Hi, re the discussions on CDO tranche spreads with respect to correlation between the assets in the CDO, I am referring to page 125 of Chapter 7 of Market Risk Measurement & Management 2022 edition, it states:

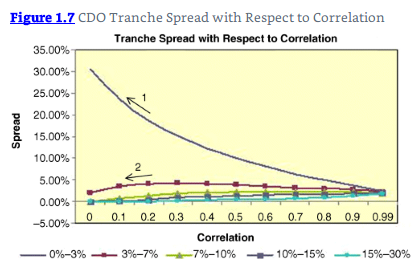

"Importantly, the correlation of the bonds in CDOs (which originally were only investment-grade bonds) decreased, since bonds of different credit qualities are typically lower-correlated. This led to huge losses of hedge funds, which had put on a strategy where they were long the equity tranche of the CDO and short the mezzanine tranche of the CDO. Figure 7.7 shows the dilemma. Hedge funds had invested in the equity tranche10 (0% to 3% in Figure 7.7) to collect the high-equity tranche spread. They had then presumably hedged11 the risk by going short the mezzanine tranche12 (3% to 7% in Figure 7.7). However, as we can see from Figure 7.7, this “hedge” is flawed."

...where they were bolded in the text above, they are the exact opposite to what the BT Forum discussion threads ( https://forum.bionicturtle.com/thre...n-in-risk-management-meissner-chapter-1.8207/ ) have described, ie Short equity tranche and Long mezzanine tranche.

Am I missing something fundamental here, pls?

Appreciate any help / inputs to clarify this, pls.

"Importantly, the correlation of the bonds in CDOs (which originally were only investment-grade bonds) decreased, since bonds of different credit qualities are typically lower-correlated. This led to huge losses of hedge funds, which had put on a strategy where they were long the equity tranche of the CDO and short the mezzanine tranche of the CDO. Figure 7.7 shows the dilemma. Hedge funds had invested in the equity tranche10 (0% to 3% in Figure 7.7) to collect the high-equity tranche spread. They had then presumably hedged11 the risk by going short the mezzanine tranche12 (3% to 7% in Figure 7.7). However, as we can see from Figure 7.7, this “hedge” is flawed."

...where they were bolded in the text above, they are the exact opposite to what the BT Forum discussion threads ( https://forum.bionicturtle.com/thre...n-in-risk-management-meissner-chapter-1.8207/ ) have described, ie Short equity tranche and Long mezzanine tranche.

Am I missing something fundamental here, pls?

Appreciate any help / inputs to clarify this, pls.

) the hedge fund did not own/short the CDO equity tranche, it has sold credit protection on the tranche (aka, short CDS that referenced the tranche) so its "short" position is a short CDS which is synthetically long the underlying bonds. They lost on this written protection when the underlying bonds downgrade, in the same way they would experience a M2M loss on a short CDS that referenced the bonds directly (without the intermediation of a CDO, so to speak)

) the hedge fund did not own/short the CDO equity tranche, it has sold credit protection on the tranche (aka, short CDS that referenced the tranche) so its "short" position is a short CDS which is synthetically long the underlying bonds. They lost on this written protection when the underlying bonds downgrade, in the same way they would experience a M2M loss on a short CDS that referenced the bonds directly (without the intermediation of a CDO, so to speak)