LIKELY to appear in their deposit tracker report?

CorrectIncorrect -

Question 55 of 80

55. Question

You work as a pension fund administrator and the Investment Committee asks for your input. The pension fund seeks to increase its allocation to alternative investments and, in particular, will add a new hedge fund strategy; aka, style. You are limited to four strategies. You are perusing the brochures of four hedge funds (each named after Greek gods per a popular marketing convention!). The four strategies are global macro, merger arb, long/short equity, and equity market neutral.

Below are the four funds. Each fund has a name, a strategy (aka, style), a tagline, and a very brief description.

- Acheilus is a Global Macro strategy. We are your effective asset (factor) allocator! We opportunistically make bets in different markets utilizing a range of strategies; you can think of us as betting on a range of factors such as commodities, interest rates, exchange rates.

- Boreas is a Merger Arb (aka, Risk Arb) strategy. We collect nickels (and dimes) in front of the proverbial steamroller! Like our sibling event-driven strategy (i.e., Distressed), we can offer you nonlinear returns but with tail exposure to extreme market conditions.

- Chimera is a Long/Short Equity strategy. We are friendly but will never hug a benchmark! Although we have some directional market exposure, we can be classified as relative value because we are stock pickers who seek alpha by way of a diversity of opinions and ability.

- Daphne is an Equity Market Neutral strategy. We bring you a basket of betas! As an event-driven strategy, our returns are highly linked to several common market risk factors including equity indices, bond spreads, and volatility factors.

Each of these descriptions is consistent with its strategy (aka, style) category EXCEPT for one. Select the fund that is NOT consistent with its description.

CorrectIncorrect -

Question 56 of 80

56. Question

Betty’s firm wants to allocate an economic capital cushion based on a one-day 99.5% value at risk (VaR) model. Further, she will conduct a basic backtest (aka, exception or frequency test) where the frequency of tail losses fit a binomial distribution. Her backtest window is limited to two years, T = 500 days. In regard to this backtest, which of the following statements is TRUE?

CorrectIncorrect -

Question 57 of 80

57. Question

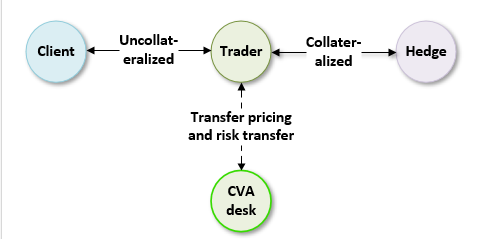

The figure below illustrates the general role of the credit value adjustment (CVA) desk at Heroic Multifunction Bank (aka, the bank). Assume the trader is a market maker. The uncollateralized trade with the customer (on the left) is hedged with a collateralized trade (on the right):

Assume the uncollateralized transaction (with the client) has a positive mark-to-market (MTM) value such that, by definition, the collateralized hedge position, therefore, has a negative MTM value. If the market moves such that, with respect to the position with the client, the position’s positive MTM value INCREASES and becomes even more positive, then which of the following implications is most likely to be TRUE?

CorrectIncorrect -

Question 58 of 80

58. Question

Andrew Ang makes an important, provocative statement when he writes “Reported illiquid asset returns are not returns.” He claims that people overstate the expected returns and understate the risk of illiquid assets, and he attributes this to three key biases. According to Ang, each of the following is a bias that overstates the expected returns (and/or understates the risk) of illiquid assets EXCEPT which is not accurate?

CorrectIncorrect -

Question 59 of 80

59. Question

Which of the following provides the BEST explicit link(s) between a bank’s contingency funding plan (CFP) and its liquidity stress testing framework?

CorrectIncorrect -

Question 60 of 80

60. Question

Bodie, Kane and Marcus explain, based on an analogy originally developed by Robert C. Merton, that we can attempt to quantify the value of market timing by recognizing that foresight is similar to holding a call option on the owned equity portfolio (without paying the premium): the perfect market timer exercises her option, so to speak, by switching from the riskfree asset to the equity portfolio (or vice-versa) depending on which offers the better return. Consequently, the Black-Scholes (BSM) formula can be used, but when the strike price is given by $1.00*exp(r*T), the BSM call option formula conveniently reduces to c = 2*N[0.5*σ(e)*sqrt(T)]-1.

If we assume annual forecasts (T = 1.0 year), and the volatility of the equity portfolio, σ(e) = 36.0% per annum, which of the following is nearest to the value of perfect market timing, as a percentage of the equity portfolio’s value?

CorrectIncorrect -

Question 61 of 80

61. Question

Patricia has been asked by the Chief Risk Officer (CRO) to estimate value at risk (VaR) at high confidence levels. Initially, she fits a generalized extreme value (GEV) distribution to the loss data. However, some members of the ultimate audience (the board) do not understand the math. She observes that Dowd(†) explains, “[t]here are also short-cut ways to estimate VaR (or ES) using EV theory. These are based on the idea that if ξ > 0, the tail of an extreme loss distribution follows a power-law times a slowly varying function: F(x) = k(x)*x^(-1/ξ) where k(x) varies slowly with x. For example, if we assume for convenience that k(x) is approximately constant, then [this equation] becomes: F(x) ≈ k*x^(-1/ξ)”. Notice the assumption that k(x) is approximately constant.

The exponent in Dowd’s power law maintains consistency with the generalized extreme value (GEV) distribution by referring to the exponent as a negative reciprocal, -1/ξ, but given this exponent is also a constant along with k(x), we can further simplify the approximation: instead of F(x) ≈ k*x^(-1/ξ), we can say that F(x) ≈ k*x^(-ξ) which is sometimes represented as F(x) ≈ k*x^(-α) where α = 1/ξ. For example, Patricia assumes the exponent’s value is -4.0. In the former syntax, ξ = 0.25 such that (-1/ξ) = -4.0; in the latter version, α = 4.0 such that (-α) = -4.0, to the same effect. For our purpose here, we will simply refer to F(x) ≈ k*x^(-ξ).

Consequently, she decides to estimate extremely confident VaRs with a power-law shortcut. Specifically, when Patricia sets xi, ξ = 4.0, she observes that the 99.50% VaR is $6.0 million. With respect to the exponent, she assumes F(x) ≈ k*x^(-ξ) = F(x) ≈ k*x^(-4.0). If the loss tail follows the power law, which is nearest to the implied 99.90% VaR?

CorrectIncorrect -

Question 62 of 80

62. Question

Acme Financial has a position in five derivative contracts with its counterparty. The current mark-to-market values of the positions are the following: +12, -9, +20, -6, and +8. The five positions are all included in a single netting set. Let’s define the “netting benefit” as the reduction in current exposure due to netting; that is, the difference between the total current exposure with netting and the current exposure “as if” netting did not apply. What is the netting benefit in this set?

CorrectIncorrect -

Question 63 of 80

63. Question

Patricia is a risk analyst who works for a large international bank. Her team is developing a new risk management framework for the bank and is currently working on risk identification. As part of extreme risk identification, Patricia has been assigned the important task of designing and performing the firm’s scenario analysis. Soon she will facilitate a brainstorming session for which she has prepared the following documents: external loss data, internal loss data (including near misses), risk and control self-assessment (RCSA) results, key risk indicator scores, audit issues, and concentrated exposures.

Assuming she continues to follow best (or good) practice with respect to scenario analysis, which of the following is a TRUE statement?

CorrectIncorrect -

Question 64 of 80

64. Question

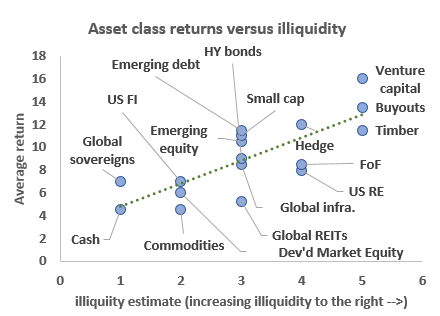

In order to identify the presence of illiquidity risk premium(s), Andrew Ang(†) references data presented by Antti Ilmanen in his well-regarded book Expected Returns (An Investor’s Guide to Harvesting Market Rewards). This data is displayed below as a scatterplot where the y-axis is the long-run average return of the asset class and the x-asset is an index of illiquidity. A higher index (ie, to the right) implies less liquidity. For example, the venture capital as an asset class is assigned to the least liquid (most illiquid) asset class but it also plots the highest long-run average return.

In regard to the illiquidity risk premium, which of the following statements it TRUE?

CorrectIncorrect -

Question 65 of 80

65. Question

Sally represents an investor who likes the strategy and style of a new, entrepreneurial start-up hedge fund. At her client’s request, she is going to conduct due diligence. According to Kevin Mirabile (author of the hedge fund due diligence reading), as Sally conducts her diligence of the hedge fund on behalf of the investor, which of the following is the most important principle or ingredient?

CorrectIncorrect -

Question 66 of 80

66. Question

Bertha is a risk manager who estimates the market risk of one of her firm’s portfolios. Because geometric returns are time-additive and arithmetic returns are cross-additive, she measures performance with both arithmetic and geometric returns. Her assumptions are gathered below:

- The portfolio value is $100.0 million and she assumes there are 250 trading days per year.

- Using geometric returns, the average return +12.0% per annum with a standard deviation of 28.0%

- Using arithmetic returns, the average return +14.0% per annum with a standard deviation of 32.0%

She wants to measure the one-day 95.0% value at risk (VaR) under both approaches: assuming arithmetic returns are normal (aka, normal VaR) and assuming geometric returns are normal; aka, lognormal VaR. She assumes the returns are serially independent. Which of the following is nearest to the difference between the one-day 95.0% normal VaR and the one-day 95.0% lognormal VaR?

CorrectIncorrect -

Question 67 of 80

67. Question

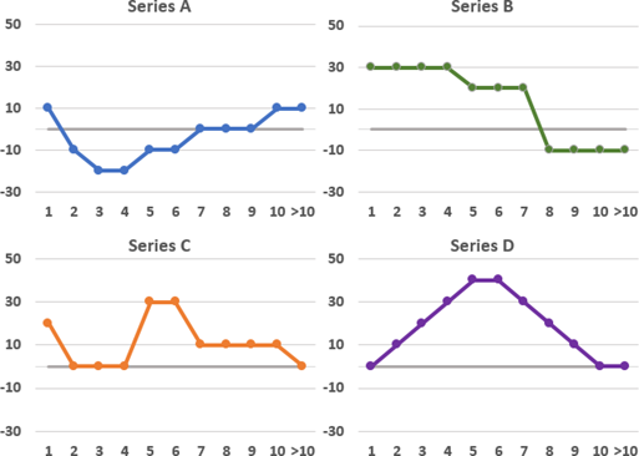

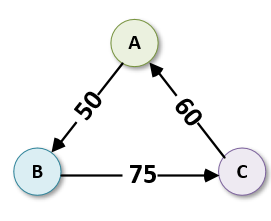

The graph below represents a trilateral scenario between three different counterparties (called A, B, and C) with position sizes in a certain fungible (aka, interchangeable) product. The values represent notional sizes and the direction represents exposures:

In this ring, the current total notional is 370. If trade compression can be achieved, which of the following is an efficient solution?

CorrectIncorrect -

Question 68 of 80

68. Question

Sally is a risk analyst at an international bank who is leading a project to conduct a causal analysis of the bank’s operational risk. The project will coordinate with, and inform modifications to, the bank’s loss database. One of the project’s goals is to analyze the organization’s controls, control layers, and key risk indicators (KRIs), and key control indicators (KCIs).

She prefers to use a factor model, and her candidates include the following approaches:

- Fault tree analysis (FTA): this deductive method will build a series of and/or conditions that can happen simultaneously or alternatively

- Root-cause analysis with bowtie tool: the visual tool will employ the 5-why analysis to probe deeply into the root causes of events

- FAIR methodology: this structured framework will generate scenarios, where each scenario will assume an asset at risk, a threat community, a threat type, and an effect

- Swiss cheese model; aka cumulative act effects: by anticipating active failures and identifying latent conditions, this model will promote effective control layering and identifying active failures

Each of these four approaches has advantages and disadvantages. For ANY of these approaches, which of the following paired statements (i.e., a single advantage paired with a single disadvantage) is a TRUE statement?

CorrectIncorrect -

Question 69 of 80

69. Question

According to Rose and Hudgins, the factors affecting the choice of non-deposit funding sources include the following: the relative costs of each funding source; the risk of each funding source, including the dependability and volatility; the length of time for which funds will be needed; the size of the financial institution needing the funds; and regulations on the use of other sources of funds. In regard to the various sources of non-deposit funding, which of the following statements is TRUE?

CorrectIncorrect -

Question 70 of 80

70. Question

We can add a momentum factor to the Fama-French so that it becomes a four-factor model. This momentum factor is denoted by WML (i.e., past winners minus past losers) or UMD (i.e., stocks that have gone up minus stocks that have gone down). At least with respect to the historical window analyzed, which is the long period from January 1965 to December 2011, which of the following statements is TRUE about the momentum factor?

CorrectIncorrect -

Question 71 of 80

71. Question

Peter has collected the historical sample of daily profit and loss (P/L) observations for his firm’s new equity portfolio but his dataset only contains 250 days. Ideally, he would prefer 1,000 observations because the board asked for a presentation that displays value at risk (VaR) at confidence levels of (99.0%, 99.1%, …, 99.8%, and 99.9%). The board also expressed a preference for a non-parametric approach; apparently, some directors are concerned that parametric approaches might be too difficult to communicate and understand. In addition to granular VaR confidence levels (e.g., 99.1%), if possible, the board would like to see confidence INTERVALS around the VaR estimates in order to gauge their precision; e.g., a 9X% confidence interval around the 99.1% VaR.

Therefore, Peter considers the following four approaches: basic historical simulation (BHS), bootstrapped historical simulation (BOOT), historical simulation using non-parametric density estimation (NPDE), and age-weighted historical simulation (AWHS). Given the realities of his relatively small, empirical dataset, which of the following statements is TRUE?

CorrectIncorrect -

Question 72 of 80

72. Question

Two counterparties (A and B, illustrated below) have between them a set of OTC derivative transactions.

Associated with the positions, these counterparties also entered into a bilateral collateral agreement prior to initiation of the underlying transactions. Each of the following is true EXCEPT which is false?

CorrectIncorrect -

Question 73 of 80

73. Question

MetroScape Bank prides itself on its modern banking solutions and customer-centric approach. During the last quarter, however, a series of events occurred that suggest the bank’s controls should (or at least can) be improved. Specifically, each of the four major types of human error was observed:

- I. Jane, a seasoned cashier at MetroScape, had been handling cash transactions for years. One busy Friday afternoon, while multitasking between customer queries and cash handling, she inadvertently gave out $500 more to a customer than he had withdrawn. Her muscle memory, developed from years of handling similar transactions, failed her in that moment of distraction.

- II. MetroScape recently redesigned its compensation and incentive programs. The incentive program rewards cross-selling, especially when a valuable customer adds an additional account and/or utilizes a new program. Due to this incentive plan, some branches aggressively cross-sold products to existing customers without sufficient regard for product suitability. Several customers called headquarters to complain about the sales tactics.

- III. A new investment product was introduced at MetroScape, and the bank’s financial advisors were tasked with guiding interested clients. Tom, one of the advisors, faced a unique situation where a client wanted to merge this new product with another existing one. Unsure and without prior experience or training in this scenario, Tom made an educated guess. Unfortunately, his decision led to significant tax implications for the client.

- IV. Lucy, a senior executive at MetroScape, was aware of the bank’s policy against insider trading. However, tempted by the prospect of significant personal gain, she used confidential information about an upcoming merger to buy shares in a company that MetroScape was about to acquire. Her actions, driven by personal greed, were a clear violation of both the bank’s policy and federal regulations.

In regard to these events and their associated control implications, each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 74 of 80

74. Question

What is the primary (valid) reason that banks need proper liquidity transfer pricing (LTP)?

CorrectIncorrect -

Question 75 of 80

75. Question

In the paper “Finding Bernie Madoff” (by Dimmock and Gerken), the authors produce several findings as they attempt to test the predictability of investment fraud. In regard to their findings specifically, each of the following is TRUE except which is not?

CorrectIncorrect -

Question 76 of 80

76. Question

Ralph employed the peaks-over-threshold (POT) approach under extreme value theory (EVT) to the estimation of value at risk (VaR) for his firm’s portfolio. He has four years of data, n = 1,000 days. He would prefer to apply a maximum likelihood estimation method (aka, MLE) to parameter estimation, but he thinks he needs to choose the threshold first. When he selects a threshold of u = 4.0%, he observes N(u) = 28 exceedances such that N(u)/n = 2.80%. Fitting the data generates these parameters: scale, β = 0.80%,; and tail index, ξ = 0.310. Based on these assumptions, the 99.90% confident VaR is 8.670%.

He subsequently decides to increases the threshold from 4.0% to 5.0% while retaining the tail index at 0.310 and the scale parameter at 0.80%. The number of exceptions declines to N(u) = 17 such that N(u)/n = 17/1,000 = 1.70%. His revised 99.90% VaR is similar at 8.630%. In regard to choosing a threshold, which of the following statements is TRUE?

CorrectIncorrect -

Question 77 of 80

77. Question

Consider two counterparties who are about to enter into bilateral framework under an ISDA Master Agreement. They are currently negotiating the credit support annex (CSA) which will govern the terms of collateral posting. Each of the following is true EXCEPT which is inaccurate?

CorrectIncorrect -

Question 78 of 80

78. Question

Reporting on operational risks presents a unique set of challenges. As GARP explains, “Unlike other risk factors, assessing the volatility of operational risk is especially challenging given this is a relatively new discipline. Credit and market risk metrics often have over a hundred years of historical trend information. Operational risk measurement is relatively new, requiring more attention to the qualitative and quantitative tracking measures used to evaluate changes in risk profiles.“(†)

Let’s assume the organization’s central operational risk function (ORF) has primary responsibility for operational risk reporting. In regard to the challenges to reporting operational risks, each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 79 of 80

79. Question

According to Patrick McGuire, which of the following best summarizes the proximate cause of the US dollar shortage during the global financial crisis (GFC)?

CorrectIncorrect -

Question 80 of 80

80. Question

Janice is preparing to conduct factor regressions in order to discover the factor loadings in her firm’s equity portfolio. She will begin by regressing three explanatory (aka, independent) variables: the market factor (MKT) plus two additional factors. Each of the following pairs of factors are good candidates for these additional factors EXCEPT which of the following pair is NOT a good candidate?

CorrectIncorrect