Learning Objectives: Describe stressed VaR and stressed ES, including their advantages and disadvantages, and compare the process of determining stressed VaR and ES to that of traditional VaR and ES. Describe reverse stress testing and describe an example of regulatory stress testing.

Questions:

24.19.1. During significant economic disturbances triggered by the COVID-19 pandemic, two investment firms adjusted their strategies to measure potential financial risks. Primera Capital analyzed a wide array of economic data from the previous decade, capturing both periods of economic stability and volatility. On the other hand, Secunda Investments concentrated on data specifically from previous financial downturns, including a major global financial crisis and the onset of the 2020 pandemic.

Based on the descriptions of the strategies employed by each firm during the 2020 economic disturbances, which statement best identifies the risk assessment approach used by Primera Capital and Secunda Investments?

a. Both used stressed VaR in one way or the other.

b. Primera's approach covered stressed VaR and traditional VaR both.

c. Primera used stressed VaR, and Secunda used traditional VaR.

d. Primera used traditional VaR, and Secunda used stressed VaR.

24.19.2. Amid a sudden market downturn, Nayeb's fund faces significant liquidity challenges. The fund must adopt a risk management strategy to prevent liquidation.

Considering the 95th percentile VaR and stressed VaR metrics, which approach should Nayeb's fund take?

a. Focus on normal market conditions by setting daily trading limits based on the 2020 VaR

b. Prepare for extreme market scenarios by adopting measures aligned with the 2008 crisis statistics.

c. Continue with current risk practices without significantly altering strategies based on past or recent data.

d. Prioritize investment returns by maintaining current strategies, assuming market conditions will stabilize.

24.19.3. Reverse stress testing involves determining what specific adverse scenarios could lead to a financial institution's failure. Which regulatory stress test exemplifies this approach by requiring banks to analyze their resilience against severe global recession scenarios and other stress conditions?

a. Dodd-Frank Act Stress Test (DFAST) for banks with assets between USD 10 billion and USD 50 billion.

b. Comprehensive Capital Analysis and Review (CCAR) for banks with consolidated assets of over USD 50 billion.

c. Basel III international regulatory framework.

d. European Systemic Risk Board (ESRB) stress testing.

Answers here:

Questions:

24.19.1. During significant economic disturbances triggered by the COVID-19 pandemic, two investment firms adjusted their strategies to measure potential financial risks. Primera Capital analyzed a wide array of economic data from the previous decade, capturing both periods of economic stability and volatility. On the other hand, Secunda Investments concentrated on data specifically from previous financial downturns, including a major global financial crisis and the onset of the 2020 pandemic.

Based on the descriptions of the strategies employed by each firm during the 2020 economic disturbances, which statement best identifies the risk assessment approach used by Primera Capital and Secunda Investments?

a. Both used stressed VaR in one way or the other.

b. Primera's approach covered stressed VaR and traditional VaR both.

c. Primera used stressed VaR, and Secunda used traditional VaR.

d. Primera used traditional VaR, and Secunda used stressed VaR.

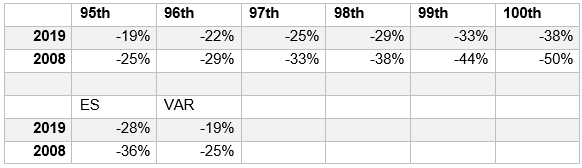

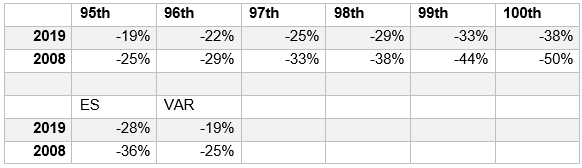

24.19.2. Amid a sudden market downturn, Nayeb's fund faces significant liquidity challenges. The fund must adopt a risk management strategy to prevent liquidation.

- Allowed Leverage: 10X

- Asset Value: $10 million

- Equity Value: $2 million

Considering the 95th percentile VaR and stressed VaR metrics, which approach should Nayeb's fund take?

a. Focus on normal market conditions by setting daily trading limits based on the 2020 VaR

b. Prepare for extreme market scenarios by adopting measures aligned with the 2008 crisis statistics.

c. Continue with current risk practices without significantly altering strategies based on past or recent data.

d. Prioritize investment returns by maintaining current strategies, assuming market conditions will stabilize.

24.19.3. Reverse stress testing involves determining what specific adverse scenarios could lead to a financial institution's failure. Which regulatory stress test exemplifies this approach by requiring banks to analyze their resilience against severe global recession scenarios and other stress conditions?

a. Dodd-Frank Act Stress Test (DFAST) for banks with assets between USD 10 billion and USD 50 billion.

b. Comprehensive Capital Analysis and Review (CCAR) for banks with consolidated assets of over USD 50 billion.

c. Basel III international regulatory framework.

d. European Systemic Risk Board (ESRB) stress testing.

Answers here: