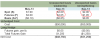

Hi, I am little confused in below table on page 36 of Hull Notes. specially around red color part. if spot is 2.00 in sept -13, why would future price difference from spot assuming future expiry is also in sept. isn't it like corn is selling in market at spot at 2.00 and future is at 1.95 then buy future at 1.95 that will expire immediately and sell it at 2.00.

I am terribly confused on thinking of why future price would be different from spot if future is expiring immediately. can you please help me to understand future expiry date in below example?

thanks in advance.

I am terribly confused on thinking of why future price would be different from spot if future is expiring immediately. can you please help me to understand future expiry date in below example?

thanks in advance.