rajivbangalore25

New Member

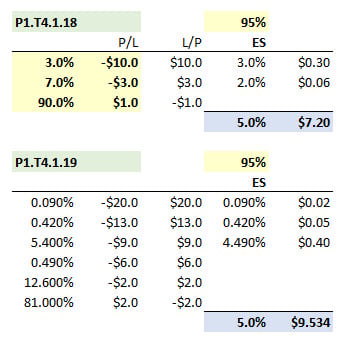

Hi David. I am having trouble with understanding this question and answer 1.19 related to Expected Shortfall in Book 4 chapter 1 Measures of Financial Risk, page 12.

Specifically, I am unable to understand this term (0.05-0.0009-0.0042)*9 and why it is added here. I was wondering if you could help me with this.