You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

endogenous credit portfolio approaches?

- Thread starter ajsa

- Start date

Hi asja,

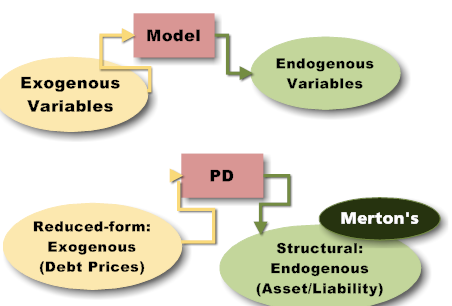

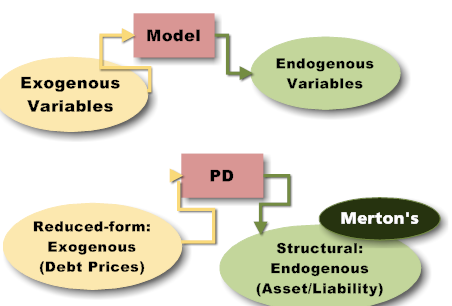

I attached below a graphic that I used last year (FRM 2008) but not this year b/c I perceived different authors uses of the terms and I don't t think endogenous/exogenous will get into the exam...

my favorite book on this (recommended!) says, "before the explosion in credit risk modeling of the last decade, structural models in the finance literature were generally those that solved for endogenous variable relationships. Reduced-form models reflected exogenously specified variable relationships. In the 1990s, the credit risk modeling literature began referring to causal economic models as structural. Reduced-form became associated with intensity-process models, which tended to exhibit relatively less focus on the drivers (causes) of default and viewed default as a randomly arriving surprise."

To me, consistent with wikipedia, a variable (not a model per se) is an endogenous variable if the variable is explained (i.e., is a causal output) within the model

versus an exogenous variable which "comes from the outside," is not explained by the model (i.e., it has no causality that "leads to it" in the model)

so under that, in the Merton, the default variable is itself endogenous because it is "explained" by (basically) the ratio of future Assets/f[liabilities]. Such that stylized model is:

f[Assets, Liabilities, volatility, etc] = P[default]

since P[default] has a causal explain in the model, it is an endogenous variable and we say "Merton is structural/endogenous"

in this way, classic reduced-form (intensity) credit models, which characterize the default as a random process, because that default distribution is not the causal result of some variables in the model, are/were associated with exogenous; i.e., default is not a function of model variables ...

So i personally cannot map entire models per se to exogenous/endogenous. I view them as properties of variables and, for example, I'd argue you can have both within a reduced form model. See here recently by Don @ Kamakura. I perceive this to be a modern reduced form model containing both exogenous and endogenous variables.

...so, I think in regard to the models (as opposed to the variables) that structural vs reduced form is more appropriate.

(I would defer to a specialist with expertise on this point, however...)

Re: "is it true using factors like industry, sector, country means the model should be endogenous, while using Macroeconomic factor means exogenous ?"

You can see that, IMO, this depends on "what is the model?" But generally, these variables would be exogenous (i.e., they are inputs into the model, not explained by the model) ... although, i would think an Economist looks at these (!) and sees some endogenous variables b/c she has different models.

"is conditional equavalent to exogenous?"

No. Two answers.

1. Technically "conditional" (IMO) has the specific meaning that we learned in Gujarati. Therefore, it appears many and variously in the models; e.g., in Merton, the PD "conditional on" estimates assets and liabilities, in an intensity model: PD | surving to this point in time

2. But, practically, it does *connote,* in this context, PD | economic state or economic cycle. Where the obvious example is CreditPortfolioView b/c it explicitly conditions the PD on the ecomomic cycle (which, in a manner of sorts, is the opposite of "through the cycle")

I hope that helps...I would be grateful for any additions/edits by somebody with *real* experience

David

I attached below a graphic that I used last year (FRM 2008) but not this year b/c I perceived different authors uses of the terms and I don't t think endogenous/exogenous will get into the exam...

my favorite book on this (recommended!) says, "before the explosion in credit risk modeling of the last decade, structural models in the finance literature were generally those that solved for endogenous variable relationships. Reduced-form models reflected exogenously specified variable relationships. In the 1990s, the credit risk modeling literature began referring to causal economic models as structural. Reduced-form became associated with intensity-process models, which tended to exhibit relatively less focus on the drivers (causes) of default and viewed default as a randomly arriving surprise."

To me, consistent with wikipedia, a variable (not a model per se) is an endogenous variable if the variable is explained (i.e., is a causal output) within the model

versus an exogenous variable which "comes from the outside," is not explained by the model (i.e., it has no causality that "leads to it" in the model)

so under that, in the Merton, the default variable is itself endogenous because it is "explained" by (basically) the ratio of future Assets/f[liabilities]. Such that stylized model is:

f[Assets, Liabilities, volatility, etc] = P[default]

since P[default] has a causal explain in the model, it is an endogenous variable and we say "Merton is structural/endogenous"

in this way, classic reduced-form (intensity) credit models, which characterize the default as a random process, because that default distribution is not the causal result of some variables in the model, are/were associated with exogenous; i.e., default is not a function of model variables ...

So i personally cannot map entire models per se to exogenous/endogenous. I view them as properties of variables and, for example, I'd argue you can have both within a reduced form model. See here recently by Don @ Kamakura. I perceive this to be a modern reduced form model containing both exogenous and endogenous variables.

...so, I think in regard to the models (as opposed to the variables) that structural vs reduced form is more appropriate.

(I would defer to a specialist with expertise on this point, however...)

Re: "is it true using factors like industry, sector, country means the model should be endogenous, while using Macroeconomic factor means exogenous ?"

You can see that, IMO, this depends on "what is the model?" But generally, these variables would be exogenous (i.e., they are inputs into the model, not explained by the model) ... although, i would think an Economist looks at these (!) and sees some endogenous variables b/c she has different models.

"is conditional equavalent to exogenous?"

No. Two answers.

1. Technically "conditional" (IMO) has the specific meaning that we learned in Gujarati. Therefore, it appears many and variously in the models; e.g., in Merton, the PD "conditional on" estimates assets and liabilities, in an intensity model: PD | surving to this point in time

2. But, practically, it does *connote,* in this context, PD | economic state or economic cycle. Where the obvious example is CreditPortfolioView b/c it explicitly conditions the PD on the ecomomic cycle (which, in a manner of sorts, is the opposite of "through the cycle")

I hope that helps...I would be grateful for any additions/edits by somebody with *real* experience

David

Last edited:

Similar threads

- Replies

- 0

- Views

- 133

- Replies

- 0

- Views

- 283

- Replies

- 0

- Views

- 320

- Replies

- 0

- Views

- 337