Part 1 Full Length Interactive Mock Exam 1

Quiz Summary

0 of 100 Questions completed

Questions:

Information

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading…

You must sign in or sign up to start the quiz.

You must first complete the following:

Results

Results

0 of 100 Questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 point(s), (0)

Earned Point(s): 0 of 0, (0)

0 Essay(s) Pending (Possible Point(s): 0)

| Average score |

|

| Your score |

|

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- Current

- Review

- Answered

- Correct

- Incorrect

-

Question 1 of 100

1. Question

Case studies that feature financial engineering by way of complex derivatives include Bankers Trust, the Orange County case, and Sachsen Landesbank. In regard to these financial engineering cases, each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 2 of 100

2. Question

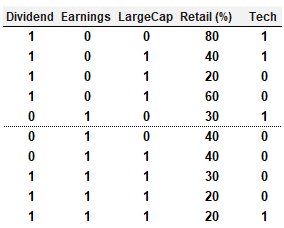

A very small sample of 10 public companies has one target variable (i.e., Dividend) and four features (i.e., Earnings, LargeCap, Retail, and Tech). Both Dividend and Earnings are binary variables where respectively, one (1) indicates the company recently paid a dividend, and its earnings dropped in the previous year. The data frame is displayed below.

Based on Dividend as the output (aka, target) variable, the base Gini coefficient is 0.420. That’s because 1- [(7/10)^2 + (3/10)^2]. What is the information gain if we split (as the root node’s feature) the Earnings feature?

CorrectIncorrect -

Question 3 of 100

3. Question

About swaps, each of the following is true EXCEPT which is false?CorrectIncorrect -

Question 4 of 100

4. Question

A large international bank uses EWMA for their risk system, with a decay factor of 0.92. On day T the forecast volatility for two variables, X&Y, are identical at 1.25% and the current correlation forecast is 15.0%. If on day T the realized returns for X & Y are 0.50% and -0.50% respectively, which of the following is closest to the new correlation?

CorrectIncorrect -

Question 5 of 100

5. Question

According to GARP, each of the following was a causal factor in the 2007-2009 global financial crisis (GFC) EXCEPT which is not a causal factor?

CorrectIncorrect -

Question 6 of 100

6. Question

A hedge fund’s big data algorithm can predict the market’s direction on five out of eight days (62.5%). Each day’s prediction is either a success (e.g., market goes up and algo predicts up) or a failure (e.g., market goes down but algo predicts up). If we dubiously assume the predictions are independent, the binomial distribution fits a series of daily predictions over, say, a week or a month. Over two months, the probability of each day’s predication being successful, p, equals 5/8 or 62.5% and the number of days, n, equals 60. We observe that n*p = 60*62.5% = 37.5 and n*(1-p) = 60*37.5% = 22.5, and both of these values (i.e., 37.5 and 22.5) are greater than 10; this satisfies a conventional test that says we can use the normal to approximate the binomial. For example, if p were only 1.0%, then n*p = 6, but 6 is less than 10, and such a binomial is deemed to be too skewed to be approximated by the normal distribution. But ours passes the test so we will approximate with the normal distribution. If we do rely on the normal distribution to approximate this binomial where p = 5/8 and n = 60, what is the probability that the algo makes a correct prediction on only half the days or worse; i.e., where X is the number of successful predictions and we approximate with the normal distribution, what is the Pr(X <= 30)?

CorrectIncorrect -

Question 7 of 100

7. Question

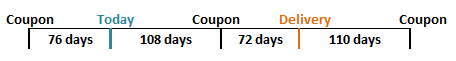

Suppose that it is known that a bond will be delivered in 180 days under the terms of a futures contract. The timing of coupon payments is shown below. The last coupon on the bond was paid 76 days ago, and the next coupon will be paid in 108 days. The coupon after the next one will be paid in 290 days (i.e., 110 days after delivery). Here is the timeline:

Assume that the risk-free interest rate for all maturities is 5.0% with continuous compounding and that the delivered bond pays a coupon of 9.0% semi-annually with a current quoted (clean) price of USD 124.80 and a conversion factor of 1.300.

Which of the following is nearest to the quoted futures price?

CorrectIncorrect -

Question 8 of 100

8. Question

A risk analyst is using the EWMA model to build a daily update of correlation and covariance rates. The two variables are random and are called X and Y. The most recent covariance weight (aka, lambda in the EWMA model) from day n-1 is 0.7. The correlation between X and Y on day N-1 is estimated to be 0.55. X and Y had estimated standard deviations of 0.015 and 0.017 with percentage changes of 3% and 4% respectively on day N-1. The updated covariance between X and Y on day n is nearest to which of the following?

CorrectIncorrect -

Question 9 of 100

9. Question

Which of the following is TRUE about the SWIFT (Society for Worldwide Interbank Financial Telecommunication) case study?

CorrectIncorrect -

Question 10 of 100

10. Question

A credit portfolio contains some number of independent credit-sensitive assets with identical default probabilities; as the defaults are i.i.d., we can use the binomial distribution to characterize the number of defaults. We are told the expected number of defaults is 4.0 with a variance of 3.80. Which is nearest to the probability of exactly four defaults; Pr(X = 4 | binomial with mean of 4.0 and variance of 3.80)?

CorrectIncorrect -

Question 11 of 100

11. Question

At the request of his boss at a large commercial bank, Jason is using the bank’s internal model to perform a valuation of a freshly constructed pass-through mortgage-backed security (MBS) pool. The pool contains about 500 mortgages with a principal value of $400 billion; all of the mortgages originated within the last 30 days. The pool’s weighted average coupon (WAC) is 7.50%. Jason is going to assume a PSA rate of 140%. This multiplies by 1.40 the baseline 100% PSA rate that starts at 0.20% CPR each month for 30 months, then levels at 6.0% CPR. Each of the following is true EXCEPT which is false?

CorrectIncorrect -

Question 12 of 100

12. Question

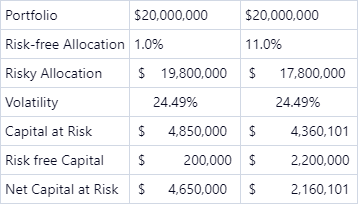

Scott, a risk manager at a small deep-value strategy, is trying to ensure his company is using a coherent risk benchmark. The deep value strategy can be volatile, and thus, Scott wants to see how his capital at risk would adjust if the portfolio had the same holdings but in a smaller proportion to increase its allocation to the risk-free asset. Which principal of a coherent benchmark is reflected in the below scenario?

CorrectIncorrect -

Question 13 of 100

13. Question

Barbara is a certified FRM who previously generated income statement and profit projections over a five-year horizon in response to her client’s request. Subsequent to the coronavirus outbreak, her client asks Barbara to generate revised financial projections (income statement and balance sheet) and provide the best single point estimate of future revenue, profit, and equity. Barbara utilizes Monte Carlo simulation. Although her client has asked for a single point estimate of these future financial metrics, Barbara perceives that the virus (and the consequential responses) render economic predictions extremely difficult and necessarily laced with great uncertainty. Which of the following is probably her BEST approach to the problem?

CorrectIncorrect -

Question 14 of 100

14. Question

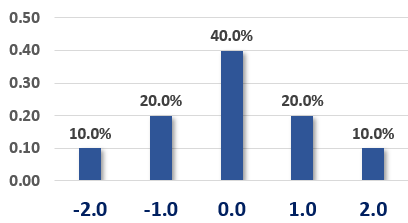

Consider the probability mass function (pmf) below. For example, Pr(X = -1.0) = 20.0%.

As we can see, this distribution is symmetrical, so we know that its skewness is zero without performing any calculations. We are told the variance is 1.20 (although we can calculate the variance). What is this distribution’s kurtosis?

CorrectIncorrect -

Question 15 of 100

15. Question

A U.S. corporate bond that matures on April 1st, 2026, pays a semi-annual coupon of 9.0% per year. The coupon payment dates are Jan 1st and July 1st. Settlement is on April 7th, 2024. The year 2024 is a leap year. The bond’s yield happens to be about 7.00%. If the cash (aka, dirty) price is $1,064.50, then which is nearest to the quoted (aka, clean) price? (Inspired by GARP EOC PQ 17.13)

CorrectIncorrect -

Question 16 of 100

16. Question

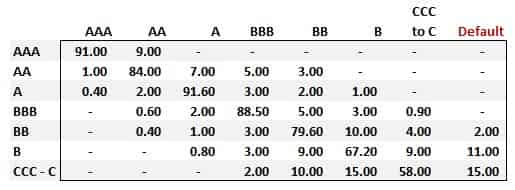

Consider the following one-year migration (aka, transition) matrix:

When is the soonest that an obligation rated AAA (the highest rating) can default?

CorrectIncorrect -

Question 17 of 100

17. Question

Arguably the U.S. savings and loan (S&L) crisis in the 1980s had multiple causes, but among the following which is the BEST summary explanation of the S&L crisis?

CorrectIncorrect -

Question 18 of 100

18. Question

A discrete random variable is characterized by the probability mass function (pmf) as given by f(x) = x*a, and its domain is the set of integers {6, 7, 8., 9, and 10}. What is the variable’s expected value?

CorrectIncorrect -

Question 19 of 100

19. Question

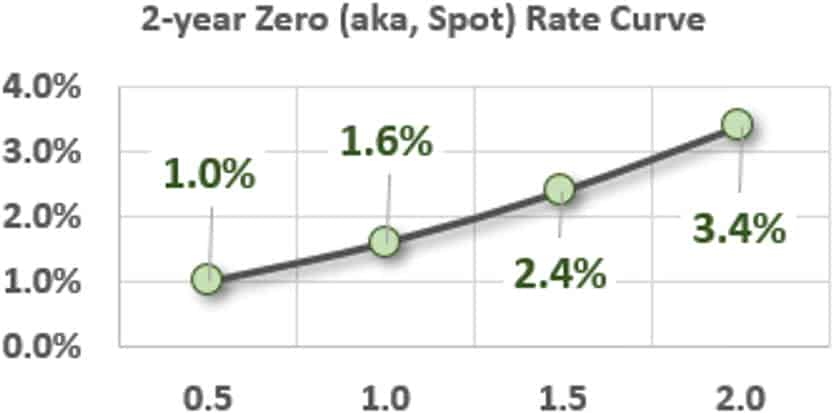

Assume the following six-month forward rates that are quoted per annum with semi-annual compounding:

- F(0, 0.5) = S(0.5) = 2.0%; i.e., the six-month spot rate

- F(0.5, 1.0) = 4.0%

- F(1.0, 1.5) = 6.0%

If the price of a 7.0% semi-annual coupon bond is $103.20, which is nearest to the 2-year spot rate?

CorrectIncorrect -

Question 20 of 100

20. Question

In regard to through-the-cycle (TTC) versus at-the-point (aka, point in time, PIT) approaches to credit ratings, each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 21 of 100

21. Question

Alice, Bert, Chris, Don, Eva, and Fred are individual investors. Each of them exhibits a particular behavioral bias.

- Alice (A) invested in the stock Cloudera (CLDR) and bad news (aka, new information) renders her original thesis obsolete but she is reluctant to sell today because an exit implies the realization of a -30.0% loss on the position and she much prefers to sell after her position experiences a double-digit gain

- Bert (B) can buy a new smartphone for $79.00 but he cannot resist a sale and prefers to pay $100.00 because it represents a 50.0% discount from the retail (MSRP) price

- Chris (C) attends an investment conference but he avoids the seminar focusing on recession risks because he is overweight homebuilders and he worries the topic will make him anxious with worry

- Don (D), who enjoys food shopping, tends to be price-conscious (e.g., he seeks bargains) when he pays cash at Sprouts or Trader Joes, but when he uses his Amazon credit card at Whole Foods he doesn’t worry about the cost because he doesn’t look at the statement for several days or weeks

- Eva (E) purchased Facebook (FB) at $160.00 because his firm’s price target was $200.00, and he decides to ignore new information until the price reaches this level

- Fred (F) was previously a patient buy-and-hold investor who purchased high-conviction stocks and only checked his portfolio once a week, but last year he signed up for a subscription to Seeking Alpha and since that time his buy/sell transactions have quintupled because he’s reading news about his portfolio holdings every day

Which of the following correctly matches the individual investor to his or her behavioral bias?

CorrectIncorrect -

Question 22 of 100

22. Question

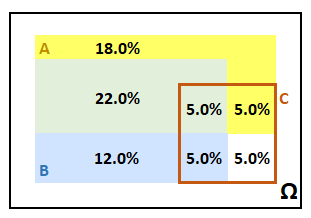

The probability graph below illustrates event A (the yellow rectangle) and event B (the blue rectangle). The unconditional probability of event A is 50.0% and the unconditional probability of event B is 44.0%; i.e., Pr(A) = 50.0% and Pr(B) = 44.0%. Their overlap is graphed by the green rectangle such that Pr(A ∩ B) = 27.0%. The orange rectangle conditions on the event C. For example, conditional on event C, there is a 50.0% probability that event A occurs, Pr(A | C) = 50.0%.

Which of the following is TRUE about, respectively, the unconditional and conditional relationship between events A and B?

CorrectIncorrect -

Question 23 of 100

23. Question

We are told to assume that an interest rate is 9.00% per annum with quarterly compounding. Each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 24 of 100

24. Question

Quotecan Corporation has issued a bond with the following features, characteristics and/or qualities: Quotecan’s interest coverage ratio (i.e., earnings before interest and taxes, EBIT, divided by interest expense) is within reasonable limits such that, at least in the near term, investors have adequate protection and should expect their interest and principal payments on the bond. On the one hand, the bond is better than junk. On the other hand, the bond carries more credit risk than bonds issued by the highest-rated corporations like, for example, Microsoft (MSFT), Apple (AAPL), Exxon Mobil (XOM), Johnson & Johnson (JNJ), Walmart (WMT). To be more specific, Quotecan’s capacity to repay may be impaired if adverse economic conditions materialize, or if circumstances suddenly change. While these obligations are not speculative in their entirety, they do contain just a few speculative elements which may render the protective elements unreliable over a longer time horizon.

Based on these facts, which credit rating is most likely assigned to Quotecan’s bond offering?

CorrectIncorrect -

Question 25 of 100

25. Question

GARP explains that “perhaps the biggest argument for ERM is that an enterprise-level perspective is the best way to prioritize risks and optimize risk management.” Each of the following is one of the four key reasons that enterprise risk might demand the practice of (or, the art and science of) enterprise risk management, ERM, EXCEPT which is NOT one of the four key reasons?

CorrectIncorrect -

Question 26 of 100

26. Question

Yesterday a web page hosted by Acme received tens of thousands of page views but some were views by malicious bots. Acme utilizes two software applications to detect these malicious “bot-views.” It uploads the same data file from yesterday to both applications. The first application detects 200 bot-views and the second application detects 300 bot-views. Among these, only 40 bot-views were detected by both applications. All bot-views are equally likely to be located, but clearly both applications only identify a minority of the bot-views (otherwise there would be a much higher number of identified bot-views common to both applications). Further, the identification of a bot-view by one application is independent of its identification by the other application. How many malicious bot-views did the web page experience on this day?

CorrectIncorrect -

Question 27 of 100

27. Question

Consider a binary cash-or-nothing call option that pays $100.00 if the stock is above $100.00 at maturity in three months. The option’s underlying non-dividend-paying stock is currently trading at $85.00. The riskfree rate is 4.0% per annum with continuous compounding. We are also told that while S = $85.00 and K = $100.00, N(1) = 0.12350 and N(d2) = 0.100, and the price of a vanilla three-month European call option on this stock is $0.62. Which is nearest to the price of the cash-or-nothing call?

CorrectIncorrect -

Question 28 of 100

28. Question

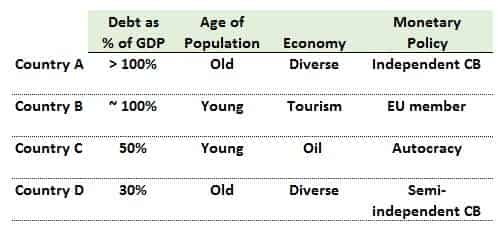

Rebecca is evaluating four different countries in an attempt to determine their respective default risk. She evaluates the countries in four categories: degree of indebtedness as measured by debt as a percentage of gross domestic product; social service/pension commitments as estimated by the average age of the population; nature of the economy (e.g., diverse versus concentrated in oil as a natural resource), and monetary policy. The four countries are summarized in the exhibit below:

Which of the four countries is most likely to default?

CorrectIncorrect -

Question 29 of 100

29. Question

GARP explains that the Basel Committee on Banking Supervision’s standard number 239 (aka, BCBS 239) “was a major driver in the rise of the chief data officer (CDO) function. The CDO is typically responsible for standardizing a firm’s approach to data management.”[1] In addition, which of the following statements is also TRUE about the Basel Committee on Banking Supervision’s standard number 239 (aka, BCBS 239)?

[1] 2020 FRM Part I: Foundations of Risk Management, 10th Edition. Pearson Learning Solutions, 10/2019

CorrectIncorrect -

Question 30 of 100

30. Question

For her investment firm, Audrey has identified six high-priority machine learning use cases. They are given below in three pairs:

I. Segment customers into different groups; and perform sentiment analysis of 10K SEC filings

II. Predict if borrower(s) will default; and forecast future stock price(s) based on fundamental data

III. Decide how to split large-volume trades to sell quickly while minimizing the adverse price effect, and decide how much of a position to hedge using derivatives.The three top-level machine learning approaches are supervised learning (S), unsupervised learning (U), and reinforcement learning (R). Which of the following is the best mapping of the advisable machine learning approach to its corresponding pair of use cases above?

CorrectIncorrect -

Question 31 of 100

31. Question

A non-dividend-paying stock has a current price of $10.00 and a volatility of 25.0% per annum. The risk-free rate is 4.0% per annum with continuous compounding. Consider the following four spread trades:

- Trade #1 is a bull spread with calls. The strike prices are: K1 = $9.00, K2 = $11.00. The up-front cost is $1.00.

- Trade #2 is a bull spread with puts. The strike prices are: K1 = $9.00, K2 = $11.00. The up-front cash flow is $0.93.

- Trade #3 is a bear spread with puts. The strike prices are: K1 = $8.00, K2 = $12.00. The up-front cost is $1.84.

- Trade #4 is a bear spread with calls. The strike prices are: K1 = $8.00, K2 = $12.00. The up-front cash flow is $2.00.

In regard to each trade’s maximum profit, each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 32 of 100

32. Question

Political Risk Services (The PRS Group) provides numerical measures of country risk for more than a hundred countries. Its International Country Risk Guide (ICRG) rating “comprises 22 variables in three subcategories of risk: political, financial, and economic. A separate index is created for each of the subcategories. The Political Risk index is based on 100 points, Financial Risk on 50 points, and Economic Risk on 50 points. The total points from the three indices are divided by two to produce the weights for inclusion in the composite country risk score.”[1]

As of July 2018, according to Damodaran, Taiwan’s composite (ICRG) score was 85. Which of the following is TRUE?

[1] https://www.prsgroup.com/explore-our-products/international-country-risk-guide/

CorrectIncorrect -

Question 33 of 100

33. Question

Consider the following three portfolios where we know the expected excess returns of Portfolios A and B; i.e., E[ER(A)] = 6.0% and E[ER(B)] = 8.4% and these in excess of the riskfree rate. For Portfolios A and B, we also know the factor betas: β(A,1) = 0.40, β(A,2) = 1.20, β(B,1) = 0.80, β(A,1) = 1.50. The unknowns are the two risk premiums on the two factors, F(1) and F(2):

- Portfolio A: E[ER(A)] = β(A,1)*F(1) + β(A,2)*F(2) = 0.40*F(1) + 1.20*F(2) = 6.0%

- Portfolio B: E[ER(B)] = β(B,1)*F(1) + β(B,2)*F(2) = 0.80*F(1) + 1.50*F(2) = 8.4%

- Portfolio C has the following betas: β(C,1) = 1.30 and β(C,2) = 0.90

If Portfolio C has betas as given by β(C,1) = 1.30 and β(C,2) = 0.90, what is the expected excess return of Portfolio C?

CorrectIncorrect -

Question 34 of 100

34. Question

Robert seeks to price an exotic path-dependent option, call it Price(E), but there exists no analytical solution available to value such a derivative. Of course, Robert does have a Black-Scholes option pricing model (BSM OPM). His BSM OPM is a closed-form solution but it will only price a vanilla option; e.g., European or non-path-dependent. Let’s refer to the analytical price of this vanilla option as BSM(V).

He employs a Monte Carlo simulation (MCS) to estimate the price of his exotic, path-dependent option, call this price MCS(E). In this MCS, he generates M sample paths of the future stock price in order to compute M sample payoffs and retrieves the discounted mean to obtain an estimate of the exotic option’s value. Further, he re-uses the same simulated sample paths to inform a simulated value of the vanilla option, call this MCS(V). To summarize, in regard to his vanilla option, he has estimates for both an analytical and simulated price, BSM(V) and MCS(V). In regard to his exotic option, he is not able to estimate BSM(E) but he has generated MCS(E).

He has now retrieved both a simulated and analytical price for the vanilla option; this difference is given by BSM(V) – MCS(V). He applies this error to revised his estimate of the exotic option per the following:

Price(E) = MSC(E) + β*[BSM(V) – MCS(V)]

Bob’s goal of course is to improve the accuracy of his estimate, as evidenced by a reduction in the variance. A good control variate should have two properties. One is that it should be inexpensive to construct, and this control variate meets that test. What is the other property that Bob seeks?

CorrectIncorrect -

Question 35 of 100

35. Question

Every year, Acme Corporation grants stock options to its executives and employees. Like most of its peers, the employee stock options (ESOs) vest over four years and always have a 10-year term. In the event of termination, depending on the particulars, options sometimes accelerate and sometimes are forfeited. Newly recruited executives often receive abnormally large, front-loaded option grants. All option grants always have a fixed strike price, and to date, Acme has never re-priced grants. In the majority of cases, Acme grants at-the-money (ATM) options; in rare cases, Acme grants out-of-the-money (OTM) options. However, Acme never grants in-the-money (ITM) ESOS. To value ESOs, the company has developed basic and advanced versions of both the Black-Scholes-Merton (BSM) and the binomial (aka, lattice) models.

Which of the following statements is TRUE?

CorrectIncorrect -

Question 36 of 100

36. Question

A bond portfolio with a face value of $7.0 million is exposed to the following two key rates:

- The 2-year key rate, KR01(2-year) is equal to $0.030 per 100 face amount and has a daily volatility, σ(bps), of 12.0 basis points

- The 5-year key rate, KR01(5-year) is equal to $0.090 per 100 face amount and has a daily volatility, σ(bps), of 25.0 basis points

As the curve experiences significant non-parallel shifts, the correlation between the key rates is only 0.440. Which of the following is nearest to the daily volatility of the portfolio (in dollars)?

CorrectIncorrect -

Question 37 of 100

37. Question

During a 36-month period during which the risk-free rate was 2.0%, consider a comparison between the market portfolio and two fund managers, Betty and Peter:

- The market portfolio’s excess return was +6.0% (its gross return was +8.0%) with a volatility of 24.0% per annum

- Peter’s portfolio’s excess return was +7.0% (his gross return was + 9.0%) with a volatility of 36.0% per annum and beta, β(P,M) = 0.750

- Betty’s portfolio’s excess return was +11.0% (her gross return was + 13.0%) with a volatility of 44.0% per annum and beta, β(B,M) = 1.650

If the capital asset pricing model (CAPM) is valid, then each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 38 of 100

38. Question

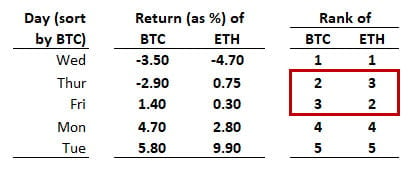

Emily listed the daily returns last week for two cryptocurrencies, bitcoin (BTC) and Ethereum (ETH). These are very small samples of only five returns for each currency. The returns are displayed below along with their ranks; e.g., Wednesday saw the worst performance for both cryptocurrencies, while Tuesday saw the best performance. Albeit a very small sample, the ranks do match on three of the days (Monday, Tuesday, and Wednesday) and differ on only two days (Thursday and Friday).

What are, respectively, the Spearman’s rank and Kendall’s tau?

CorrectIncorrect -

Question 39 of 100

39. Question

The spot price of oil is $100.000 per barrel while the riskfree rate is 3.0% and its storage cost is 2.0% per annum. Oil has positive systematic risk. Specifically, its beta with respect to the market, β(Oil, M) = 1.10. The market’s expected return is 14.0%; i.e., the market’s expected excess return is +11.0%. Finally, the expected growth rate of the oil price (aka, price appreciation) is +8.0%. All rates are per annum with continuous compounding. We are interested in the traded price of the fifteen-month (i.e., 1.25 year) forward contract, and we’ll assume the traded price equals the theoretical price. Which of the following statements is true about (i) the slope of the forward curve and (ii) whether we expect normal contango or normal backwardation?

CorrectIncorrect -

Question 40 of 100

40. Question

Peter is a Financial Analyst whose boss asked him to develop a model, or if necessary a set of models, that are multi-factor risk models for the firm’s fixed income and derivative investment portfolios. Specifically, there are four objectives as follows:

I. To measure and hedge the risk of bond portfolios in terms of the relatively small number of liquid bonds available, in particular, on-the-run government bonds

II. To measure and hedge the risk of a portfolio of swaps in terms of the highly liquid money market and swap instruments, which are more numerous

III. To measure the risk of mixed portfolios not terms of other securities but instead to model direct changes to the shape of the term structure

IV. To measure portfolio volatility by assuming a term structure of volatility but doing so without an excessive “curse of dimensionality;” i.e., avoiding too many correlation pairs

For these four objectives, Peter has three basic multi-factor risk metrics: key-rate exposures, partial ’01s, and forward-bucket ’01s. For which of the four objectives is key-rate exposures best suited?

CorrectIncorrect -

Question 41 of 100

41. Question

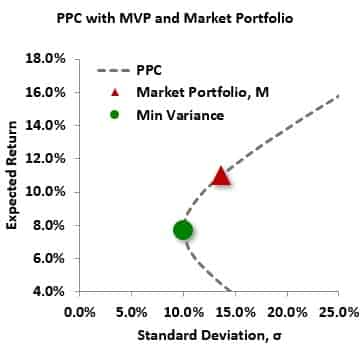

The plot below illustrates an actual portfolio possibilities curve (PPC, dashed line). Two prominent portfolios (minimum variance and market portfolio) are also plotted.

The green point is the minimum variance portfolio, MVP, which has an expected return of 7.70% and standard deviation, σ, of 10.0%. The red triangle is the Market Portfolio that has an expected return of 11.0% and standard deviation, σ, of 13.7%. If the riskfree rate is 4.0%, what is the formula for the capital market line (CML)?

CorrectIncorrect -

Question 42 of 100

42. Question

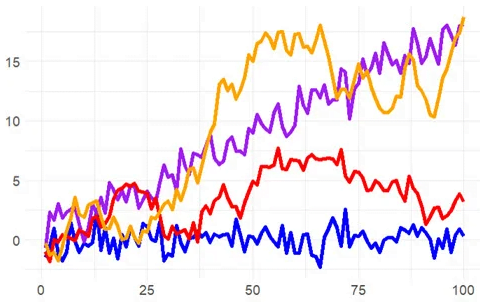

Jeremy simulates four time series: white noise, white noise with trend, a random walk, and a random walk with drift. They are plotted below.

Jeremy conducts an Augmented Dickey-Fuller (ADF) test with the R function adf.test(). According to GARP, the ADF is the most widely used unit root test. Its null hypothesis is that the series is a unit root process and its corresponding alternative hypothesis is that the series is stationary. Importantly, this adf.test() does allow an intercept and trend: it evaluates a trend-stationary process as stationary but evaluates a difference-stationary process (prior to transformation) as non-stationary.

If Jeremy performs an ADF test on each of these four series, what is the most likely outcome?

CorrectIncorrect -

Question 43 of 100

43. Question

The current level of a stock index is 7,790 while the risk-free rate is 4.0% per annum with annual compounding. The dividend yield assumption is 1.50% with continuous compounding. We can observe that the nine-month futures contract is currently trading at a price of 8,000. If an index arbitrage is possible, what is the index arbitrage trade?

CorrectIncorrect -

Question 44 of 100

44. Question

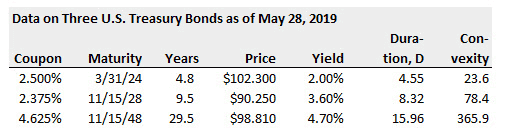

On May 28, 2019, Robin the Portfolio Manager considers the purchase of $100.0 million face amount of the U.S. Treasury 2 3/8s (2.375%) due November 15, 2028, at a cost of $90,250,000. She refers to this as her “bullet” investment. After an analysis of the interest rate environment, she is comfortable with the pricing of the bond at a yield of 3.60% and with its duration of 8.32 years.

However, upon further inspection, Robin considers an alternative to the above-mentioned bullet investment in the 10-year 2 3/8s. Specifically, the alternative is a “barbell” investment in the shorter maturity 5-year 2 1/2s and the longer maturity 30-year 4 5/8s. The barbell would be constructed to have the same COST and DURATION as the bullet investment. Which of the following is nearest to the convexity of the alternative barbell portfolio?

CorrectIncorrect -

Question 45 of 100

45. Question

Securitization is a trend that is over fifty years old: The Housing and Urban Development Act of 1968 gave birth to Ginnie Mae (https://www.ginniemae.gov/) in an effort to promote homeownership by way of guaranteeing residential mortgage-backed securities (MBS). As GARP explains (see Figure 4.2 of Chapter 4) there have been several milestones along the way. Each of the following statements about securitization is true EXCEPT which is false?

CorrectIncorrect -

Question 46 of 100

46. Question

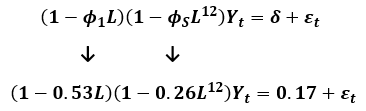

Consider the following seasonal time series model that is represented with lag notation:

Note that ϕ(1) = 0.530 and ϕ(s) = 0.260. In regard to this seasonal model, each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 47 of 100

47. Question

The current spot exchange rate between the euro (EUR) and quote currency YYY is 1.3000 EURYYY. The EUR risk-free rate is 4.0% and the YYY risk-free rate is 2.0%; each interest rate is per annum with annual compounding. According to covered interest rate parity (CIRP), which is nearest to the forward rate in nine months (T = 0.75 years) quoted in points?

CorrectIncorrect -

Question 48 of 100

48. Question

A speculative (aka, junk) bond has 15.0 years to maturity and pays a semi-annual 6 1/8 coupon; i.e., its coupon rate is 6.125% payable semi-annually. Its yield is 11.00%. If we assume a reasonable shock value (i.e., less than 100 basis points), which of the following is nearest to the bond’s effective convexity?

CorrectIncorrect -

Question 49 of 100

49. Question

In regard to limits policies, GARP explains that “optimal risk governance requires the ability to link risk appetite and limits to specific business practices. Accordingly, appropriate limits need to be developed for each business as well as for the specific risks associated with the business (as well as for the entire portfolio of the enterprise).” Most institutions set two types of limits, tier 1 (one) and tier 2 (two) limits. About these limits, which of the following is TRUE?

CorrectIncorrect -

Question 50 of 100

50. Question

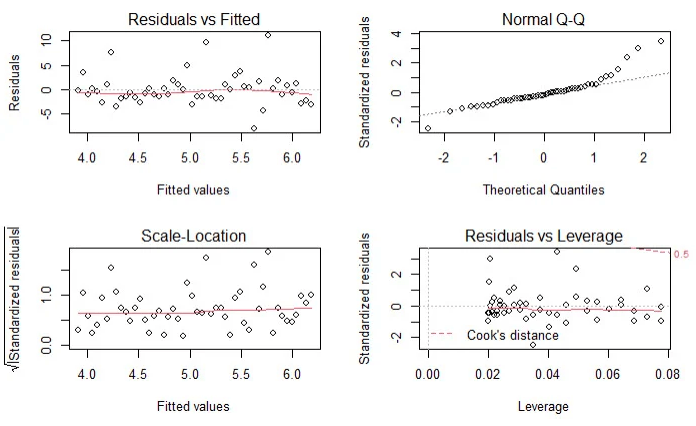

Patrick generated a simple regression line for a sample of 50 pairwise observations. After generating the regression model, he ran R’s built-in plot(model) function which produces a standard set of regression diagnostics. These four plots are displayed below.

About these diagnostic plots, which of the following statements is TRUE?

CorrectIncorrect -

Question 51 of 100

51. Question

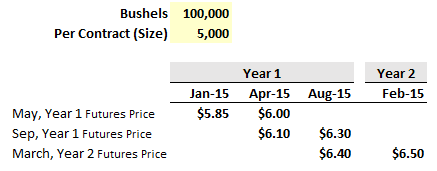

On January 15th of Year 1, a company decides to hedge the planned purchase of 100,000 bushels of corn thirteen months later (on February 15 of Year 2). Below are displayed the per-bushel futures prices of three selected contracts on four different dates.

Assume the following: at the time of ultimate purchase (February 15 of Year 2), the spot price is $6.47 per bushel when the final contract’s basis is $6.47 – $6.50 = -$0.03. If the company employs a stack-and-roll strategy, what is the company’s net (i.e., after hedging) cost to acquire the corn? [inspired by GARP’s EOC Question 8.20]

CorrectIncorrect -

Question 52 of 100

52. Question

Consider a 9-year bond with a semi-annual 10.0% coupon that has a current price of $119.780 and a yield of 7.000%. If the yield drops to 6.850%, the bond’s price increases to $120.900. If this is the case, then which of the following is nearest to the bond’s dollar value of ’01 (DV01)?

CorrectIncorrect -

Question 53 of 100

53. Question

GARP explains that “risk management must be implemented across the entire enterprise under a set of unified policies and methodologies. (This is called enterprise risk management …). The infrastructure of risk management, which includes both physical resources and clearly defined operational processes, must be up to the task of an enterprise-wide scope.”[1] However, it is a difficult and daunting task to evaluate the fitness of a firm or bank’s risk management system. Among the following features, indicators, or characteristics, which is MOST LIKELY to signify that the firm is serious about its risk management process?

[1] 2020 FRM Part I: Foundations of Risk Management, 10th Edition. Pearson Learning Solutions, 10/2019.

CorrectIncorrect -

Question 54 of 100

54. Question

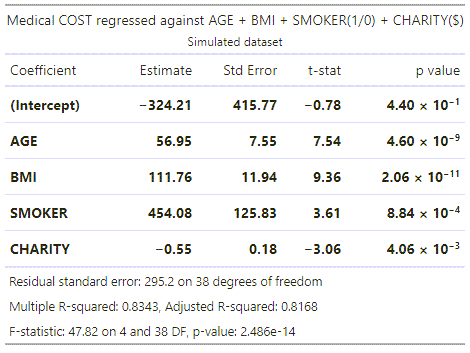

Mary works for an insurance company and she has regressed medical costs (aka, the response or dependent variable) for a sample of patients against four independent variables: AGE, BMI, SMOKER, and CHARITY. The sample’s average age is 38.51 years. Body mass index (BMI) is mass divided by height squared and the sample’s average BMI is 22.16. SMOKER is a dummy variable where zero indicates a non-smoker and 1 indicates a smoker; the sample’s average SMOKER value is 0.163 which indicates that 16.3% of the sample are smokers. CHARITY is the dollar amount of charitable spending in the last year; the sample average is $490.70 donated to charity in the last year. Mary’s regression results are displayed below.

Each of the following statements is true about these regression results EXCEPT which is false?

CorrectIncorrect -

Question 55 of 100

55. Question

Today an exchange introduced a new futures contract. The open interest started at zero. Because it is a new contract, there were only the following four trades:

- Trader Adam (TA) buys (aka, takes a long position in) 1,000 contracts from Trader Betty (TB) who is the seller (aka, takes a short position) and both are new positions

- Trader Charles (TC) buys 300 contracts, in a new position, from Trader Adam (TA) who closes out 300 of his contracts

- Trader Denise (TD) sells 225 contracts, in a new position, to Trader Betty (TB), the buyer who closes out 225 of her contracts

- Trader Betty (TB) delivers on 175 of her short contracts to Trader Adam (TA) who takes delivery on 175 of his long contracts

What is the open interest, after the above four trades, at the end of the day?

CorrectIncorrect -

Question 56 of 100

56. Question

Assume that the following upward-sloping zero rate (aka, spot rate) curve prevails:

Tuckman introduces the concept of a coupon effect in Chapter 3. Each of the following statements relates to this coupon effect and is necessarily true EXCEPT which statement is false?

CorrectIncorrect -

Question 57 of 100

57. Question

To hedge risk, the firm’s toolbox includes derivatives such as swaps, futures, forwards, and options. About the use of derivatives to hedge, each of the following is true EXCEPT which is inaccurate?

CorrectIncorrect -

Question 58 of 100

58. Question

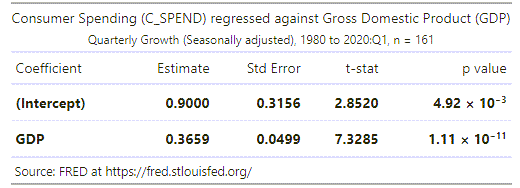

Debra is an economist who is interested in the relationship between consumer spending and the gross domestic product (GDP). From the FRED database at the Fed’s Bank of St. Louis (https://fred.stlouisfed.org/) she collects quarterly data from 1980 through the first quarter of 2020; her series includes n = 161 quarters of data. She regresses consumer spending (C_SPEND), as the response (aka, dependent) variable against GDP as the explanatory (aka, independent) variable. Each series is not a level, but rather a seasonally adjusted percent change. The regression results are displayed below.

Additionally, Debra calculates the (univariate) standard deviation of each variable over the period: σ(C_SPEND) = 2.484 and σ(GDP) = 3.412. In regard to these regression results, each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 59 of 100

59. Question

Derivatives can be cleared through a central counterparty (CCP) or they can be cleared bilaterally; i.e., uncleared transactions are cleared bilaterally. If the derivatives are cleared through a CCP, they can be either exchange-traded or over-the-market (OTC). In this way, we distinguish between the exchange and the clearinghouse (which may be owned by an exchange). While exchanges operate CCPs, we can also refer to the emergent OTC CCPs. In regard to central counterparties (CCPs), which of the following statements is TRUE?

CorrectIncorrect -

Question 60 of 100

60. Question

Exactly one year ago, Sally purchased a $100.00 face value bond that pays a semi-annual coupon with a coupon rate of 9.0% per annum. When she purchased the bond, it had a maturity of 10.0 years and its yield to maturity (YTM; aka, yield) was 6.00%. If the bond’s price today happens to be unchanged from one year ago (when she purchased the bond), which of the following is nearest to the bond’s yield (yield to maturity) today?

CorrectIncorrect -

Question 61 of 100

61. Question

One of the risk management building blocks is the need to balance risk and reward. Specifically, GARP says, “Economic capital provides the firm with a conceptually satisfying way to balance risk and reward. For each activity, firms can compare the revenue and profit they are making from an activity to the amount of economic capital required to support that activity.” Each of the following statements is true about RAROC EXCEPT which is inaccurate?

CorrectIncorrect -

Question 62 of 100

62. Question

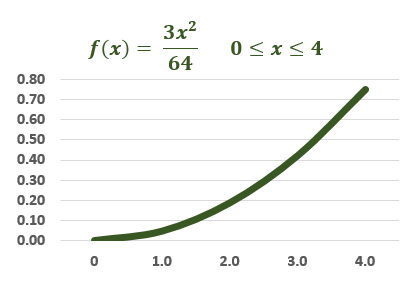

Consider a random variable that represents the loss severity of a risky asset and is given by the continuous probability distribution f(x) = 3*x^2/64 on the domain from zero to four:

What are this variable’s mean and variance?

CorrectIncorrect -

Question 63 of 100

63. Question

A trader shorts 500 shares when the stock price is $70.00. The initial and maintenance margin, respectively, are 150.0% and 125.0%. At what share price will further margin be required?

CorrectIncorrect -

Question 64 of 100

64. Question

As a market maker, Toughgreen Financial has written (aka, taken a short position in) a single contract for 100 call options on a non-dividend-paying stock whose volatility is 36.0% per annum when the riskless rate is 3.0%. Their strike price is $100.00 but the options are underwater because the current stock price is $90.00. The option term is six months. At the current stock price, each option has a value of $5.88 and each option’s percentage delta, Δ = +0.410. From Toughgreen’s perspective, if the stock price increases by +$3.00 to $93.00, which is nearest to the impact on the position’s value?

CorrectIncorrect -

Question 65 of 100

65. Question

According to GARP, one of the building blocks in risk management is a proper understanding of the difference between expected loss, unexpected loss, and extreme risk; aka, tail risk. In regard to this building block, which of the following statements is TRUE?

CorrectIncorrect -

Question 66 of 100

66. Question

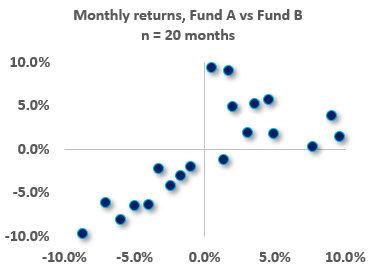

Below is a scatterplot of monthly returns, Fund A versus Fund B, over twenty months (n = 20).

Skewness is a trivial (special) case of coskewness; e.g., S(AAA) and S(BBB) are the trivial instances of coskewness. Similarly, Kurtosis is the trivial case of coskewness; e.g., K(AAAA) and K(BBBB) are the trivial instances of cokurtosis. In regard to this scatterplot (this two-variable application), how many nontrivial coskewness measures apply; are they positive or negative; and how many nontrivial cokurtosis measures exist?

CorrectIncorrect -

Question 67 of 100

67. Question

Ralph creates a portfolio with two positions: a short call and a short put with identical maturities on the same stock that has a current price, S(0) = $20.00. His short call with a strike price, K1 = $22.00 has a premium, c1 = $1.75. His short put with a strike price, K2 = $18.00 has a premium, p2 = $1.25. Both options are out-of-the-money by the same amount of $2.00. Recall that option profit is equal to the payoff net of the premium and we (typically) ignore the impact of discounting. On the future date with both options mature, under which future stock price scenario is Ralph’s trade profitable?

CorrectIncorrect -

Question 68 of 100

68. Question

Sally owns a non-dividend-paying stock that is currently trading at $60.00. As a hedge, she buys an out-of-the-money three-month European put option on the stock with a fixed strike price of $57.00, which is a 5.0% discount to the current stock price. The stock’s volatility is 36.0% per annum. The riskfree rate is 4.0%. According to the Black-Scholes-Merton model, what is the value of the put? (here is a Z lookup table snippet that you can use http://www.bionicturtle.com/images/2018/forum/082718-t4-815-1-zlookup.jpg).

CorrectIncorrect -

Question 69 of 100

69. Question

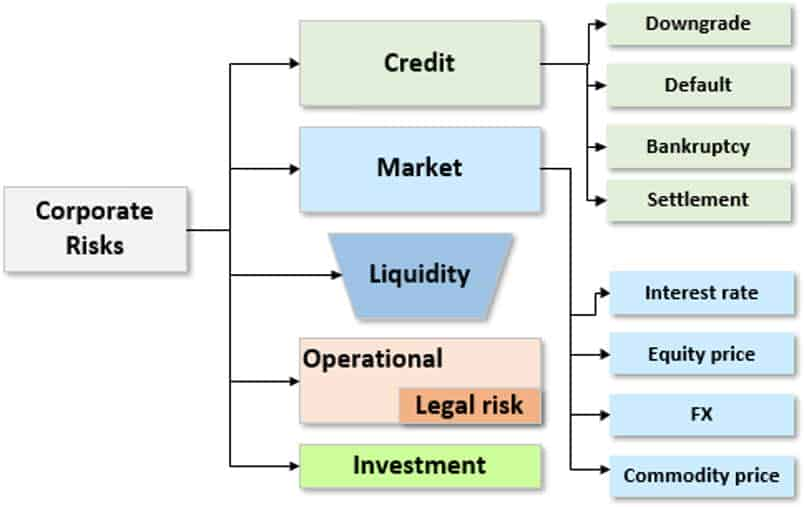

Galaxy Financial is a large bank whose risk department developed the following risk typology after surveying key stakeholders within the bank:

Which of the following is most likely TRUE about their typology?

CorrectIncorrect -

Question 70 of 100

70. Question

An asset has a one-month volatility of 6.0%. If the asset’s returns are i.i.d., the asset has a three-month volatility of 6.0% * sqrt(3/1) = 10.4% and a one-year volatility of 6.0% * sqrt(12/1) = 20.8%. In general, by convention (and to avoid confusion), we should prefer the annualized measure: interest rate and volatility inputs and outputs are generally expressed in per annum terms. However, let’s assume we are interested in the three-month value-at-risk (VaR) of this asset. If we assume that the asset’s arithmetic returns, [S(t)-S(t-1)]/S(t-1), have a normal distribution and i.i.d., then per the square root rule (SRR) the 95.0% confident three-month relative VaR of this asset is 6.0% * sqrt(3/1) * 1.645 = 17.10%; the “relative” adjective signifies that we are excluding the positive expected return which would mitigate this worst expected loss.

Now let’s violate the i.i.d. assumption. Specifically, let’s retain the “identical” but edit the “independence” to make an assumption of +0.50 auto- or serial-correlation between the returns; i.e., if the returns are correlated, they cannot be independent and i.i.d. is not satisfied such that we cannot rely on the square root rule (SRR). Now we are interested in the three-period (i.e., three-month) VaR based on a three-month volatility but where the variable (log return) has a positive correlation (with itself) of 0.50. Hint: per variance properties σ^2(X + Y + Z) = σ^2(X + Y) + σ^2(Z) + 2*COV(X +Y, Z) or equivalently σ^2(R1 + R2 + R3) = σ^2(R1 + R2) + σ^2(R3) + 2*COV(R1 +R2, R3).

If each one-month return has a standard deviation of 6.0% and the serial correlation between returns is +0.50, which is nearest to the three-month 95.0% normal relative VaR?

CorrectIncorrect -

Question 71 of 100

71. Question

Joe is a 29-year-old single male who prefers to invest in a fund because he has neither the time nor interest to spend researching and selecting individual stocks. His financial advisor Sally is experience in the following fund categories: closed- and open-end mutual funds, hedge funds, and index funds. When Sally asks for Joe’s preferences, his only strongly felt opinion is that he prefers to avoid paying high expenses or fees (reading the financial news gives him the impression that he should seek low fees because fees are trending toward zero). Which of the following is she MOST LIKELY to recommend to Joe?

CorrectIncorrect -

Question 72 of 100

72. Question

Given a universe of 500 stocks and an initial assumption for the risk-free rate, an analyst generates the efficient frontier. She assumes the mean-variance framework. The investment committee compliments her analysis and makes a request: they ask her to decrease the risk-free rate (the rate at which an investor can both borrow and lend) but otherwise make no changes (aka, ceteris paribus) to the expected returns or variance matrix for the equities. Which of the following is most likely to be correct?

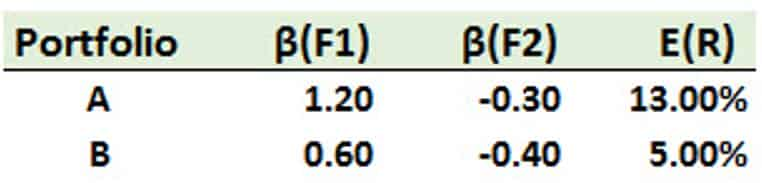

CorrectIncorrect -

Question 73 of 100

73. Question

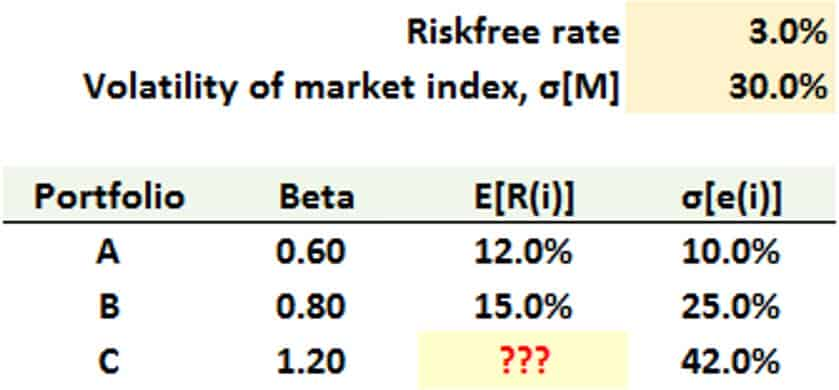

In a single-factor economy, each of the following portfolios (A, B, and C) is well-diversified:

You discover there is NOT an arbitrage strategy among these three portfolios. In this case, what should be the expected return of Portfolio (C)?

CorrectIncorrect -

Question 74 of 100

74. Question

Let’s assume two normal variables: X ~ N(0, 3.0^2) and Y ~ N(4.0, 9.0^2). Let V be a mixture distribution where X has a component weight of 80% and Y has a component weight of 20%. Let W = 0.80*X + 0.20*Y with the assumption that X and Y are independent; that is, this W is the sum of independent, random variables. Which is more likely (the mixture or the convolution) to realize a negative outcome; that is, is Pr(V<0) > Pr(W<0), or on the other hand, is Pr(W<0) > Pr(V<0)?

CorrectIncorrect -

Question 75 of 100

75. Question

Customers of insurance companies do not like to see their premiums increase, obviously. At the same time, most customers care about the claims process and quality: if the insurance doesn’t pay out when it is needed, so the cheapest policy is not always the best! In regard to an increase in the premium(s), which of the following is MOST LIKELY to be TRUE?

CorrectIncorrect -

Question 76 of 100

76. Question

In the wake of the global financial crisis (GFC), stress testing has received prominent media attention. Siddique and Hasan explain that “stress testing has many approaches. For example, at many institutions, finance and treasury have had ownership of the budgeting process. Hence, centralized stress testing could be housed in such a central function. Other institutions have taken a more decentralized approach, wherein the central function has only acted as an aggregator. Effective stress testing does not need a given organisational form or approach. However, a given organisational form will require certain aspects to ensure effectiveness. For example, in a decentralized approach towards stress testing, consistency across the organisation becomes important, and the institution will need to find ways of ensuring that consistency.”[1]

Each of the following statements is true about stress testing EXCEPT which is false?

[1] Siddique and Hasan, Stress Testing: Approaches, Methods, and Applications (London: Risk Books, 2013)

CorrectIncorrect -

Question 77 of 100

77. Question

Suppose that there are two independent economic factors, F1 and F2 . The risk-free rate is 1.0%, and all stocks have independent firm-specific components with a standard deviation of 25%. The following are well-diversified portfolios; e.g., Portfolio (A) has a beta sensitivity to factor the first factor, β(F1), of 1.20 and an expected return of 13.0%:

Which is the correct return-beta relationship in this economy?

CorrectIncorrect -

Question 78 of 100

78. Question

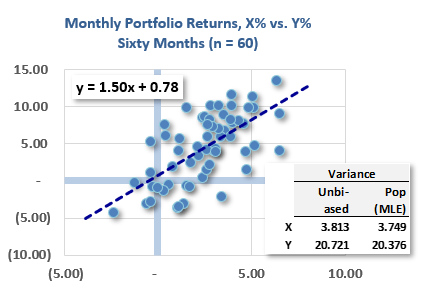

The scatterplot below plots sixty pairwise monthly returns over the last five years; each dot represents the return of Y (on the y-axis) and the return of X (on the x-axis) in a given month. Also shown is the ordinary least squares (OLS) regression line generated by Excel: Y = 1.50*X + 0.78. Finally, the univariate variances for each series are shown.

Which of the following is nearest to the correlation between X and Y? (Bonus question: if we flipped the axes, then what is the correlation?)

CorrectIncorrect -

Question 79 of 100

79. Question

The originate-to-distribute (OTD) banking model has both advantages and disadvantages. In regard to the OTD banking model, which of the following statements is TRUE?

CorrectIncorrect -

Question 80 of 100

80. Question

Gigh Inc., a publicly traded company, had a wild swing today after OPEC cut production. Gigh ended the day with a -16% loss. Prior to this (most recently), the daily volatility was estimated to be 4.40% according to the exponentially weighted moving average (EWMA) model. The EWMA model had originally assumed a lambda, λ, of 0.70, but David wants to adjust the model’s responsiveness to recent market conditions. David notices that his error is too high, so he wants to change the model to respond more quickly to changes in volatility, so he decides to decrease λ by 0.10. After David properly adjusts lambda, what is the new volatility estimate using EWMA?

CorrectIncorrect -

Question 81 of 100

81. Question

Assume the riskfree rate is 3.0% while the market portfolio has a return of 13.0% (i.e., excess return is 10.0%) with volatility of 15.0%. Further, the following four portfolios are observed:

- Portfolio (A) has an expected return of 11.0% with volatility of 8.0%

- Portfolio (B) has an expected return of 7.0% with volatility of 20.0% and its correlation to the market is 0.30

- Portfolio (C) has a beta with respect to the market β(C, M) = 1.50 and its realized return of +20.0% implies an alpha of +2.0%

- Portfolio (D) has a beta with respect to the market β(C, M) = 0.40 and its realized return of +9.0% implies an alpha of +2.0%

Under the conditions of modern portfolio theory (MPT; mean-variance framework) and the capital asset pricing model (CAPM), each of the above portfolios is valid and plausible EXCEPT which is not possible?

CorrectIncorrect -

Question 82 of 100

82. Question

In comparing and contrasting the law of large numbers (LLN) and the central limit theorem (CLT), each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 83 of 100

83. Question

For its most recent fiscal year, Acehouse Property-Casualty (APC) reports revenue of $300.0 million. Losses due to payouts (aka, loss and loss adjustment expense) were $213.0 million. Expenses (aka, underwriting expenses) were $69.0 million. Dividends paid were $6.0 million. Investment income was $9.0 million. What was the Operating ratio; aka, Combined ratio after dividends (CRAD) adjusted for Investment Income?

CorrectIncorrect -

Question 84 of 100

84. Question

Scott is a risk manager for an investment manager. He is interested in estimating the potential loss the portfolio can expect over a specific time frame at a given confidence level (VaR) and the average of all potential losses beyond that potential loss (aka, expected shortfall, ES). Over the past 120 days, the portfolio’s ten worst daily returns were the following:

Find the 1-day 5% VaR and ES for Scott (per Ch 2 Calculating and Applying VaR).

CorrectIncorrect -

Question 85 of 100

85. Question

A portfolio with a volatility of 30.0% has a Treynor measure of 0.080. The portfolio has a correlation of 0.50 with the market index which itself has a volatility of 20.0%. What is the portfolio’s Sharpe measure?

CorrectIncorrect -

Question 86 of 100

86. Question

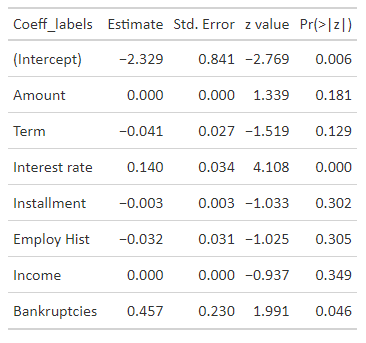

Darlene is a risk analyst who evaluates the creditworthiness of loan applicants at her financial institution. Her department is testing a new logistic regression model. If the model performs well in testing, it will be deployed to assist in the underwriting decision-making process. The training data is a sub-sample (n = 800) from the same LendingClub database used in reading. In the logistic regression, the dependent variable is a 0/1 for the terminal state of the loan being either zero (fully paid off) or one (deemed irrecoverable or defaulted). In the actual code, this dependent variable is labeled ‘outcome’.

The following are the features (aka, independent variables) as given by their textual labels: Amount, Term, Interest_rate, Installment, Employ_hist, Income, and Bankruptcies. In regard to units in the database, please note the following: Amount is thousands of dollars ($000s); Term is months; Interest_rate is effectively multiplied by one hundred such that 7 equates to 7% or 0.070; Installment is dollars; Employment_hist is years; Income is thousand of dollars ($000); and Bankruptcies is a whole number {0, 1, 2, …}.

The table below displays the logistic regression results:

In regard to this logistic regression, each of the following statements is true EXCEPT which is false?CorrectIncorrect -

Question 87 of 100

87. Question

Consider the following four mutual funds and their respective behaviors:

- Fund A is an open-end fund that engages in “late trading” by accepting orders after 4 pm

- Fund B engages in “front running” by allowing its traders to make profitable trades in their own accounts ahead of the fund’s large block trades

- Fund C engages in “directed brokerage” because it has an informal, reciprocal arrangement that guarantees the fund will use the brokerage for trades but only if the brokerage recommends its clients to the mutual fund

- Fund D engages in “timing the market” because, among its watchlist of 100 stocks, it buys (sells) whenever the price moves two standard deviations below (above) its 200-day moving average

Each of these behaviors is undesirable (or illegal) EXCEPT which is acceptable; i.e., which of the following statements is TRUE?

CorrectIncorrect -

Question 88 of 100

88. Question

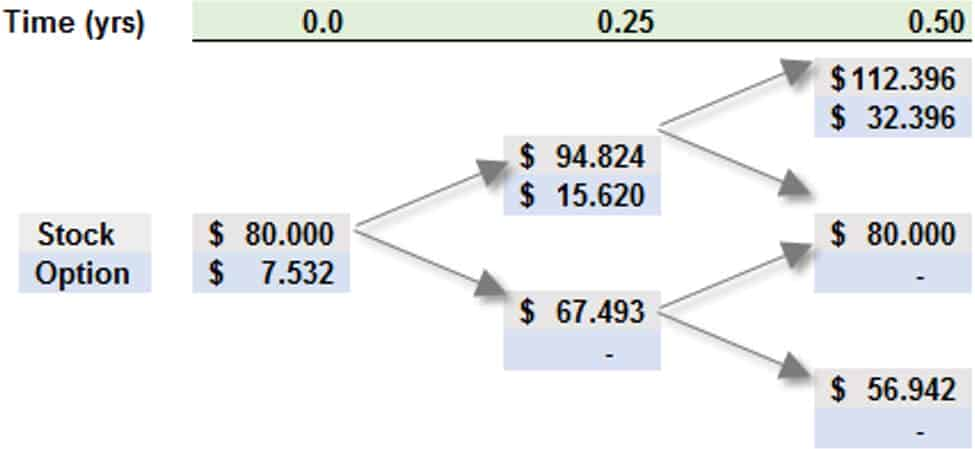

Consider a six-month at-the-money (ATM) European call option on a non-dividend-paying stock with a current price of $80.00. Peter the Risk Analyst has employed a two-step (i.e., three months per step) binomial model to price the option, as displayed below:

Peter’s model matches the up and down movements to his estimate of the stock’s prospective volatility, which he assumes is 34.0% per annum. The risk-free rate is 4.0%. Which of the following is nearest to the risk-neutral probability of the stock price going up in a single step?

CorrectIncorrect -

Question 89 of 100

89. Question

About risk reporting practices, the Committee says “[51.] Accurate, complete and timely data is a foundation for effective risk management. However, data alone does not guarantee that the board and senior management will receive appropriate information to make effective decisions about risk. To manage risk effectively, the right information needs to be presented to the right people at the right time. Risk reports based on risk data should be accurate, clear and complete. They should contain the correct content and be presented to the appropriate decision-makers in a time that allows for an appropriate response. To effectively achieve their objectives, risk reports should comply with the following principles. Compliance with these principles should not be at the expense of each other …”[1]

Each of the following is a risk reporting principle EXCEPT which is not a risk reporting principle?

[1] “Principles for Effective Data Aggregation and Risk Reporting,” (Basel Committee on Banking Supervision Publication, January 2013)

CorrectIncorrect -

Question 90 of 100

90. Question

Peter wants to model the following AR(2) time series: Y(t) = 0.750*Y(t-1) – 0.1250*T(t-2) + e(t). He wonders if this AR(2) is stationary. He realizes that he can write this as a lag polynomial:

- Y(t) = 0.750*L – 0.1250*L^2 + ε(t); first he expresses the model with lag operators

- (1 – 0.750*L + 0.1250*L^2)*Y(t) = ε(t); then he isolates the lag polynomial

- (1 – 0.50*L)(1 – 0.250*L)*Y(t) = ε(t); finally, he factors the polynomial

Which of the following statements about this AR(2) time series is true?

CorrectIncorrect -

Question 91 of 100

91. Question

The daily standard deviation of Bitcoin (BTC) is $200.00 while the standard deviation of the futures contract price (on the same BTC) is $340.00. The correlation between the two changes is 0.850. If the size of one futures contract is five Bitcoins (5 BTC), and the trader seeks to hedge the purchase of 100 Bitcoins (100 BTC), then how many contracts should be shorted to hedge?

CorrectIncorrect -

Question 92 of 100

92. Question

After Barbara wrote (i.e., sold) 100 put option contracts, the trade’s position delta was +7,200. The put options were in-the-money as the stock price was $70.00 while the options’ strike price was $100.00. Each contract was for 100 put options. The percentage gamma of each put option was +0.0120. If the stock price subsequently, immediately decreased by $10.00 to $60.00, which is nearest to an estimate of the trade’s new position delta?

CorrectIncorrect -

Question 93 of 100

93. Question

The riskfree rate is 3.0% and the market portfolio’s expected return is 10.0% (put another way, the market’s excess expected return is 7.0%). Consider two portfolios:

- Portfolio A has a high volatility, σ(A) = 50.0% per annum, but its correlation to the market portfolio is only, ρ(A, M) = 0.30

- Portfolio B has a moderate volatility, σ(B) = 30.0% per annum, and its correlation to the market portfolio is, ρ(B, M) = 0.70

If both portfolios lie on the security market line (SML), and if Portfolio A has an expected return, ER(A) = 7.20%, then what is the expected return of Portfolio B?

CorrectIncorrect -

Question 94 of 100

94. Question

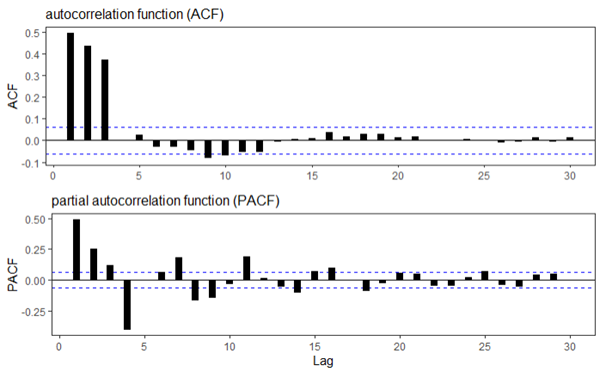

Below are plotted the autocorrelation function (ACF) and partial autocorrelation function (PACF) for a simulated time-series process. Please note that the horizontal dashed blue lines represent the 95.0% confidence interval.

Which of the following time-series models is most likely described by these ACF and PACF plots?

CorrectIncorrect -

Question 95 of 100

95. Question

Peter is a new analyst who has been asked to perform a valuation of a mortgage-backed security (MBS) using one of the firm’s models. The pool is likely to be stripped into interest-only (IO) and principal-only (PO) strips. Each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 96 of 100

96. Question

Trader Joe (who is unrelated to the awesome grocery store!) takes a long position in 100 out-of-the-money (OTM) put option contracts when the non-dividend-paying stock price is $88.00 and its volatility is 28.0%; each contract is for 100 options. The strike price is $80.00, and the option term is six months. The risk-free rate is 5.0%. The value of each option is $4.38, and the position’s value is $43,800.00. With respect to these puts, the immediate percentage delta, Δ = -0.2550 and gamma, Γ = 0.0130. If the stock price jumps by +$7.00 to $95.00, which is nearest to the position’s value as approximated by delta and gamma; i.e., without a full re-pricing of the position?

CorrectIncorrect -

Question 97 of 100

97. Question

Which of the following is TRUE about the bank’s audit function?

CorrectIncorrect -

Question 98 of 100

98. Question

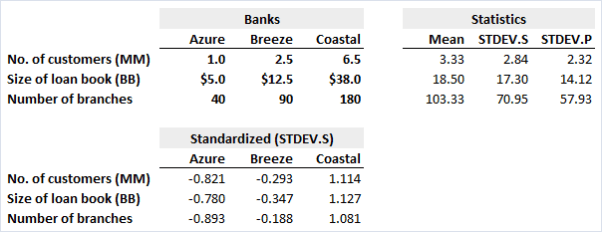

For each of three banks (Azure Bank, Breeze Bank, and Coastal Bank), Stella collected the following data on three features:

Statistics displayed (top-right panel) include the mean, sample standard deviation (STDEV.S), and population standard deviation (STDEV.P). The standardized features (lower-left panel) are based on the sample standard deviation.

With respect to the standardized features (not the raw values), which of the following is nearest to the Euclidean distance between Breeze Bank and Coastal Bank?

CorrectIncorrect -

Question 99 of 100

99. Question

Among over-the-counter (OTC) interest rate derivatives, interest rate swap contracts are the most actively traded, according to BIS (source: https://www.bis.org/publ/qtrpdf/r_qt2212e.htm). Further, as Libor phases out, swaps will increasingly reference overnight rates such as SOFR and SONIA. About these modern overnight indexed swap (OIS) contracts, each of the following statements is true EXCEPT which is false?

CorrectIncorrect -

Question 100 of 100

100. Question

Analyst Patricia is analyzing the following four bonds:

- Bond A is a $100.00 face value bond with 7.0 years to maturity that pays a monthly coupon at a rate of 6.0% per annum and offers a yield of 5.0% per annum (with monthly compound frequency)

- Bond B is a $100.00 face value bond with 10.0 years to maturity that pays a semi-annual coupon at a rate of 4.0% per annum and offers a yield of 5.0% per annum (with semi-annual compound frequency)

- Bond C is a $100.00 face value bond with 10.0 years to maturity that pays an annual coupon at a rate of 7.0% per annum and offers a yield of 6.0% per annum (with annual compound frequency)

- Bond D is a $1,000.00 face value zero-coupon bond with 30.0 years to maturity that offers a yield (aka, yield to maturity) of 8.0% per annum with semi-annual compound frequency

In terms of their current theoretical prices, which bonds are, respectively, the cheapest and most expensive (among the four)?

CorrectIncorrect