Hi David,

I'm lost in the ways 3 tiers of capital should be alloated to credit/market/operational risks.

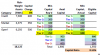

Under min. capital req'd column:

1. For credit risk: why only $300 from Tier 1 to be allocated? We have another $600;

2. For market risk: why only $100 from Tier 1 to be allocated, why don't we allocate more than that? Do we consider tier 1 and 3 only for market risks?

3. For operational risk: why only $250 from Tier 1? $500 is left after allocation from Tier 1 to credit and market risks, can't we apply the whole to operational risk?

Thanks

Mish

I'm lost in the ways 3 tiers of capital should be alloated to credit/market/operational risks.

Under min. capital req'd column:

1. For credit risk: why only $300 from Tier 1 to be allocated? We have another $600;

2. For market risk: why only $100 from Tier 1 to be allocated, why don't we allocate more than that? Do we consider tier 1 and 3 only for market risks?

3. For operational risk: why only $250 from Tier 1? $500 is left after allocation from Tier 1 to credit and market risks, can't we apply the whole to operational risk?

Thanks

Mish