AIMs: Describe the APT and the assumptions underlying it. Use the APT to calculate the expected returns on an asset.

Questions:

63.1. Each of the following is an assumption of the arbitrage pricing model (APM) EXCEPT for:

a. Homogeneous expectations

b. A security (stock) is linearly related to a set of indexes (factors); i.e., linearity assumption

c. Investors utilize a mean-variance framework

d. Error terms are uncorrelated; i.e., E(e(i),e(j)] = 0

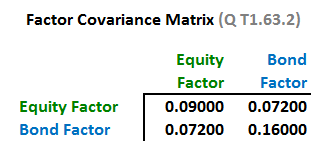

63.2. Your colleague Robert uses a two-factor model in order to estimate the volatility of a Portfolio. He specifies the covariance matrix as follows:

The Portfolio has the following factor sensitivities (i.e., betas): 0.60 to the Global Equity Factor and 0.25 to the Global Bond Factor. The volatility of the Portfolio is nearest to which value?

a. 16.44%

b. 18.60%

c. 21.15%

d. 25.30%

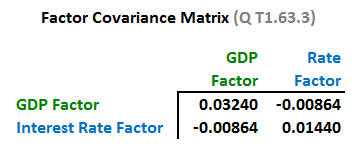

63.3. In order to determine the covariance between Markets A and B, you develop the following factor covariance matrix using a two-factor model:

Suppose that Market A exhibits the following factor sensitivities: 0.80 to the GDP Factor and 0.10 to the Interest Rate factor. Market B exhibits the following factor sensitivities: 0.70 to GDP and 0.20 to Interest Rates. Which value is nearest to the covariance between Market A and Market B? (note: this is a variation on GARP's actual sample question in 2011 Practice Exam, Part 1, Exam 1, Question 6).

a. 0.0028

b. 0.0075

c. 0.0164

d. 0.1259

Answers:

Questions:

63.1. Each of the following is an assumption of the arbitrage pricing model (APM) EXCEPT for:

a. Homogeneous expectations

b. A security (stock) is linearly related to a set of indexes (factors); i.e., linearity assumption

c. Investors utilize a mean-variance framework

d. Error terms are uncorrelated; i.e., E(e(i),e(j)] = 0

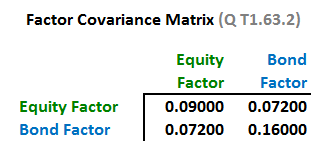

63.2. Your colleague Robert uses a two-factor model in order to estimate the volatility of a Portfolio. He specifies the covariance matrix as follows:

The Portfolio has the following factor sensitivities (i.e., betas): 0.60 to the Global Equity Factor and 0.25 to the Global Bond Factor. The volatility of the Portfolio is nearest to which value?

a. 16.44%

b. 18.60%

c. 21.15%

d. 25.30%

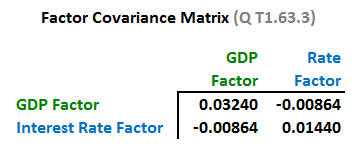

63.3. In order to determine the covariance between Markets A and B, you develop the following factor covariance matrix using a two-factor model:

Suppose that Market A exhibits the following factor sensitivities: 0.80 to the GDP Factor and 0.10 to the Interest Rate factor. Market B exhibits the following factor sensitivities: 0.70 to GDP and 0.20 to Interest Rates. Which value is nearest to the covariance between Market A and Market B? (note: this is a variation on GARP's actual sample question in 2011 Practice Exam, Part 1, Exam 1, Question 6).

a. 0.0028

b. 0.0075

c. 0.0164

d. 0.1259

Answers: