Learning Objectives: Describe an interest rate bucketing approach, define forward bucket 01, and compare forward bucket 01s to KR01s. Calculate the corresponding duration measure given a KR01 or forward bucket 01.

24.17.1. An investment analyst is calculating the forward bucket 01 of a bond. The bond pays an 8% coupon annually, has a face value of $500,000, and matures in 3 years. The analyst notes that the forward rate curve is flat at 5% (with all forward rates calculated for 1-year periods) and uses two forward buckets of 0-2 years and 2-3 years.

What is the forward bucket 01 of the bond for the 2–3-year bucket, assuming an upward shift in interest rates?

a. 44.42

b. 92.29

c. 99.38

d. 133.25

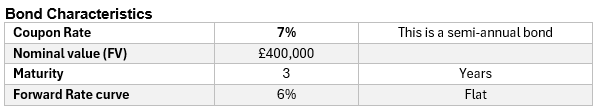

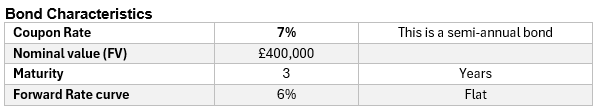

24.17.2. An investment analyst is calculating the interest rate risk of a bond using both forward bucket and key rate shift (KR01) approaches. The bond has the following characteristics:

a. KR01 = $27.95

b. KR01 = $58.30

c. KR01 = $63.19

d. KR01 = $83.84

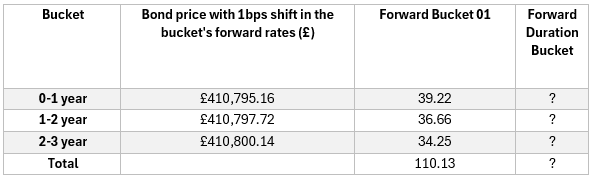

24.17.3. You are tasked with evaluating the interest rate sensitivity of a semiannual coupon bond (UK Gilt) in your investment portfolio. Below are the bond's characteristics and the results of a forward rate analysis conducted to assess the bond's price sensitivity to a 1-basis point upward shift in forward rates across different maturity buckets.

Forward Bucket Analysis

You have segmented the bond's forward rates into three maturity buckets and calculated the changes in the bond’s price for a 1-basis point increase in forward rates for each bucket. The following table summarizes the bond price adjustments and the calculated Forward Bucket 01 values:

Using the provided Forward Bucket 01 values and the bond's current market price, calculate the Forward Duration Bucket for the total shift across all buckets.

a. 0.955

b. 0.892

c. 0.834

d. 2.681

Answers here:

24.17.1. An investment analyst is calculating the forward bucket 01 of a bond. The bond pays an 8% coupon annually, has a face value of $500,000, and matures in 3 years. The analyst notes that the forward rate curve is flat at 5% (with all forward rates calculated for 1-year periods) and uses two forward buckets of 0-2 years and 2-3 years.

What is the forward bucket 01 of the bond for the 2–3-year bucket, assuming an upward shift in interest rates?

a. 44.42

b. 92.29

c. 99.38

d. 133.25

24.17.2. An investment analyst is calculating the interest rate risk of a bond using both forward bucket and key rate shift (KR01) approaches. The bond has the following characteristics:

- Coupon Rate: 9% annually

- Face Value: $300,000

- Maturity: 3 years

- Forward Rate Curve: Flat at 4%

a. KR01 = $27.95

b. KR01 = $58.30

c. KR01 = $63.19

d. KR01 = $83.84

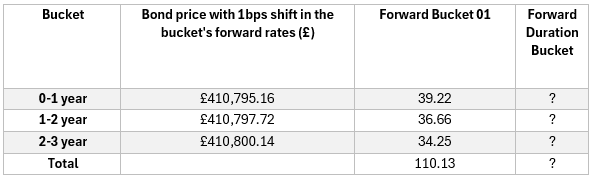

24.17.3. You are tasked with evaluating the interest rate sensitivity of a semiannual coupon bond (UK Gilt) in your investment portfolio. Below are the bond's characteristics and the results of a forward rate analysis conducted to assess the bond's price sensitivity to a 1-basis point upward shift in forward rates across different maturity buckets.

Forward Bucket Analysis

You have segmented the bond's forward rates into three maturity buckets and calculated the changes in the bond’s price for a 1-basis point increase in forward rates for each bucket. The following table summarizes the bond price adjustments and the calculated Forward Bucket 01 values:

Using the provided Forward Bucket 01 values and the bond's current market price, calculate the Forward Duration Bucket for the total shift across all buckets.

a. 0.955

b. 0.892

c. 0.834

d. 2.681

Answers here: