Learning objectives: Explain how forecasts are generated from ARMA models. Describe the role of mean reversion in long-horizon forecasts. Explain how seasonality is modeled in a covariance-stationary ARMA.

Questions:

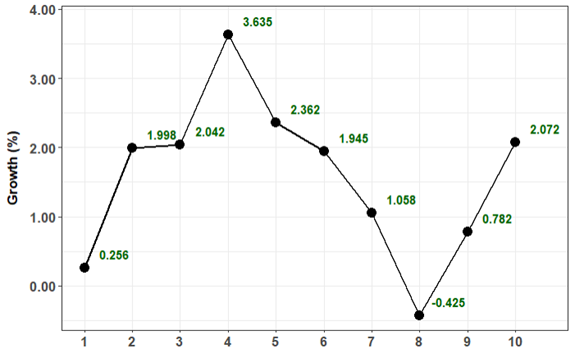

20.25.1. Below is plotted the monthly growth rate of a new cryptocurrency over the prior ten months. Two months ago, the growth rate was +0.782%. Last month, the growth rate was +2.072%. We will omit the percentage symbol (%) and assume the growth rates are percentages; specifically, Y(9) = Y(t-2) = +0.782 and Y(10) = Y(t-1) = +2.072.

Your colleagues have determined that the best model for this series is an AR(2) model which is given by Y(t) = ẟ + ϕ(1)*Y(t-1) + ϕ(2)*Y(t-2) + ε(t). In this instance of the model, the intercept is 0.40, the first AR parameter is 0.50 and the second AR parameter is 0.30; specifically, the model is given by Y(t) = 0.40 + 0.50*Y(t-1) + 0.30*Y(t-2) + ε(t). Please note that the intercept of 0.40 here signifies 0.40% such that, in decimal terms, the same model is given by Y(t) = 0.0040 + 0.50*Y(t-1) + 0.30*Y(t-2) + ε(t) where Y(t-2) = 0.007820 and Y(t-1) = 0.020720 but the AR parameters in either case are 0.50 and 0.30.

What is the one- and two-step forecast, Y(t) = Y(11) and Y(t+1) = Y(12)?

a. Y(11) = 1.671 and Y(12) 1.857

b. Y(11) = 2.244 and Y(12) 2.505

c. Y(11) = 2.773 and Y(12) 3.380

d. Y(11) = 3.025 and Y(12) = 4.164

20.25.2. Jennifer is an analyst who is deciding which second-order model to fit to her time series dataset. She prefers to fit either an MA(2) or AR(2) model:

a. 0.177 (MA) and 0.856 (AR)

b. 0.590 (MA) and 1.639 (AR)

c. 1.330 (MA) and 2.715 (AR)

d. 2.902 (MA) and 3.333 (AR)

20.25.3. Consider the following seasonal time series model that is represented with lag notation:

Note that ϕ(1) = 0.530 and ϕ(s) = 0.260. In regard to this seasonal model, each of the following statements is true EXCEPT which is false?

a. This seasonal model is a restricted AR(13) model

b. The coefficient on lag 13 is -0.13780

c. The coefficients on lags 2 through 11 are zero

d. This seasonal model is deterministic because lag 12 is a dummy variable

Answers here:

Questions:

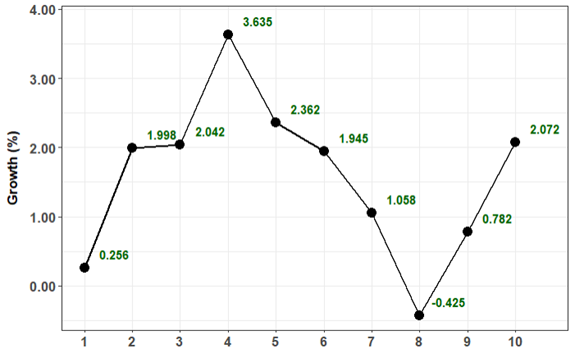

20.25.1. Below is plotted the monthly growth rate of a new cryptocurrency over the prior ten months. Two months ago, the growth rate was +0.782%. Last month, the growth rate was +2.072%. We will omit the percentage symbol (%) and assume the growth rates are percentages; specifically, Y(9) = Y(t-2) = +0.782 and Y(10) = Y(t-1) = +2.072.

Your colleagues have determined that the best model for this series is an AR(2) model which is given by Y(t) = ẟ + ϕ(1)*Y(t-1) + ϕ(2)*Y(t-2) + ε(t). In this instance of the model, the intercept is 0.40, the first AR parameter is 0.50 and the second AR parameter is 0.30; specifically, the model is given by Y(t) = 0.40 + 0.50*Y(t-1) + 0.30*Y(t-2) + ε(t). Please note that the intercept of 0.40 here signifies 0.40% such that, in decimal terms, the same model is given by Y(t) = 0.0040 + 0.50*Y(t-1) + 0.30*Y(t-2) + ε(t) where Y(t-2) = 0.007820 and Y(t-1) = 0.020720 but the AR parameters in either case are 0.50 and 0.30.

What is the one- and two-step forecast, Y(t) = Y(11) and Y(t+1) = Y(12)?

a. Y(11) = 1.671 and Y(12) 1.857

b. Y(11) = 2.244 and Y(12) 2.505

c. Y(11) = 2.773 and Y(12) 3.380

d. Y(11) = 3.025 and Y(12) = 4.164

20.25.2. Jennifer is an analyst who is deciding which second-order model to fit to her time series dataset. She prefers to fit either an MA(2) or AR(2) model:

- MA(2): Y(t) = μ + θ(1)*ε(t-1) + θ(2)*ε(t-2) + ε(t)

- AR(2): Y(t) = ẟ + ϕ(1)*Y(t-1) + ϕ(2)*Y(t-2) + ε(t)

- MA(2): Y(t) = 0.590 + 0.460*ε(t-1) + 0.180*ε(t-2) + ε(t)

- AR(2): Y(t) = 0.590 + 0.460*Y(t-1) + 0.180*Y(t-2) + ε(t)

a. 0.177 (MA) and 0.856 (AR)

b. 0.590 (MA) and 1.639 (AR)

c. 1.330 (MA) and 2.715 (AR)

d. 2.902 (MA) and 3.333 (AR)

20.25.3. Consider the following seasonal time series model that is represented with lag notation:

Note that ϕ(1) = 0.530 and ϕ(s) = 0.260. In regard to this seasonal model, each of the following statements is true EXCEPT which is false?

a. This seasonal model is a restricted AR(13) model

b. The coefficient on lag 13 is -0.13780

c. The coefficients on lags 2 through 11 are zero

d. This seasonal model is deterministic because lag 12 is a dummy variable

Answers here:

Last edited by a moderator: