Learning Objectives: Define recovery rate and calculate the expected loss from a loan. Describe alternative methods to credit ratings produced by rating agencies. Explain historical failures and potential challenges to the use of credit ratings in making investment decisions.

Questions:

24.11.1. A risk manager at a commercial bank is conducting a training session for new risk analysts on the components of credit risk, particularly the concept of recovery rates. During the session, the risk manager illustrates recovery scenarios by using the example of the bank holding a corporate bond.

Which of the following statements would the risk manager be correct in identifying as an example of a recovery rate for a corporate bond held by the bank?

a. If the corporate issuer undergoes restructuring, the restructured terms could result in the bank receiving payments that cumulatively amount to 45% of the original loan amount over time.

b. If the corporate issuer defaults and the bond is unsecured, the market price of the bond might immediately drop to 45% of its original face value.

c. At the purchase time, the bond is assessed with a 55% likelihood of default over its lifetime due to the issuer's financial instability.

d. In the event of the corporate issuer's default, the bank is expected to recover 45% of the bond’s face value through the liquidation of the issuer’s assets.

24.11.2. A risk manager at a large bank is tasked with overhauling the bank’s internal credit rating system to enhance its loan decision-making process. During a workshop aimed at improving the understanding of internal ratings among the credit analysis team, the risk manager discusses the benefits and drawbacks of using point-in-time versus through-the-cycle ratings.

Which of the following statements would be correct regarding the characteristics and implications of these rating approaches?

a. Point-in-time ratings, because they reflect current economic conditions, help stabilize the economic cycle by ensuring banks lend more during downturns and less during booms.

b. Through-the-cycle ratings are preferred for long-term lending as they smooth out cyclical fluctuations and provide a more stable basis for setting regulatory capital requirements.

c. Internal ratings systems based on machine learning algorithms are less accurate than those using traditional discriminant analysis since they rely on nonlinear functions and a larger number of variables.

d. Banks are encouraged to use point-in-time ratings for determining regulatory capital as these ratings are typically more conservative and mitigate the risk of over-lending during economic booms.

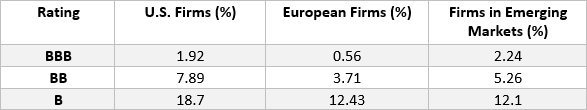

24.11.3. A financial analyst at an international investment firm is evaluating the credit risk associated with corporate bonds from different geographical regions. The analyst is particularly concerned about the consistency of credit ratings across various markets due to historical variations in default probabilities as reported by S&P. Given the following historical data on five-year cumulative default probabilities:

Which of the following statements would be correct concerning the challenges of using credit ratings for making investment decisions?

a. Credit ratings are universally consistent across regions; hence, a BBB rating indicates similar default risks irrespective of whether the firm is in the U.S., Europe, or emerging markets.

b. Historical data suggests that European firms with a BBB rating have shown lower default probabilities compared to their U.S. counterparts, indicating regional variations in rating standards.

c. Emerging market firms consistently show higher default rates across all rating categories when compared to U.S. and European firms, underscoring the higher risk associated with these regions.

d. Internal ratings developed by banks are less reliable than those from established credit rating agencies and should not be used for assessing default probabilities in international markets.

Answers here:

Questions:

24.11.1. A risk manager at a commercial bank is conducting a training session for new risk analysts on the components of credit risk, particularly the concept of recovery rates. During the session, the risk manager illustrates recovery scenarios by using the example of the bank holding a corporate bond.

Which of the following statements would the risk manager be correct in identifying as an example of a recovery rate for a corporate bond held by the bank?

a. If the corporate issuer undergoes restructuring, the restructured terms could result in the bank receiving payments that cumulatively amount to 45% of the original loan amount over time.

b. If the corporate issuer defaults and the bond is unsecured, the market price of the bond might immediately drop to 45% of its original face value.

c. At the purchase time, the bond is assessed with a 55% likelihood of default over its lifetime due to the issuer's financial instability.

d. In the event of the corporate issuer's default, the bank is expected to recover 45% of the bond’s face value through the liquidation of the issuer’s assets.

24.11.2. A risk manager at a large bank is tasked with overhauling the bank’s internal credit rating system to enhance its loan decision-making process. During a workshop aimed at improving the understanding of internal ratings among the credit analysis team, the risk manager discusses the benefits and drawbacks of using point-in-time versus through-the-cycle ratings.

Which of the following statements would be correct regarding the characteristics and implications of these rating approaches?

a. Point-in-time ratings, because they reflect current economic conditions, help stabilize the economic cycle by ensuring banks lend more during downturns and less during booms.

b. Through-the-cycle ratings are preferred for long-term lending as they smooth out cyclical fluctuations and provide a more stable basis for setting regulatory capital requirements.

c. Internal ratings systems based on machine learning algorithms are less accurate than those using traditional discriminant analysis since they rely on nonlinear functions and a larger number of variables.

d. Banks are encouraged to use point-in-time ratings for determining regulatory capital as these ratings are typically more conservative and mitigate the risk of over-lending during economic booms.

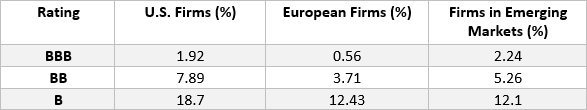

24.11.3. A financial analyst at an international investment firm is evaluating the credit risk associated with corporate bonds from different geographical regions. The analyst is particularly concerned about the consistency of credit ratings across various markets due to historical variations in default probabilities as reported by S&P. Given the following historical data on five-year cumulative default probabilities:

Which of the following statements would be correct concerning the challenges of using credit ratings for making investment decisions?

a. Credit ratings are universally consistent across regions; hence, a BBB rating indicates similar default risks irrespective of whether the firm is in the U.S., Europe, or emerging markets.

b. Historical data suggests that European firms with a BBB rating have shown lower default probabilities compared to their U.S. counterparts, indicating regional variations in rating standards.

c. Emerging market firms consistently show higher default rates across all rating categories when compared to U.S. and European firms, underscoring the higher risk associated with these regions.

d. Internal ratings developed by banks are less reliable than those from established credit rating agencies and should not be used for assessing default probabilities in international markets.

Answers here: