Learning objectives: Apply the exponentially weighted moving average (EWMA) model to estimate volatility. Describe the generalized autoregressive conditional heteroskedasticity (GARCH(p,q)) model for estimating volatility and its properties. Calculate volatility using the GARCH(1,1) model.

Questions:

703.1. The most recent estimate of the daily volatility of an asset is 4.0% and the price of the asset at the close of trading yesterday was $50.00. The lambda parameter, λ, in the EWMA model is 0.790. Suppose that the price of the asset at the close of trading today is $49.00. If we use a simple daily return rather than a log return, which is nearest to the volatility updated by the EWMA model?

a. 3.6720%

b. 3.9530%

c. 4.1060%

d. 4.7825%

703.2. For the purpose of updating volatility for an asset return series, your colleague Anita is trying to choose between an EWMA and a GARCH(1,1) volatility model. Among the following reasons, which is the BEST reason to prefer the EWMA over the GARCH(1,1) model?

a. She wants to forecast forward volatility

b. She wants to incorporate the concept of mean reversion into the model

c. She want the weights assigned to the historical returns to decline exponentially

d. In terms of best fit, her GARCH(1,1) alpha parameter is 0.92 and beta parameter is 0.13

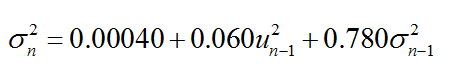

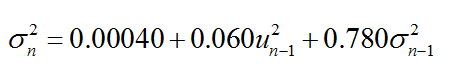

703.3. Assume the following GARCH(1,1) model is a good fit for a equity index series:

At the close of trading yesterday the index was at 200.0 and its volatility was 6.0%. If the index closed today at 192.0, which is nearest to the updated volatility estimate under this GARCH(1,1) model?

a. 4.8590%

b. 5.7480%

c. 6.0606%

d. 7.2793%

Answers here:

Questions:

703.1. The most recent estimate of the daily volatility of an asset is 4.0% and the price of the asset at the close of trading yesterday was $50.00. The lambda parameter, λ, in the EWMA model is 0.790. Suppose that the price of the asset at the close of trading today is $49.00. If we use a simple daily return rather than a log return, which is nearest to the volatility updated by the EWMA model?

a. 3.6720%

b. 3.9530%

c. 4.1060%

d. 4.7825%

703.2. For the purpose of updating volatility for an asset return series, your colleague Anita is trying to choose between an EWMA and a GARCH(1,1) volatility model. Among the following reasons, which is the BEST reason to prefer the EWMA over the GARCH(1,1) model?

a. She wants to forecast forward volatility

b. She wants to incorporate the concept of mean reversion into the model

c. She want the weights assigned to the historical returns to decline exponentially

d. In terms of best fit, her GARCH(1,1) alpha parameter is 0.92 and beta parameter is 0.13

703.3. Assume the following GARCH(1,1) model is a good fit for a equity index series:

At the close of trading yesterday the index was at 200.0 and its volatility was 6.0%. If the index closed today at 192.0, which is nearest to the updated volatility estimate under this GARCH(1,1) model?

a. 4.8590%

b. 5.7480%

c. 6.0606%

d. 7.2793%

Answers here:

Last edited by a moderator: