Hi David,

A bond with a face value of $10.0 million has a one-year probability of default (PD) of 1.0% and an expected recovery rate of 35.0%. What is the bond's one-year 99.0% expected shortfall (ES; aka, CVaR)?

a. $3.25 million

b. $6.5 million

c. $9.1 million

d. Not enough information: need the tail distribution

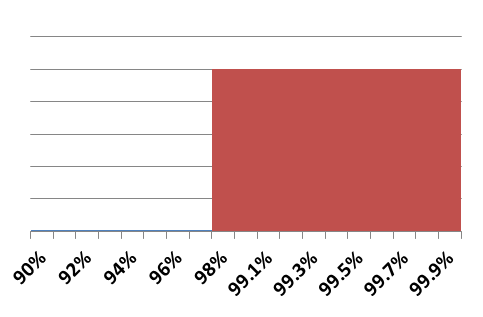

Your answer was B. $6.5 millionAs expected shortfall (ES) is the expected loss conditional on exceeding the VaR, and the VaR significance coincides with the PD, the ES is the expected (average) loss conditional on default, which is 1-recovery rate = 65% * $10 million = $6.5 million.

My question is, what if PD=2% and alpha is 1%, ES would be??? what is the relation between PD and the significance level?

Thanks

Imad

A bond with a face value of $10.0 million has a one-year probability of default (PD) of 1.0% and an expected recovery rate of 35.0%. What is the bond's one-year 99.0% expected shortfall (ES; aka, CVaR)?

a. $3.25 million

b. $6.5 million

c. $9.1 million

d. Not enough information: need the tail distribution

Your answer was B. $6.5 millionAs expected shortfall (ES) is the expected loss conditional on exceeding the VaR, and the VaR significance coincides with the PD, the ES is the expected (average) loss conditional on default, which is 1-recovery rate = 65% * $10 million = $6.5 million.

My question is, what if PD=2% and alpha is 1%, ES would be??? what is the relation between PD and the significance level?

Thanks

Imad