Learning objectives: Describe the various types and uses of options, define moneyness. Explain the payoff function and calculate the profit and loss from an options position. Explain the specification of exchange-traded stock option contracts, including that of nonstandard products.

Questions:

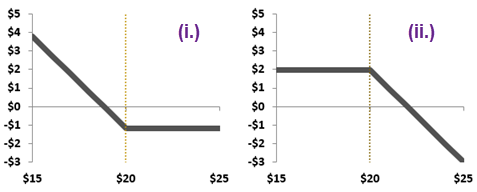

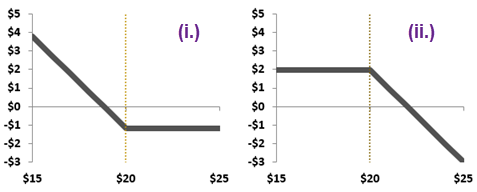

22.23.1. These two graphs (i. and ii. below) each plot an option as a function of the asset price on the option's expiration date.

What is true about these graphs?

a. These are payoff functions for (i) a long call and (ii) a long put

b. These are payoff functions for (i) a short call and (ii) a short put

c. These are profit functions for (i) a short put and (ii) a long call

d. These are profit functions for (i) a long put and (ii) a short call

22.23.2. Charles purchased a European option one month ago. Today the option's price is $1.92 while the underlying current stock price is $17.00. His colleague Leah, who is skilled with the Black-Scholes option-pricing model (BSM OPM), informs him that the option currently has an implied volatility of 38.0% and a time value of $0.42. What can Charles (and we!) infer as TRUE about his option?

a. It must be a call option rather than a put

b. The strike price is either $15.50 or $18.50

c. The option has a remaining maturity of two months

d. Nothing because we are not given the option's maturity

22.23.3. BLXD is a special purpose acquisition corporation (SPAC) that trades today at a price of $11.16 after recently going public via a de-SPAC merger. The Chicago Board Options Exchange (CBOE) just introduced a new set of strike prices near today's stock price, We will assume the exchange employs the following guidelines for new options.

a. $4.17

b. $11.15

c. $37.50

d. Underwater options are canceled in a reverse split

Answers here:

Questions:

22.23.1. These two graphs (i. and ii. below) each plot an option as a function of the asset price on the option's expiration date.

What is true about these graphs?

a. These are payoff functions for (i) a long call and (ii) a long put

b. These are payoff functions for (i) a short call and (ii) a short put

c. These are profit functions for (i) a short put and (ii) a long call

d. These are profit functions for (i) a long put and (ii) a short call

22.23.2. Charles purchased a European option one month ago. Today the option's price is $1.92 while the underlying current stock price is $17.00. His colleague Leah, who is skilled with the Black-Scholes option-pricing model (BSM OPM), informs him that the option currently has an implied volatility of 38.0% and a time value of $0.42. What can Charles (and we!) infer as TRUE about his option?

a. It must be a call option rather than a put

b. The strike price is either $15.50 or $18.50

c. The option has a remaining maturity of two months

d. Nothing because we are not given the option's maturity

22.23.3. BLXD is a special purpose acquisition corporation (SPAC) that trades today at a price of $11.16 after recently going public via a de-SPAC merger. The Chicago Board Options Exchange (CBOE) just introduced a new set of strike prices near today's stock price, We will assume the exchange employs the following guidelines for new options.

- Multiples of $2.50 when the current stock price is between USD 5.00 and USD 25.00

- Multiples of $5.00 when the current stock price is between USD 25.00 and USD 200.00

- Multiples of $10.00 when the current stock price is greater than USD 200.00

a. $4.17

b. $11.15

c. $37.50

d. Underwater options are canceled in a reverse split

Answers here: