Learning objectives: Compute the variance of a weighted sum of two random variables. Compute the conditional expectation of a component of a bivariate random variable. Describe the features of an iid sequence of random variables. Explain how the iid property is helpful in computing the mean and variance of a sum of iid random variables

Questions:

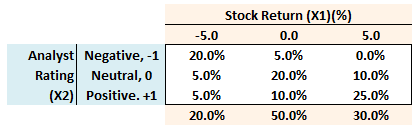

20.10.1. Below is the joint distribution of analyst ratings (i.e., negative, neutral, or positive) and stock returns (-5, zero, or +5 in percentage terms).

We are interested in the conditional distribution of stock returns given a negative analyst rating. For example, the expected stock return conditional on a negative analyst rating is [-5.0 * (20.0%/25.0%)] + [0 * (5.0%/25.0%)] + [+5 * (0%/25.0%)]= -4.0. The variance of the stock return conditional on a negative analyst rating is [-5.0 - (-4.0)]^2 * 80% + [0 - (-4.0)]^2 * 20% + [+5.0 - (-4.0)]^2 * 0% = 4.0. What is the skew of the stock return conditional on a negative analyst rating?

a. -6.00

b. -3.50

c. +1.50

d. +12.00

20.10.2. Six of your colleagues are studying for the FRM with you. The group is identifying common applications (or models) where the i.i.d. assumption is required. Your study partners make the following statements, where each is presuming the i.i.d. property as a condition for their statement:

I. Adam says the expected value of the sum of (T) random variables, where each is X(i) ~ N(μ, σ^2), is the product, T×μ.

II. Betty says the variance of the sum of (T) normal random variables, where each is X(i) ~ N(μ, σ^2), is the product, T×σ^2; hence, the standard deviation of this sum is sqrt(T)×σ.

III. Chris says that the probability of exactly two defaults in a portfolio of 20 obligors where the default probability of each is 3.0% is given by C(20,2)*0.030^2*(1-0.030)^(20-2).

IV. Derek says the variance of the number of defaults for a portfolio of 20 obligors where the default probability of each is 3.0% is given by 20*0.030*(1-0.030).

V. Erica says that because one customer logs into the new website every 10 seconds, on average, the probability of zero logins over the next 60 seconds (one minute) is only 6^0*exp(-6)/0!.

In order to be a TRUE statement, which of these statements requires the i.i.d. property?

a. None require the i.i.d. property

b. Only Betty's (II.) statement requires the i.i.d. property

c. Only Betty, Chris, and Derek's statements (II., III. and IV.) require the i.i.d. property

d. All require the i.i.d. property except for Adam's statement, which only requires identical variables

20.10.3. An asset has a one-month volatility of 6.0%. If the asset's returns are i.i.d., the asset has a three-month volatility of 6.0% * sqrt(3/1) = 10.4% and a one-year volatility of 6.0% * sqrt(12/1) = 20.8%. In general, by convention (and to avoid confusion), we should prefer the annualized measure: interest rate and volatility inputs and outputs are generally expressed in per annum terms. However, let's assume we are interested in the three-month value-at-risk (VaR) of this asset. If we assume that the asset's arithmetic returns, [S(t)-S(t-1)]/S(t-1), have a normal distribution and i.i.d., then per the square root rule (SRR) the 95.0% confident three-month relative VaR of this asset is 6.0% * sqrt(3/1) * 1.645 = 17.10%; the "relative" adjective signifies that we are excluding the positive expected return which would mitigate this worst expected loss.

Now let's violate the i.i.d. assumption. Specifically, let's retain the "identical" but edit the "independence" to make an assumption of +0.50 auto- or serial-correlation between the returns; i.e., if the returns are correlated, they cannot be independent and i.i.d. is not satisfied such that we cannot rely on the square root rule (SRR). Now we are interested in the three-period (i.e., three-month) VaR based on a three-month volatility but where the variable (log return) has a positive correlation (with itself) of 0.50. Hint: per variance properties σ^2(X + Y + Z) = σ^2(X + Y) + σ^2(Z) + 2*COV(X +Y, Z) or equivalently σ^2(R1 + R2 + R3) = σ^2(R1 + R2) + σ^2(R3) + 2*COV(R1 +R2, R3).

If each one-month return has a standard deviation of 6.0% and the serial correlation between returns is +0.50, which is nearest to the three-month 95.0% normal relative VaR?

a. 17.1%

b. 24.2%

c. 29.6%

d. 51.5%

Answers here:

Questions:

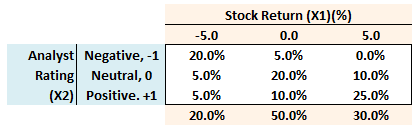

20.10.1. Below is the joint distribution of analyst ratings (i.e., negative, neutral, or positive) and stock returns (-5, zero, or +5 in percentage terms).

We are interested in the conditional distribution of stock returns given a negative analyst rating. For example, the expected stock return conditional on a negative analyst rating is [-5.0 * (20.0%/25.0%)] + [0 * (5.0%/25.0%)] + [+5 * (0%/25.0%)]= -4.0. The variance of the stock return conditional on a negative analyst rating is [-5.0 - (-4.0)]^2 * 80% + [0 - (-4.0)]^2 * 20% + [+5.0 - (-4.0)]^2 * 0% = 4.0. What is the skew of the stock return conditional on a negative analyst rating?

a. -6.00

b. -3.50

c. +1.50

d. +12.00

20.10.2. Six of your colleagues are studying for the FRM with you. The group is identifying common applications (or models) where the i.i.d. assumption is required. Your study partners make the following statements, where each is presuming the i.i.d. property as a condition for their statement:

I. Adam says the expected value of the sum of (T) random variables, where each is X(i) ~ N(μ, σ^2), is the product, T×μ.

II. Betty says the variance of the sum of (T) normal random variables, where each is X(i) ~ N(μ, σ^2), is the product, T×σ^2; hence, the standard deviation of this sum is sqrt(T)×σ.

III. Chris says that the probability of exactly two defaults in a portfolio of 20 obligors where the default probability of each is 3.0% is given by C(20,2)*0.030^2*(1-0.030)^(20-2).

IV. Derek says the variance of the number of defaults for a portfolio of 20 obligors where the default probability of each is 3.0% is given by 20*0.030*(1-0.030).

V. Erica says that because one customer logs into the new website every 10 seconds, on average, the probability of zero logins over the next 60 seconds (one minute) is only 6^0*exp(-6)/0!.

In order to be a TRUE statement, which of these statements requires the i.i.d. property?

a. None require the i.i.d. property

b. Only Betty's (II.) statement requires the i.i.d. property

c. Only Betty, Chris, and Derek's statements (II., III. and IV.) require the i.i.d. property

d. All require the i.i.d. property except for Adam's statement, which only requires identical variables

20.10.3. An asset has a one-month volatility of 6.0%. If the asset's returns are i.i.d., the asset has a three-month volatility of 6.0% * sqrt(3/1) = 10.4% and a one-year volatility of 6.0% * sqrt(12/1) = 20.8%. In general, by convention (and to avoid confusion), we should prefer the annualized measure: interest rate and volatility inputs and outputs are generally expressed in per annum terms. However, let's assume we are interested in the three-month value-at-risk (VaR) of this asset. If we assume that the asset's arithmetic returns, [S(t)-S(t-1)]/S(t-1), have a normal distribution and i.i.d., then per the square root rule (SRR) the 95.0% confident three-month relative VaR of this asset is 6.0% * sqrt(3/1) * 1.645 = 17.10%; the "relative" adjective signifies that we are excluding the positive expected return which would mitigate this worst expected loss.

Now let's violate the i.i.d. assumption. Specifically, let's retain the "identical" but edit the "independence" to make an assumption of +0.50 auto- or serial-correlation between the returns; i.e., if the returns are correlated, they cannot be independent and i.i.d. is not satisfied such that we cannot rely on the square root rule (SRR). Now we are interested in the three-period (i.e., three-month) VaR based on a three-month volatility but where the variable (log return) has a positive correlation (with itself) of 0.50. Hint: per variance properties σ^2(X + Y + Z) = σ^2(X + Y) + σ^2(Z) + 2*COV(X +Y, Z) or equivalently σ^2(R1 + R2 + R3) = σ^2(R1 + R2) + σ^2(R3) + 2*COV(R1 +R2, R3).

If each one-month return has a standard deviation of 6.0% and the serial correlation between returns is +0.50, which is nearest to the three-month 95.0% normal relative VaR?

a. 17.1%

b. 24.2%

c. 29.6%

d. 51.5%

Answers here:

Last edited by a moderator: