Hi David

On page 170 of VRM, GARP says that when key rates are defined in terms of par yields, one can immediately calculate the position necessary to hedge a portfolio once the exposure of the portfolio to the key rates are calculated.

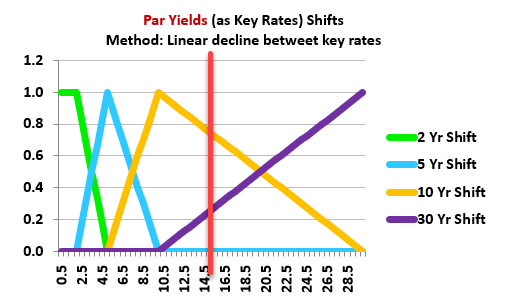

I think I am struggling to see why all the changes in the par yields should add up to the yield-based DV01 (as the book mentions on p170). I understand that making a 1bp change in all the spot rates is equivalent to making a 1bp change in all the yields, but I am not sure how this links to par yields, yield-based DV01 and computing the necessary hedge positions.

Thanks in advance

Rohin

On page 170 of VRM, GARP says that when key rates are defined in terms of par yields, one can immediately calculate the position necessary to hedge a portfolio once the exposure of the portfolio to the key rates are calculated.

I think I am struggling to see why all the changes in the par yields should add up to the yield-based DV01 (as the book mentions on p170). I understand that making a 1bp change in all the spot rates is equivalent to making a 1bp change in all the yields, but I am not sure how this links to par yields, yield-based DV01 and computing the necessary hedge positions.

Thanks in advance

Rohin