[email protected]

Active Member

Hi David,

For the Jorion question, can you provide the equation 6.3? Do we need to know this for the exam?

Thanks

Question 10:

A bank reports 6 exceptions to its 99 percent VAR over the last year (252 days), including 4 that follow another day of exception. Compute the likelihood-ratio tests, and discuss whether unconditional and conditional coverage is rejected.

Answer:

We build an exception table as in Table 6.5.

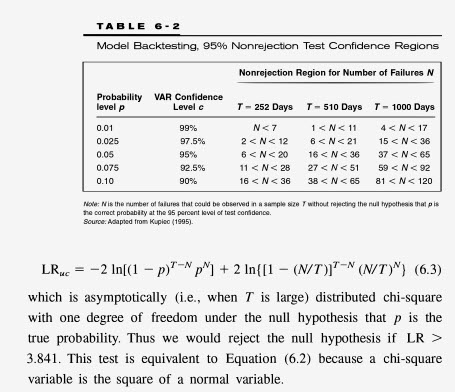

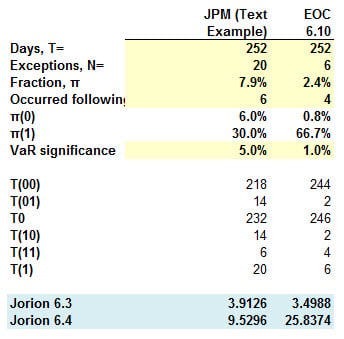

The fractions of exceptions is 6/252 = 2.4%, compared to the target of 1%. Using Equation (6.3), we find = 3.498, which is less than the chi-square cutoff point of 3.84, so we do not reject the hypothesis that there is no bias. From Equation (6.4), = 25.837, which is too high. So, it seems that there is bunching

For the Jorion question, can you provide the equation 6.3? Do we need to know this for the exam?

Thanks

Question 10:

A bank reports 6 exceptions to its 99 percent VAR over the last year (252 days), including 4 that follow another day of exception. Compute the likelihood-ratio tests, and discuss whether unconditional and conditional coverage is rejected.

Answer:

We build an exception table as in Table 6.5.

The fractions of exceptions is 6/252 = 2.4%, compared to the target of 1%. Using Equation (6.3), we find = 3.498, which is less than the chi-square cutoff point of 3.84, so we do not reject the hypothesis that there is no bias. From Equation (6.4), = 25.837, which is too high. So, it seems that there is bunching