Hi,

I have a doubt about the meaning of the hedge ratio.

Hedge ratio = ρ * σ_spot / σ_fut

Number of contracts = HedgeRatio * PortfolioValue / ValueFuturesContract

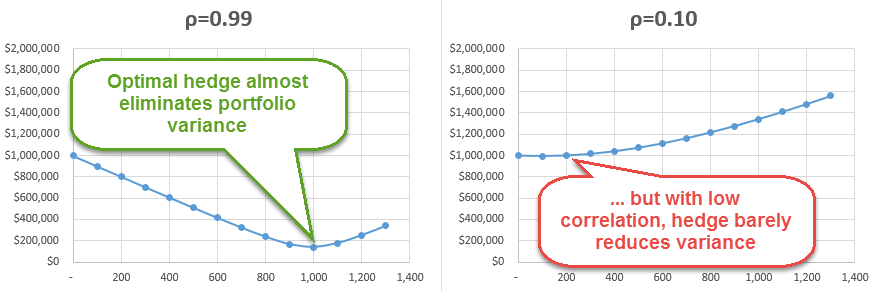

Therefore, the lower the correlation, the lower the number of contracts.

So, let's say that I have a portfolio of $ 1.000.000 of Crude Oil (σ_spot = 100) that I want to hedge. I have two products that I can use to hedge it:

- 1. Crude Oil futures:

- 2. Weather futures:

If I calculate the number of contracts to hedge the position for each product I have:

1. N=0.99*100/100*1.000.000/1.000=990

2. N=0.10*100/100*1.000.000/1.000 = 100

How is it possible that with less correlation the number of contracts will be less? Would it cost less to hedge the position with a less correlated product? It is counterintuitive for me. What am I missing?

Thank you in advance.

I have a doubt about the meaning of the hedge ratio.

Hedge ratio = ρ * σ_spot / σ_fut

Number of contracts = HedgeRatio * PortfolioValue / ValueFuturesContract

Therefore, the lower the correlation, the lower the number of contracts.

So, let's say that I have a portfolio of $ 1.000.000 of Crude Oil (σ_spot = 100) that I want to hedge. I have two products that I can use to hedge it:

- 1. Crude Oil futures:

ρ = 0.99

σ_fut = 100

Value Futures Contract = $ 1.000

σ_fut = 100

Value Futures Contract = $ 1.000

ρ = 0.10

σ_fut = 100

Value Futures Contract = $ 1.000

σ_fut = 100

Value Futures Contract = $ 1.000

If I calculate the number of contracts to hedge the position for each product I have:

1. N=0.99*100/100*1.000.000/1.000=990

2. N=0.10*100/100*1.000.000/1.000 = 100

How is it possible that with less correlation the number of contracts will be less? Would it cost less to hedge the position with a less correlated product? It is counterintuitive for me. What am I missing?

Thank you in advance.