Fran

Administrator

Questions

AIMs: Interpret the relationship between spot, forward and par rates. Assess the impact of maturity on the price of a bond and the returns generated by bonds. Define the “flattening” and “steepening” of rate curves and construct a hypothetical trade to reflect expectations that a curve will flatten or steepen.

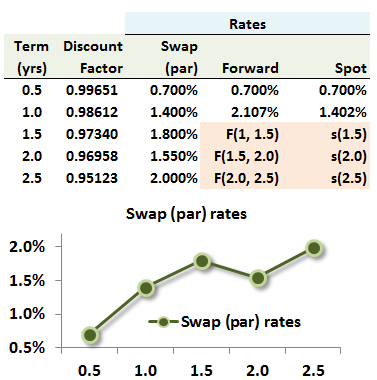

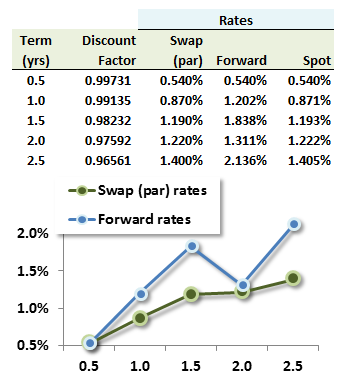

314.1. Assume the 2.5 year swap (par) rate curve below, where all rates are expressed with semi-annual compound frequency:

Each of the following must be true EXCEPT which is false?

a. F(1, 1.5) = 2.615%

b. F(1.5, 2.0) is less than 1.80%

c. F(2.0, 2.5) is greater than 1.55%

d. 1.5-year spot rate, s(1.5) is less than 1.80%

314.2. Assume that today we observe the following swap (par) rate curve and its corresponding, implied forward (and spot) rates:

The present value of the fixed side of a 2.5-year swap that pays 1.400%, by definition, is par; that is, a $100 face value bond that pays a semi-annual 1.40% coupon with a 2.5 year maturity has a present value of $100. Let us assume the swap rate term structure is completely unchanged over the next year. In six months (T0 + 0.5 years), as the swap maturity reduces to two years, the present value of the fixed side of the swap will increase to $100.36. Compares to this price of of $100.36, what happens to the price in the subsequent six months, as swap maturity reduces to 1.5 years?

a. Unclear

b. Decreases below $100.36 (as maturity decreases from 2.0 to 1.5 years)

c. Unchanged at $100.36 (as maturity decreases from 2.0 to 1.5 years)

d. Increases above $100.36 (as maturity decreases from 2.0 to 1.5 years)

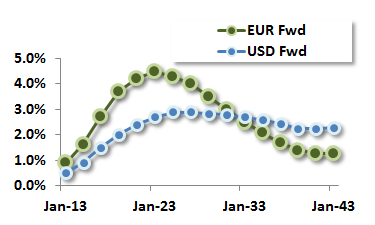

314.3. Consider the following stylized 30-year forward swap rate curve as of January 2013, which compares EUR to USD:

For example, the USD 10y6m of 2.7% is lower than the EUR 10y6m of 4.5%; where 10y6m refers to the six-month rate 10 years forward in 2023. On the other hand, the USD 30y6m of 2.3% is higher than the EUR 30y6m of 1.25%; where 30y6m refers to the six-month forward swap rate 30 years forward in 2043. A trader wants to express a view that the two curves will converge in shape. Under these conditions, each of the following is TRUE except which is false?

a. A bet that the EUR forward curve reverts to resemble the USD forward curve, in shape specifically (not levels), is a bet the EUR forward curve will "steepen"

b. A bet that the USD forward curve contorts to converge on, and more resemble the shape of, the EUR forward curve is a bet on on the "flattening of the EUR forward curve"

c. A trader who locks in a rate to receive the high EUR 10y6 rate and pay the low EUR 30y6 rate, and who encounters an unchanged (static) forward rate curve, cannot experience roll-down losses

d. A primary function of roll-down analysis is to evaluate the trade's profile of interim (short-term) losses or gains under an assumption of unchanged forward curve assumption

Answers:

AIMs: Interpret the relationship between spot, forward and par rates. Assess the impact of maturity on the price of a bond and the returns generated by bonds. Define the “flattening” and “steepening” of rate curves and construct a hypothetical trade to reflect expectations that a curve will flatten or steepen.

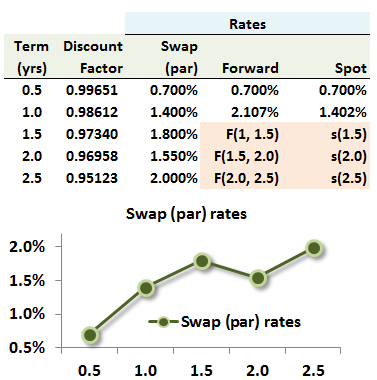

314.1. Assume the 2.5 year swap (par) rate curve below, where all rates are expressed with semi-annual compound frequency:

Each of the following must be true EXCEPT which is false?

a. F(1, 1.5) = 2.615%

b. F(1.5, 2.0) is less than 1.80%

c. F(2.0, 2.5) is greater than 1.55%

d. 1.5-year spot rate, s(1.5) is less than 1.80%

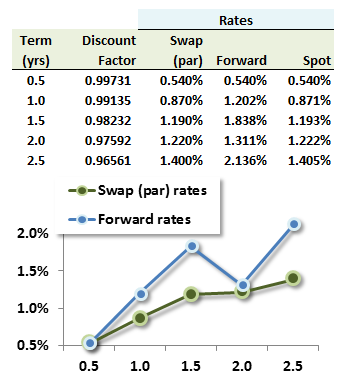

314.2. Assume that today we observe the following swap (par) rate curve and its corresponding, implied forward (and spot) rates:

The present value of the fixed side of a 2.5-year swap that pays 1.400%, by definition, is par; that is, a $100 face value bond that pays a semi-annual 1.40% coupon with a 2.5 year maturity has a present value of $100. Let us assume the swap rate term structure is completely unchanged over the next year. In six months (T0 + 0.5 years), as the swap maturity reduces to two years, the present value of the fixed side of the swap will increase to $100.36. Compares to this price of of $100.36, what happens to the price in the subsequent six months, as swap maturity reduces to 1.5 years?

a. Unclear

b. Decreases below $100.36 (as maturity decreases from 2.0 to 1.5 years)

c. Unchanged at $100.36 (as maturity decreases from 2.0 to 1.5 years)

d. Increases above $100.36 (as maturity decreases from 2.0 to 1.5 years)

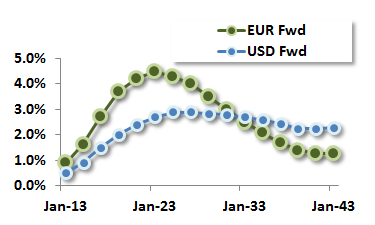

314.3. Consider the following stylized 30-year forward swap rate curve as of January 2013, which compares EUR to USD:

For example, the USD 10y6m of 2.7% is lower than the EUR 10y6m of 4.5%; where 10y6m refers to the six-month rate 10 years forward in 2023. On the other hand, the USD 30y6m of 2.3% is higher than the EUR 30y6m of 1.25%; where 30y6m refers to the six-month forward swap rate 30 years forward in 2043. A trader wants to express a view that the two curves will converge in shape. Under these conditions, each of the following is TRUE except which is false?

a. A bet that the EUR forward curve reverts to resemble the USD forward curve, in shape specifically (not levels), is a bet the EUR forward curve will "steepen"

b. A bet that the USD forward curve contorts to converge on, and more resemble the shape of, the EUR forward curve is a bet on on the "flattening of the EUR forward curve"

c. A trader who locks in a rate to receive the high EUR 10y6 rate and pay the low EUR 30y6 rate, and who encounters an unchanged (static) forward rate curve, cannot experience roll-down losses

d. A primary function of roll-down analysis is to evaluate the trade's profile of interim (short-term) losses or gains under an assumption of unchanged forward curve assumption

Answers: