You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

key rate and bucket exposures

- Thread starter sharon

- Start date

hi gizmo,

I will see if we can expand the key rate exposure XLS to include more of chapter 7, i think it's a good idea...

... but, in regard to 7.2, that's less "interesting" that it may seem in terms of calculations: all it seeks to do is make sure that the hedging portfolio key rates equal the underlying exposure (mortgage bond) key rate. That is, if the underlying mortgage bond has a 5-year key rate of X, you want the SUM of KR01s of the hedge portfolio bonds to equal the same X; such that, if the key rate shifts by 1 bps, then the portfolio value change equals the underlying value change (the hedge works!)

...in this way, the 7.2 literally takes all those KR01 as inputs and, as text says, all it does at that point is solve for four unknowns given four equations

Thanks, David

I will see if we can expand the key rate exposure XLS to include more of chapter 7, i think it's a good idea...

... but, in regard to 7.2, that's less "interesting" that it may seem in terms of calculations: all it seeks to do is make sure that the hedging portfolio key rates equal the underlying exposure (mortgage bond) key rate. That is, if the underlying mortgage bond has a 5-year key rate of X, you want the SUM of KR01s of the hedge portfolio bonds to equal the same X; such that, if the key rate shifts by 1 bps, then the portfolio value change equals the underlying value change (the hedge works!)

...in this way, the 7.2 literally takes all those KR01 as inputs and, as text says, all it does at that point is solve for four unknowns given four equations

Thanks, David

HI DAVID

as usual many thanks.

as i started on working the L2 - still waiting to hear your regard on the AIMS and what is your plan for the L2 nominies, also i think that your notes on the L1 studies were great., are you going to do the same on the L2 topics?

i personaly think that because they diveded the exam in two they will go deeper on the readings, and that is why i think you should offer notes in what you are going to offer to the L2 nominies

waitnig to hear on the program

and again, many thanks

gizmo.

as usual many thanks.

as i started on working the L2 - still waiting to hear your regard on the AIMS and what is your plan for the L2 nominies, also i think that your notes on the L1 studies were great., are you going to do the same on the L2 topics?

i personaly think that because they diveded the exam in two they will go deeper on the readings, and that is why i think you should offer notes in what you are going to offer to the L2 nominies

waitnig to hear on the program

and again, many thanks

gizmo.

hi david

i tried to figure the numbers in table 7.2 and i can't figure why these are the numbers that tuckman put?

from where does 0.01818 comes from? and what is 0.00122 stands for?

after breaking my mind on it, still haven't quite figure it out...

please if you can post an explanation on it, i will appreciate it

hope to get answers...

thanks

gizmo

i tried to figure the numbers in table 7.2 and i can't figure why these are the numbers that tuckman put?

from where does 0.01818 comes from? and what is 0.00122 stands for?

after breaking my mind on it, still haven't quite figure it out...

please if you can post an explanation on it, i will appreciate it

hope to get answers...

thanks

gizmo

Hi gizmo,

re: L2 notes, yes, we do plan similar treatment, please see calendar @ http://www.bionicturtle.com/products/announcement/2010_frm_calendar/

re: table 7.2, the entries (e.g., 0.01818, 0.00122) are all key rate 01s.

That is, they are just like DV01 except they give the dollar change in the bond for a one basis point (1 bps) change in the key rate instead of the entire term structure parallel shift (as the yield-based DV01 assumes).

So, for example, 0.01818 is the dollar change in the price of the 2-year bond (used as one of the bonds in the hedging portfolio, to hedge the mortgage bond) given a 1 bps shock to the 2-year rate (i.e., a one basis point decline in the 2-year rate 1 bps AND a decline in the neighboring rates spanning from 0 to five years).

... you will note that, in regard to the mortgage bond, the 0.98129 = 0.98 in the first row of the Key Rate 01($) column in table 7.1

(... FWIW, I also believe the table contains an error: I do not agree with Tuckman that several entries should contain zeros for the 5- and 30-year par bonds. He argues that, e.g., the 30-year bond, because it is par bond, is only sensitive to the 30-year rate, but I do not agree; i think the entire row for the 30-year bond should be nonzero as shocking the shorter rates impacts the coupons.).

David

re: L2 notes, yes, we do plan similar treatment, please see calendar @ http://www.bionicturtle.com/products/announcement/2010_frm_calendar/

re: table 7.2, the entries (e.g., 0.01818, 0.00122) are all key rate 01s.

That is, they are just like DV01 except they give the dollar change in the bond for a one basis point (1 bps) change in the key rate instead of the entire term structure parallel shift (as the yield-based DV01 assumes).

So, for example, 0.01818 is the dollar change in the price of the 2-year bond (used as one of the bonds in the hedging portfolio, to hedge the mortgage bond) given a 1 bps shock to the 2-year rate (i.e., a one basis point decline in the 2-year rate 1 bps AND a decline in the neighboring rates spanning from 0 to five years).

... you will note that, in regard to the mortgage bond, the 0.98129 = 0.98 in the first row of the Key Rate 01($) column in table 7.1

(... FWIW, I also believe the table contains an error: I do not agree with Tuckman that several entries should contain zeros for the 5- and 30-year par bonds. He argues that, e.g., the 30-year bond, because it is par bond, is only sensitive to the 30-year rate, but I do not agree; i think the entire row for the 30-year bond should be nonzero as shocking the shorter rates impacts the coupons.).

David

sleepybird

Active Member

Hi David,

For table 7.1, can you show how the values in column 1 were calculated?

For the initial value, we don’t know the FV for PV calculation. How is 100,453.13 calculated?

How is the value calculated for after 2 year shift, 5 year shift, etc.?

The book does not provide explanations.

Thanks.

For table 7.1, can you show how the values in column 1 were calculated?

For the initial value, we don’t know the FV for PV calculation. How is 100,453.13 calculated?

How is the value calculated for after 2 year shift, 5 year shift, etc.?

The book does not provide explanations.

Thanks.

Hi sleepybird,

Do you have T3 access, because i just revised the XLS that exactly mimics the calculations (there are two aspects to it: the region of rates change and, what took me longer to figure out and requires time to understand, that he used PAR yields not spot yields), see https://www.dropbox.com/s/vl6g8wbbyi9ko2f/key_rate_shift.xlsx

Do you have T3 access, because i just revised the XLS that exactly mimics the calculations (there are two aspects to it: the region of rates change and, what took me longer to figure out and requires time to understand, that he used PAR yields not spot yields), see https://www.dropbox.com/s/vl6g8wbbyi9ko2f/key_rate_shift.xlsx

Last edited by a moderator:

sleepybird

Active Member

I'm still debating on which tier to register for. Well, that certainly helps in the decision making process  .

.

.

.i don't want to upsell you, if you don't get T3, just let me know and I'll copy the calcs here

... and in case it helps to be reminded (see my focus review article here on this @ https://learn.bionicturtle.com/topic/market-risk-focus-review-video-1-of-2/), while key rates are interesting, the particulars of Tuckman's derivation, especially the use of par yields, remains of very low testability (I'm on record with GARP that I feel they publish too many AIMs for Tuckman's Chapters 7 & 9 given the superficial testing record)

... and in case it helps to be reminded (see my focus review article here on this @ https://learn.bionicturtle.com/topic/market-risk-focus-review-video-1-of-2/), while key rates are interesting, the particulars of Tuckman's derivation, especially the use of par yields, remains of very low testability (I'm on record with GARP that I feel they publish too many AIMs for Tuckman's Chapters 7 & 9 given the superficial testing record)

Last edited by a moderator:

sleepybird

Active Member

David,

It would be GREATLY appreciated if you could copy the calc here (also if you could please include calc for table 7.2), since I'm on the topic right now.

I got the discount code (returning customer) from Suzzane and I plan to register in the next couple days (T2 or T3).

Thank you very much for your help.

Sleepybird

It would be GREATLY appreciated if you could copy the calc here (also if you could please include calc for table 7.2), since I'm on the topic right now.

I got the discount code (returning customer) from Suzzane and I plan to register in the next couple days (T2 or T3).

Thank you very much for your help.

Sleepybird

Hi sleepybird,

Here is a snippet from the learning XLS: https://www.dropbox.com/s/fpgamwpad67v5h9/0809_TuckmanTable7.1_snippet.xlsx (screenshot below)

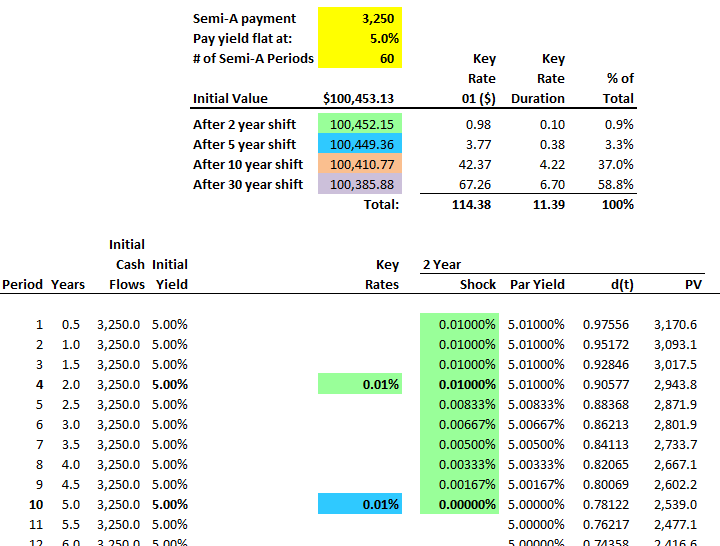

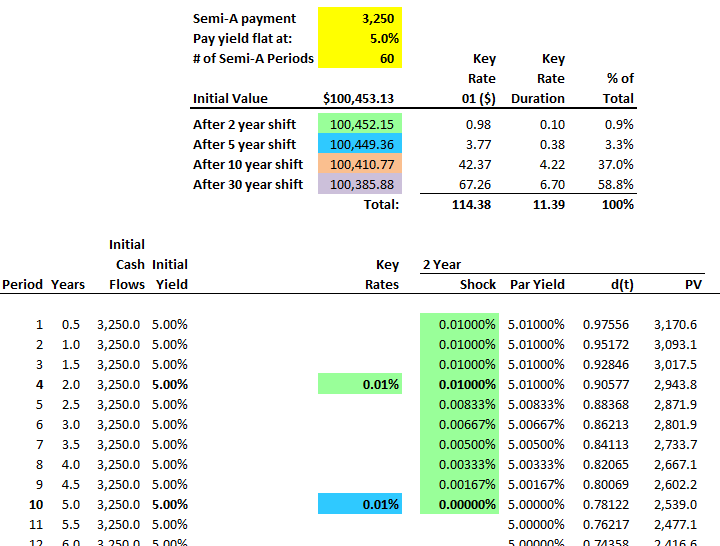

This shows show the 2-year key rate of $0.98 is calculated in Table 7.1. The green cells are the starting point: the neighboring rates to the 2-year rate (i.e., from 0.5 years up to 4.5 years since 5-year is the next key rate) are all shifted up from 5.0% to slightly higher par yields. The bond is then repriced according to this non-flat curve (it is flat at 5 years and beyond: the point is to only yank up a segment of the curve), and the result it $100,452.15 which is a $0.98 price decline.

I don't have Table 7.2 in XLS (yet): the key rates for the 4 hedging securities are just given (assumed) but would be figured in the same way. Then it's a solution of four unknowns with four equations. I may add this to our development list .... thanks,

Here is a snippet from the learning XLS: https://www.dropbox.com/s/fpgamwpad67v5h9/0809_TuckmanTable7.1_snippet.xlsx (screenshot below)

This shows show the 2-year key rate of $0.98 is calculated in Table 7.1. The green cells are the starting point: the neighboring rates to the 2-year rate (i.e., from 0.5 years up to 4.5 years since 5-year is the next key rate) are all shifted up from 5.0% to slightly higher par yields. The bond is then repriced according to this non-flat curve (it is flat at 5 years and beyond: the point is to only yank up a segment of the curve), and the result it $100,452.15 which is a $0.98 price decline.

I don't have Table 7.2 in XLS (yet): the key rates for the 4 hedging securities are just given (assumed) but would be figured in the same way. Then it's a solution of four unknowns with four equations. I may add this to our development list .... thanks,

sleepybird

Active Member

Hi David,

Thanks for the posting. Sorry this is still not very clear to me.

1. How are the values from period 5 to 10 in the “shock” column determined (I can understand from period 1 to 4).

2. Your table calculates the value 100,452.15 for “after 2 year shift.” So to calculate the initial value (i.e., without any shifts), I simply change the values in the “shock” column to all 0s (i.e., sum of the PV column would be 100,453.13?) I used excel formula =PV(5%/12, 360, 3250,0), which gives me $605,415.26. Shouldn’t the value also be 100,453.13? What is the correct excel shortcut formula?

3. You used year 0.5. 1.0, etc. but isn’t the 3,250 a MONTHLY mortgage payment? Why are we pricing it based on semi annual instead of monthly basis?

Thanks in advance for your patience on this.

Sleepybird

Thanks for the posting. Sorry this is still not very clear to me.

1. How are the values from period 5 to 10 in the “shock” column determined (I can understand from period 1 to 4).

2. Your table calculates the value 100,452.15 for “after 2 year shift.” So to calculate the initial value (i.e., without any shifts), I simply change the values in the “shock” column to all 0s (i.e., sum of the PV column would be 100,453.13?) I used excel formula =PV(5%/12, 360, 3250,0), which gives me $605,415.26. Shouldn’t the value also be 100,453.13? What is the correct excel shortcut formula?

3. You used year 0.5. 1.0, etc. but isn’t the 3,250 a MONTHLY mortgage payment? Why are we pricing it based on semi annual instead of monthly basis?

Thanks in advance for your patience on this.

Sleepybird

hi sleepybird,

I attached the XLS snippet above, can you please look at the Excel that i prepared for you, it shows the calcs ... i shared the XLS to show you the calcs, here is the link again https://www.dropbox.com/s/fpgamwpad67v5h9/0809_TuckmanTable7.1_snippet.xlsx

I attached the XLS snippet above, can you please look at the Excel that i prepared for you, it shows the calcs ... i shared the XLS to show you the calcs, here is the link again https://www.dropbox.com/s/fpgamwpad67v5h9/0809_TuckmanTable7.1_snippet.xlsx

- see xls, the requires an understanding of (and complications introduced by) par yield. But, in truth, is not essential to the key rate shift technique: my full XLS also performs using simple shifts in spot rate.

- Yes, if you changed all the shocks (green) to zero, the green (currently 100,452.15) would match the initial value of 11,453.13. The PV() formula is already in cell G6 (initial value) = pv(5%/2, 30*2, -3,250,0) = 100,453.12; your monthly period is fine, it's just that Tuckman defined it differently for some reason

- Tuckman uses semi-annual mortgage payments, I agree that it's unusual. The new (3rd edition) of this text drops the mortgage and uses a C-strip instead. Here, I was just interested in matching his calcs and he used semi-annual. Of course, the whole thing can be done with monthly periods. Thanks,

charleszhao115

New Member

hi David, did 2014 curriculum replaced key rate exposure with something else? couldn't find any related material here. thanks

Hi @charleszhao115

Key rate exposures continue to be fully expressed in 2014 syllabus; AIMs are essentially unchanged:

Key rate exposures continue to be fully expressed in 2014 syllabus; AIMs are essentially unchanged:

Chapter 5................................Multi-Factor Risk Metrics and Hedges

Candidates, after completing this reading, should be able to:

• Describe and assess the major weakness attributable to single-factor approaches when hedging portfolios or implementing asset liability techniques.

• Define key rate exposures and know the characteristics of key rate exposure factors including partial ‘01s and forward-bucket ‘01s.

• Describe key-rate shift analysis.

• Define, calculate, and interpret key rate ‘01 and key rate duration.

• Describe the key rate exposure technique in multi-factor hedging applications; summarize its advantages/disadvantages.

• Calculate the key rate exposures for a given security, and compute the appropriate hedging positions given a specific key rate exposure profile.

• Describe the relationship between key rates, partial ‘01s and forward-bucket ‘01s, and calculate the forward bucket '01 for a shift in rates in one or more buckets.

• Construct an appropriate hedge for a position across its entire range of forward bucket exposures.

• Explain how key rate and multi-factor analysis may be applied in estimating portfolio volatility

After attempting to reconstruct the table in Tuckman using Excel, I think the key rate hedging process can be boiled down to the following steps:

1. Find KR01 for all your current positions, including existing hedges

2. Sum all KR01s for all product, by each key rate to determine current exposure to key rate (e.g., if you have 4 bonds with some sort of 10 year KR01, sum these to get total 10 year KR01 exposure)

3. Immunize your key rate exposure with the appropriate security (2 yr exposure with 2 year bond, 5 year exposure with 5 year bond, etc.)

4. Consider an alternate hedge, immunizing only your largest exposures to save on hedging cost

Quick way to calculate face amount of bond to hedge:

Current exposure of particular KR maturity/KR01 of security used to hedge

Is that how I should be interpreting this chapter?

1. Find KR01 for all your current positions, including existing hedges

2. Sum all KR01s for all product, by each key rate to determine current exposure to key rate (e.g., if you have 4 bonds with some sort of 10 year KR01, sum these to get total 10 year KR01 exposure)

3. Immunize your key rate exposure with the appropriate security (2 yr exposure with 2 year bond, 5 year exposure with 5 year bond, etc.)

4. Consider an alternate hedge, immunizing only your largest exposures to save on hedging cost

Quick way to calculate face amount of bond to hedge:

Current exposure of particular KR maturity/KR01 of security used to hedge

Is that how I should be interpreting this chapter?

HI @bpdulog

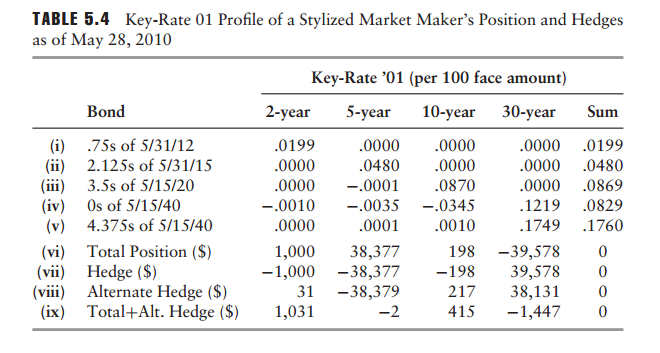

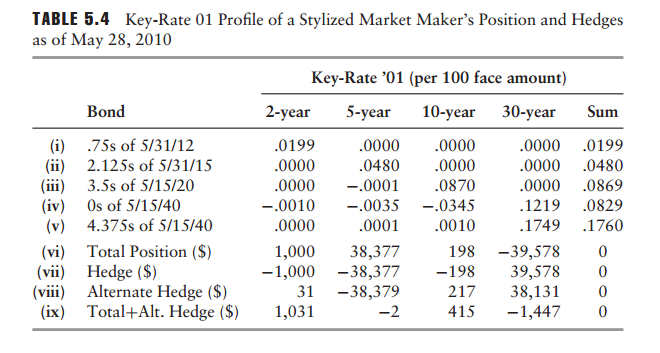

I agree with your generalization. Tuckman's key rate hedge is summarized, of course, in his Table 5.4 (below). The initial scenario consists of four trades (two shorts and their associated long hedges) where the Trader has achieved his goal of a DV01-neutral position, which is evidenced by the Sum (last column) of zero in the (vi) Total Position ($) row; i.e., he hedged to neutralize duration/DV01, which only protects him against parallel moves. The non-zero values at key rate (2-year, 5-year, ....) of row (vi) show that "the key-rate profile of the trader’s book is not flat. In fact, the trader essentially has on a substantial 5s-30s steepener, meaning a position that will make money if 30-year yields rise relative to 5-year yields but lose money if the opposite occurs. But this accumulated steepener is a byproduct of market making and not the result of deliberate risk taking. The trader, therefore, will construct a hedge to flatten out the key-rate profile in row (vi)."

The objective becomes, then per your step 3, to neutralize the key rate (KR01) exposures by solving for a portfolio with offsetting KR01 of -1,000 at 2 years, -38,377 at 5-years, etc. As Tuckman explains, at worst, this is a problem of solving for four unknowns with four functions. Notice that he uses the same bond instruments to hedge (minus one of the 40-year bonds) and the only additional instrument required is the two-year bond (.75s of 5/31/12). Basically, he solves for four face values (F2, F5, F10, and F30) in order to achieve the four KR01 values in row (vii) which, by definition, neutralize the key rates.

The alternate hedge is a more convenient approximation, it is not concerned with achieving exact zeros for all KR01 (rather, per the final row [xi], it's goal is just near-to-zero). The logic of the alternate hedge is: identify the big risk which is the "5s-30s" steepener and mostly neutralize that with a DV01 hedge (rather than a KR01 hedge). I hope that helps!

I agree with your generalization. Tuckman's key rate hedge is summarized, of course, in his Table 5.4 (below). The initial scenario consists of four trades (two shorts and their associated long hedges) where the Trader has achieved his goal of a DV01-neutral position, which is evidenced by the Sum (last column) of zero in the (vi) Total Position ($) row; i.e., he hedged to neutralize duration/DV01, which only protects him against parallel moves. The non-zero values at key rate (2-year, 5-year, ....) of row (vi) show that "the key-rate profile of the trader’s book is not flat. In fact, the trader essentially has on a substantial 5s-30s steepener, meaning a position that will make money if 30-year yields rise relative to 5-year yields but lose money if the opposite occurs. But this accumulated steepener is a byproduct of market making and not the result of deliberate risk taking. The trader, therefore, will construct a hedge to flatten out the key-rate profile in row (vi)."

The objective becomes, then per your step 3, to neutralize the key rate (KR01) exposures by solving for a portfolio with offsetting KR01 of -1,000 at 2 years, -38,377 at 5-years, etc. As Tuckman explains, at worst, this is a problem of solving for four unknowns with four functions. Notice that he uses the same bond instruments to hedge (minus one of the 40-year bonds) and the only additional instrument required is the two-year bond (.75s of 5/31/12). Basically, he solves for four face values (F2, F5, F10, and F30) in order to achieve the four KR01 values in row (vii) which, by definition, neutralize the key rates.

The alternate hedge is a more convenient approximation, it is not concerned with achieving exact zeros for all KR01 (rather, per the final row [xi], it's goal is just near-to-zero). The logic of the alternate hedge is: identify the big risk which is the "5s-30s" steepener and mostly neutralize that with a DV01 hedge (rather than a KR01 hedge). I hope that helps!

Ashok_Kothavle

Member

Hi sleepybird,

Do you have T3 access, because i just revised the XLS that exactly mimics the calculations (there are two aspects to it: the region of rates change and, what took me longer to figure out and requires time to understand, that he used PAR yields not spot yields), see http://www.bionicturtle.com/how-to/spreadsheet/2012.5.b.3.-key-rate-shift/

Mr David,

This link (http://www.bionicturtle.com/how-to/spreadsheet/2012.5.b.3.-key-rate-shift) is missing. Where can I find it?

Ashok

Similar threads

- Replies

- 0

- Views

- 179

- Replies

- 6

- Views

- 1K

- Replies

- 0

- Views

- 195

- Replies

- 0

- Views

- 233