Learning objectives: Calculate the final contract price on a Eurodollar futures contract. Describe and compute the Eurodollar futures contract convexity adjustment. Explain how Eurodollar futures can be used to extend the LIBOR zero curve. Calculate the duration-based hedge ratio and create a duration-based hedging strategy using interest rate futures. Explain the limitations of using a duration-based hedging strategy.

Questions:

721.1. Suppose that the nine-month LIBOR interest rate is 2.50% per annum and the one-year LIBOR interst rate is 3.10% per annum, both expressed per annum with actual/365 and continuous compounding. Which of the following is nearest to the 3-month Eurodollar futures price quote for a contract maturing in nine months? (note: inspired by Hull's EOC Problem 6.13)

a. 95.1374

b. 96.9000

c. 97.5000

d. 98.2693

721.2. It is August and Sally is a fund manager with $50.0 million invested in government bonds who is worried that interest rates are expected to be volatile over the next quarter (note: this question is inspired by Hull's EOC Problem 6.18). She decides to use the December Treasury bond ("T-bond") futures contract to hedge the value of the portfolio. The current futures price is 108-00 or $108.00. Because each contract is for the delivery of $100,000 face value of bonds, the futures contract price is therefore $108,000.00. Suppose the modified duration of the bond portfolio in three months will be 13.0 years. The cheapest-to-deliver (CTD) in the T-bond contract is anticipated to be an bond with 18.0 years to maturity that pays a 5.0% semi-annual coupon; at maturity, the duration of this CTD bond is expected to be about 12.0 years.

However, the manager does not want to completely neutralize duration. Rather, she wants to REDUCE the portfolio's duration by 7.0 years, from 13.0 years to 6.0 years. About how many T-bond futures contracts should she trade to achieve this reduction in duration of the net portfolio?

a. 15 contracts

b. 270 contracts

c. 333 contracts

d. 502 contracts

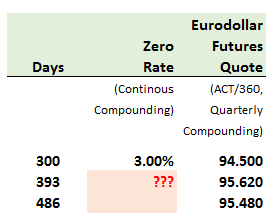

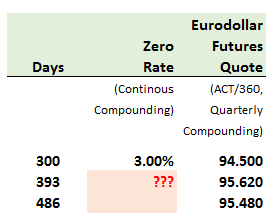

721.3. Below are given three-month Eurodollar Futures quotes for contracts with maturities of, respectively, 300, 393 and 486 days; for example, 94.50 is the Eurodollar Futures quote for a contract that matures in 300 days and settlement will be based on the then-prevailing three-month LIBOR.

Which is nearest to the implied 393-day zero rate expressed per annum with continuous compounding?

a. 3.601%

b. 4.380%

c. 5.538%

d. 6.026%

Answers here:

Questions:

721.1. Suppose that the nine-month LIBOR interest rate is 2.50% per annum and the one-year LIBOR interst rate is 3.10% per annum, both expressed per annum with actual/365 and continuous compounding. Which of the following is nearest to the 3-month Eurodollar futures price quote for a contract maturing in nine months? (note: inspired by Hull's EOC Problem 6.13)

a. 95.1374

b. 96.9000

c. 97.5000

d. 98.2693

721.2. It is August and Sally is a fund manager with $50.0 million invested in government bonds who is worried that interest rates are expected to be volatile over the next quarter (note: this question is inspired by Hull's EOC Problem 6.18). She decides to use the December Treasury bond ("T-bond") futures contract to hedge the value of the portfolio. The current futures price is 108-00 or $108.00. Because each contract is for the delivery of $100,000 face value of bonds, the futures contract price is therefore $108,000.00. Suppose the modified duration of the bond portfolio in three months will be 13.0 years. The cheapest-to-deliver (CTD) in the T-bond contract is anticipated to be an bond with 18.0 years to maturity that pays a 5.0% semi-annual coupon; at maturity, the duration of this CTD bond is expected to be about 12.0 years.

However, the manager does not want to completely neutralize duration. Rather, she wants to REDUCE the portfolio's duration by 7.0 years, from 13.0 years to 6.0 years. About how many T-bond futures contracts should she trade to achieve this reduction in duration of the net portfolio?

a. 15 contracts

b. 270 contracts

c. 333 contracts

d. 502 contracts

721.3. Below are given three-month Eurodollar Futures quotes for contracts with maturities of, respectively, 300, 393 and 486 days; for example, 94.50 is the Eurodollar Futures quote for a contract that matures in 300 days and settlement will be based on the then-prevailing three-month LIBOR.

Which is nearest to the implied 393-day zero rate expressed per annum with continuous compounding?

a. 3.601%

b. 4.380%

c. 5.538%

d. 6.026%

Answers here: