Learning objectives: Explain how deposit insurance gives rise to a moral hazard problem. Describe investment banking financing arrangements including private placement, public offering, best efforts, firm commitment, and Dutch auction approaches. Describe the potential conflicts of interest among commercial banking, securities services, and investment banking divisions of a bank and recommend solutions to the conflict of interest problems. Describe the distinctions between the banking book and the trading book of a bank. Explain the originate-to-distribute model of a bank and discuss its benefits and drawbacks.

Questions:

701.1. Below are displayed the loans account in the Balance Sheet of Deposits and Loans Corporation (DLC) for the year ending December 31st, 2016. Also shown is the breakdown of the Allowance for loan losses. (Please note this format is realistic and mimics the presentation given by, for example, Bank of America's annual report).

About these accounts, each of the following statements is true EXCEPT which is false?

a. The actual (not expected) loan losses for DLC during 2016 were $195.0 million before netting any recoveries

b. The book value (aka, carrying value) of loans which contributes to DLC's reported Total Assets is $12,451.4 million

c. The most direct impact on DLC's 2016 Income Statement is "Net Charge Offs" which reduced DLC's reported Pre-tax Operating Income by $175.0 million

d. If the 2016 "Provision for loan losses" had increased from $120.0 million to $200.0 million (i.e., nearer to loans charged off) then reported Assets and Equity (as of December 31st, 2016) would have both decreased

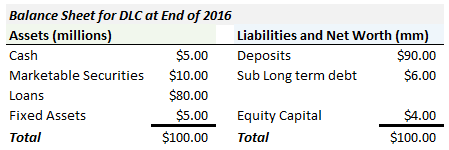

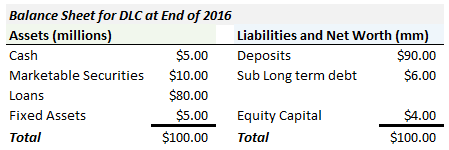

701.2. Regulators estimate that Deposits and Loans Corporation (DLC) will report a profit that is normally distributed with a mean of $1.30 million and a standard deviation of $3.0 million. Below is displayed the summary Balance Sheet for DLC:

How much equity capital IN ADDITION to DLC's current equity position should regulators require for there to be a 99.9% chance of the capital not being wiped out by losses? (this is a variation on Hull's EOC Question 2.15) (Source: John C. Hull, Risk Management and Financial Institutions, 5th edition (Hoboken, New Jersey: John Wiley & Sons, 2018))

a. None

b. About $1.50 million

c. About $3.97 million

d. About $14.46 million

701.3. Hull's Chapter 2 introduces several key banking definitions. Consider the definitions below (Source: John C. Hull, Risk Management and Financial Institutions, 5th edition (Hoboken, New Jersey: John Wiley & Sons, 2018))

I. Moral hazard: Moral hazard is the possibility that insurance itself motives the insured party to engage is riskier behavior

II. Firm commitment IPO: Faced with a choice between "firm commitment" versus "best efforts," an investment bank underwriting an initial public offering (IPO) is more likely to prefer the firm commitment if (i) the bank is more confident in obtaining a higher public sale price and (ii) the bank has a greater risk appetite

III. Trading book: Assets in the trading book are market to market daily, or if they do not have a market, marked according to a model ("marking to model"); but loans in the banking book are not marked to market, they are recorded in the books as principal amount owed plus accrued interest

IV. Originate-to-distribute: Originate-to-distribute refers to the business model that has the intention to securitize

V. Poison pill: An example of a poison pill is when a potential acquisition target grants to its key employees stock options that vest in the event of a takeover

VI. Market maker: A market maker facilitates trading by always being prepared to quote a bid (the price at which it is prepared to buy) and an offer (the price at which it is prepared to sell)

Which of the above definitions is CORRECT?

a. None of these definitions are correct

b. II., IV, and VI are accurate (but I., III., and V. are incorrect)

c. I., III., and V. are accurate (but II., IV, and VI. are incorrect)

d. All of these definitions are accurate

Answers here:

Questions:

701.1. Below are displayed the loans account in the Balance Sheet of Deposits and Loans Corporation (DLC) for the year ending December 31st, 2016. Also shown is the breakdown of the Allowance for loan losses. (Please note this format is realistic and mimics the presentation given by, for example, Bank of America's annual report).

About these accounts, each of the following statements is true EXCEPT which is false?

a. The actual (not expected) loan losses for DLC during 2016 were $195.0 million before netting any recoveries

b. The book value (aka, carrying value) of loans which contributes to DLC's reported Total Assets is $12,451.4 million

c. The most direct impact on DLC's 2016 Income Statement is "Net Charge Offs" which reduced DLC's reported Pre-tax Operating Income by $175.0 million

d. If the 2016 "Provision for loan losses" had increased from $120.0 million to $200.0 million (i.e., nearer to loans charged off) then reported Assets and Equity (as of December 31st, 2016) would have both decreased

701.2. Regulators estimate that Deposits and Loans Corporation (DLC) will report a profit that is normally distributed with a mean of $1.30 million and a standard deviation of $3.0 million. Below is displayed the summary Balance Sheet for DLC:

How much equity capital IN ADDITION to DLC's current equity position should regulators require for there to be a 99.9% chance of the capital not being wiped out by losses? (this is a variation on Hull's EOC Question 2.15) (Source: John C. Hull, Risk Management and Financial Institutions, 5th edition (Hoboken, New Jersey: John Wiley & Sons, 2018))

a. None

b. About $1.50 million

c. About $3.97 million

d. About $14.46 million

701.3. Hull's Chapter 2 introduces several key banking definitions. Consider the definitions below (Source: John C. Hull, Risk Management and Financial Institutions, 5th edition (Hoboken, New Jersey: John Wiley & Sons, 2018))

I. Moral hazard: Moral hazard is the possibility that insurance itself motives the insured party to engage is riskier behavior

II. Firm commitment IPO: Faced with a choice between "firm commitment" versus "best efforts," an investment bank underwriting an initial public offering (IPO) is more likely to prefer the firm commitment if (i) the bank is more confident in obtaining a higher public sale price and (ii) the bank has a greater risk appetite

III. Trading book: Assets in the trading book are market to market daily, or if they do not have a market, marked according to a model ("marking to model"); but loans in the banking book are not marked to market, they are recorded in the books as principal amount owed plus accrued interest

IV. Originate-to-distribute: Originate-to-distribute refers to the business model that has the intention to securitize

V. Poison pill: An example of a poison pill is when a potential acquisition target grants to its key employees stock options that vest in the event of a takeover

VI. Market maker: A market maker facilitates trading by always being prepared to quote a bid (the price at which it is prepared to buy) and an offer (the price at which it is prepared to sell)

Which of the above definitions is CORRECT?

a. None of these definitions are correct

b. II., IV, and VI are accurate (but I., III., and V. are incorrect)

c. I., III., and V. are accurate (but II., IV, and VI. are incorrect)

d. All of these definitions are accurate

Answers here:

Last edited: