Hi David

Hope you are well. Appreciate if you could explain below example taken from Qbank. I couldn't understand the relation btwn PVBP and VAR?

Thanks

Imad

Question 11 - #29487

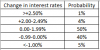

The price value of a basis point (PVBP) of a $20 million bond portfolio is $25,000. Interest rate changes over the next one year are summarized below:

A)

$2,500,000.

B)

$2,750,000.

C)

$5,000,000.

D)

$12,500.

The correct answer was C) $5,000,000.

At 5% probability level change in interest rates is 2.00% or higher.Change in Portfolio value for 200 bps change in interest rate = 200*$25,000VAR = $5,000,000.

Hope you are well. Appreciate if you could explain below example taken from Qbank. I couldn't understand the relation btwn PVBP and VAR?

Thanks

Imad

Question 11 - #29487

The price value of a basis point (PVBP) of a $20 million bond portfolio is $25,000. Interest rate changes over the next one year are summarized below:

Change in Interest rates

Probability

>+2.50%

1%

+2.00-2.49%

4%

0.00-1.99%

50%

-0.99-0.00%

45%

<-1.00%

5%

Compute VAR for the bond portfolio at 95 percent confidence level.A)

$2,500,000.

B)

$2,750,000.

C)

$5,000,000.

D)

$12,500.

The correct answer was C) $5,000,000.

At 5% probability level change in interest rates is 2.00% or higher.Change in Portfolio value for 200 bps change in interest rate = 200*$25,000VAR = $5,000,000.

and apply Allen/Hull's hybrid logic (which assumes the loss observation--in this case the interest rate change--itself is a random event with a probability mass centered where the observation is observed); that approach would assume the 4.0% probability p.m.f. weight (i.e., 5.0% CDF) extends to the midpoint of the "0.00 - 1.99%" bin, which retrieves 1.0%. Not that I am defending that choice. Rather, I think it's pretty clear the question is looking for the 2.0% that falls right "on the border," which is to me easily the most natural choice. I do think it's helpful to see why 2.0% rate shock is the natural choice: we want the beginning of the 5.0% probability tail (or end of the 95.0% body, if you like), this location would naturally fall at the

and apply Allen/Hull's hybrid logic (which assumes the loss observation--in this case the interest rate change--itself is a random event with a probability mass centered where the observation is observed); that approach would assume the 4.0% probability p.m.f. weight (i.e., 5.0% CDF) extends to the midpoint of the "0.00 - 1.99%" bin, which retrieves 1.0%. Not that I am defending that choice. Rather, I think it's pretty clear the question is looking for the 2.0% that falls right "on the border," which is to me easily the most natural choice. I do think it's helpful to see why 2.0% rate shock is the natural choice: we want the beginning of the 5.0% probability tail (or end of the 95.0% body, if you like), this location would naturally fall at the