Learning objectives: Describe how exchanges can be used to alleviate counterparty risk. Explain the developments in clearing that reduce risk. Compare exchange-traded and OTC markets and describe their uses.

Questions:

601.1. An exchange is a central financial center where parties can trade standardized contracts, explains Gregory. An exchange performs the following three key functions: product standardization, trading venue, and reporting services. An exchange is different than a clearinghouse, however. An exchange is a trade execution venue, but clearing reduces counterparty risk (see http://trtl.bz/1ZZ7y7I). With respect to the need for clearing and the reduction Gregory in counterparty risk, Gregory reviews the following three definitions for clearing, margining and netting (although not necessarily in that order): (Source: John Gregory, Central Counterparties: Mandatory Clearing and Bilateral Margin Requirements for OTC Derivatives (New York: John Wiley & Sons, 2014))

I. The reconciling and resolving of contracts between counterparties and it occurs between trade execution and settlement

II. This involves the offsetting of contracts, which is useful to reduce the exposure of counterparties and the underlying network to which they are exposed

III. This involves exchange members receiving and paying cash or other assets against gains and losses in their positions and providing extra coverage against losses in case they default

Which of the following is CORRECT?

a. I. refers to netting

b. II. refers to margining

c. III. refers to clearing

d. None of the above is correct

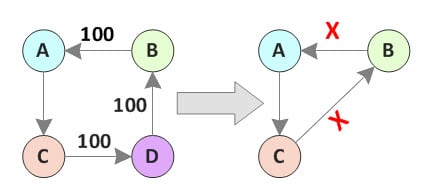

601.2. Consider the four counterparties illustrated below on the left (A, B, C and D) which illustrates their initial bilateral credit exposures. An arrow indicates the direction of money owed. For example, Counterparty D has a credit exposure of 100.0 to Counterparty C, while Counterparty B has an exposure of 100.0 to entity D. Clearing rings can reduce bilateral exposure. As Gregory writes, "Clearing rings were relatively informal means of reducing exposure via a ring of three or more members. To achieve the benefits of ‘ringing’, participants in the ring had to be willing to accept substitutes for their original counterparties. Rings were voluntary but once joining a ring, exchange rules bound participants to the ensuing settlements. Some members would choose not to join a ring whereas others might participate in multiple rings. In a clearing ring, groups of exchange members agree to accept each other’s contracts and allow counterparties to be interchanged." (Source: John Gregory, Central Counterparties: Mandatory Clearing and Bilateral Margin Requirements for OTC Derivatives (New York: John Wiley & Sons, 2014))

In the OTC derivative market, the historical function of a clearing ring is essentially performed by compression.

Assume a clearing ring achieves the configuration above on the RIGHT. Which of the following is NOT NECESSARILY true about this application of the clearing ring?

a. Counterparty risk has been reduced

b. Counterparty A is indifferent (unaffected)

c. Counterparty B is indifferent (unaffected)

d. Counterparty D benefits

601.3. In a comparison between exchange-traded derivatives and over-the-counter (OTC) derivatives, which of the following statements is TRUE?

a. Customized OTC derivatives are exotic and exotic products are not socially useful

b. Compared to an exchange-traded derivative, a customized OTC derivative offers better liquidity but greater basis risk

c. Due to the leverage inherent in customized OTC derivatives, the total market value of OTC derivatives is nearly 100% of their gross notional outstanding

d. Compared to an exchange-traded derivative, a disadvantage of OTC derivatives is their relative lack of fungibility; i.e., difficulty in unwinding position or assigning to another counterparty

Answers here:

Questions:

601.1. An exchange is a central financial center where parties can trade standardized contracts, explains Gregory. An exchange performs the following three key functions: product standardization, trading venue, and reporting services. An exchange is different than a clearinghouse, however. An exchange is a trade execution venue, but clearing reduces counterparty risk (see http://trtl.bz/1ZZ7y7I). With respect to the need for clearing and the reduction Gregory in counterparty risk, Gregory reviews the following three definitions for clearing, margining and netting (although not necessarily in that order): (Source: John Gregory, Central Counterparties: Mandatory Clearing and Bilateral Margin Requirements for OTC Derivatives (New York: John Wiley & Sons, 2014))

I. The reconciling and resolving of contracts between counterparties and it occurs between trade execution and settlement

II. This involves the offsetting of contracts, which is useful to reduce the exposure of counterparties and the underlying network to which they are exposed

III. This involves exchange members receiving and paying cash or other assets against gains and losses in their positions and providing extra coverage against losses in case they default

Which of the following is CORRECT?

a. I. refers to netting

b. II. refers to margining

c. III. refers to clearing

d. None of the above is correct

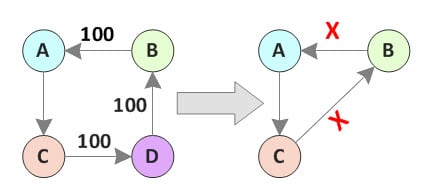

601.2. Consider the four counterparties illustrated below on the left (A, B, C and D) which illustrates their initial bilateral credit exposures. An arrow indicates the direction of money owed. For example, Counterparty D has a credit exposure of 100.0 to Counterparty C, while Counterparty B has an exposure of 100.0 to entity D. Clearing rings can reduce bilateral exposure. As Gregory writes, "Clearing rings were relatively informal means of reducing exposure via a ring of three or more members. To achieve the benefits of ‘ringing’, participants in the ring had to be willing to accept substitutes for their original counterparties. Rings were voluntary but once joining a ring, exchange rules bound participants to the ensuing settlements. Some members would choose not to join a ring whereas others might participate in multiple rings. In a clearing ring, groups of exchange members agree to accept each other’s contracts and allow counterparties to be interchanged." (Source: John Gregory, Central Counterparties: Mandatory Clearing and Bilateral Margin Requirements for OTC Derivatives (New York: John Wiley & Sons, 2014))

In the OTC derivative market, the historical function of a clearing ring is essentially performed by compression.

Assume a clearing ring achieves the configuration above on the RIGHT. Which of the following is NOT NECESSARILY true about this application of the clearing ring?

a. Counterparty risk has been reduced

b. Counterparty A is indifferent (unaffected)

c. Counterparty B is indifferent (unaffected)

d. Counterparty D benefits

601.3. In a comparison between exchange-traded derivatives and over-the-counter (OTC) derivatives, which of the following statements is TRUE?

a. Customized OTC derivatives are exotic and exotic products are not socially useful

b. Compared to an exchange-traded derivative, a customized OTC derivative offers better liquidity but greater basis risk

c. Due to the leverage inherent in customized OTC derivatives, the total market value of OTC derivatives is nearly 100% of their gross notional outstanding

d. Compared to an exchange-traded derivative, a disadvantage of OTC derivatives is their relative lack of fungibility; i.e., difficulty in unwinding position or assigning to another counterparty

Answers here:

Last edited: