Learning objectives: Describe linear and nonlinear trends. Describe trend models to estimate and forecast trends

Questions:

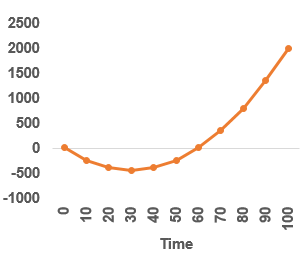

699.1. Consider the following quadratic trend model:

Which of the following functions correctly characterizes this trend?

a. Tr = 10 + 0.3*TIME + 0.3*TIME^2

b. Tr = 10 + 30*TIME - 0.3*TIME^2

c. Tr = 10 - 0.4*TIME - 0.4*TIME^2

d. Tr = 10 - 30*TIME + 0.5*TIME^2

699.2. You work for the International Monetary Fund in Washington DC, monitoring Singapore’s real consumption expenditures. Using a sample of real consumption data (measured in billions of 2005 Singapore dollars), y(t), t=1990:Q1, 1990:Q2, ... , 2006:Q3, 2006:Q4 where y(0) is 1990:Q2, you estimate the linear consumption trend model, y(t) = β(0) + β(1)*TIME(t) + e(i), where e(i) ~ N(0, σ^2), obtaining the estimates β(0) = 0.510, β(1) = 2.30, and σ^2 = 16. Based on your estimated trend model, which is nearest to the 95.0% interval forecast 2010:Q1? (source: Diebold's Question 5.1)

a. 39 to 54

b, 153 to 216

c. 177 to 192

d. 181 to 189

699.3. You would like to describe an account that begins at TIME(0) = $100.00 and compounds continuously at 9.0% per annum. What is a function that characterizes the value of this account, A(t), over time according to such a continuous and constant growth trend?

a. A(t) = $100*exp[0.090*TIME(t)]

b. ln[A(t)] = ln($100) + 0.09*TIME(t)

c. Neither (A) nor (B)

d. Both (A) and (B)

Answers here:

Questions:

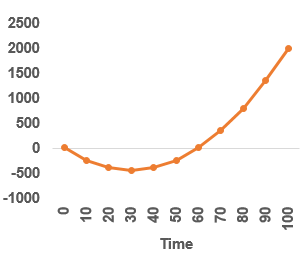

699.1. Consider the following quadratic trend model:

Which of the following functions correctly characterizes this trend?

a. Tr = 10 + 0.3*TIME + 0.3*TIME^2

b. Tr = 10 + 30*TIME - 0.3*TIME^2

c. Tr = 10 - 0.4*TIME - 0.4*TIME^2

d. Tr = 10 - 30*TIME + 0.5*TIME^2

699.2. You work for the International Monetary Fund in Washington DC, monitoring Singapore’s real consumption expenditures. Using a sample of real consumption data (measured in billions of 2005 Singapore dollars), y(t), t=1990:Q1, 1990:Q2, ... , 2006:Q3, 2006:Q4 where y(0) is 1990:Q2, you estimate the linear consumption trend model, y(t) = β(0) + β(1)*TIME(t) + e(i), where e(i) ~ N(0, σ^2), obtaining the estimates β(0) = 0.510, β(1) = 2.30, and σ^2 = 16. Based on your estimated trend model, which is nearest to the 95.0% interval forecast 2010:Q1? (source: Diebold's Question 5.1)

a. 39 to 54

b, 153 to 216

c. 177 to 192

d. 181 to 189

699.3. You would like to describe an account that begins at TIME(0) = $100.00 and compounds continuously at 9.0% per annum. What is a function that characterizes the value of this account, A(t), over time according to such a continuous and constant growth trend?

a. A(t) = $100*exp[0.090*TIME(t)]

b. ln[A(t)] = ln($100) + 0.09*TIME(t)

c. Neither (A) nor (B)

d. Both (A) and (B)

Answers here:

Last edited by a moderator:

)

) ...

...