The following passage is in the P1.T3.R19 Hull Financial Markets & Products Study Notes (Page 88):

Shouldn't the full price equal the present value of its cash flows PLUS accrued interest? (Passage states that AI is not zero.)

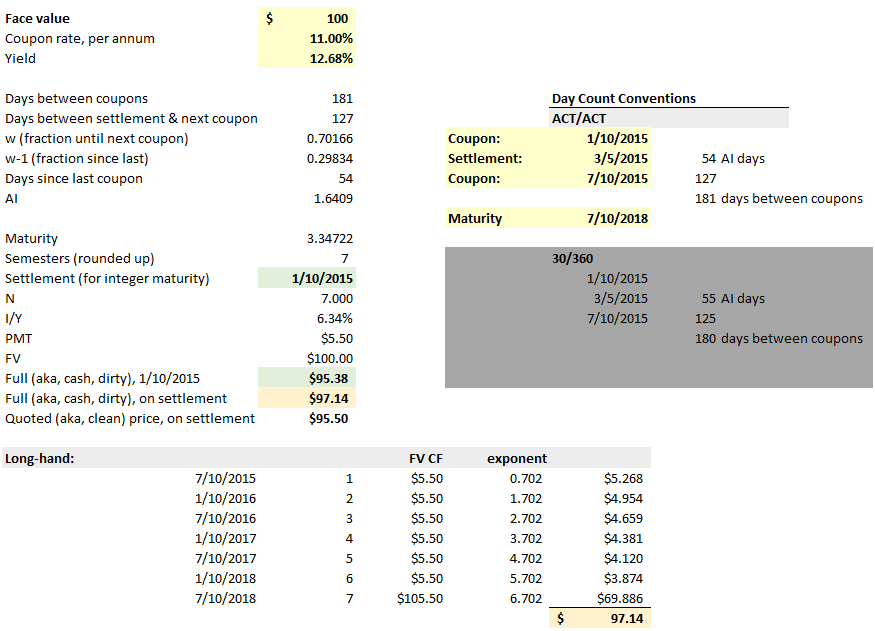

When accrued interest is not zero, the amount paid/received for a bond (i.e., its full price) should equal the present value of its cash flows.

Shouldn't the full price equal the present value of its cash flows PLUS accrued interest? (Passage states that AI is not zero.)