Concept: These on-line quiz questions are not specifically linked to AIMs, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical AIM-by-AIM question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

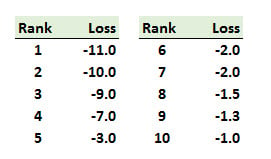

409.1. You have collected your portfolio's daily profit and loss (P&L) for the most recent 100 traded days. You sorted (ranked) the outcomes from worst to best. Below are the ten worst days; e.g., the worst daily loss was -11.0.

You want to estimate the portfolio's value at risk (VaR) under the historical simulation approach, and its expected shortfall. Which are, respectively, the portfolio's 95.0% value at risk (VaR) and 95.0% expected shortfall (ES)?

a. 95% VaR is either {3.0, 5.0, or 7.0} and 95% ES is 3.0

b. 95% VaR is either {2.0, 3.0, or 2.5} and 95% ES is 8.0

c. 95% VaR is either {2.0 or 3.0} and 95% ES is either {7.0 or 8.0}

d. 95% VaR is 3.0 and 95% ES is either {7.0, 8.0 or 9.3}

409.2. A $100.0 million equity portfolio contains two equally-weighted and uncorrelated (i.e., correlation equals zero) positions. The positions' volatilities are 30.0% and 40.0% per annum. If their returns are i.i.d. normal, which is nearest to the 10-day 95.0% value at risk (VaR) if we assume 250 trading days per year?

a. $4.93 million

b. $6.58 million

c. $8.22 million

d. $17.41 million

409.3. The following table shows the sorted worst six (6) returns, sorted, among a trailing window of 100 returns. For example, the worst return was -13.00% and it happened 14 days prior. The weights under simple historical simulation (HS) are compared to the weights under exponentially weighted moving average (EWMA) where lambda parameter is set equal to 0.920. For example, 20 days prior the return was -11.00% and this return is assigned a weight of (1-0.920)*0.920^(20-1)/(1-0.920)^100 = 1.64%.

If we assume that "1/2 of a given return’s weight is to the right and 1/2 to the left of the actual observation" and "the required VaR level is a linearly interpolated return, where the distance to the two adjacent cumulative weights determines the return," which is nearest to the 95.0% value at risk (VaR) under the hybrid approach?

a. 95% Hybrid VaR is about 9.00%

b. 95% Hybrid VaR is about 10.00%

c. 95% Hybrid VaR is about 11.00%

d. 95% Hybrid VaR is about 11.50%

Answers here:

Questions:

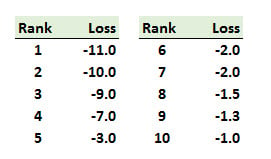

409.1. You have collected your portfolio's daily profit and loss (P&L) for the most recent 100 traded days. You sorted (ranked) the outcomes from worst to best. Below are the ten worst days; e.g., the worst daily loss was -11.0.

You want to estimate the portfolio's value at risk (VaR) under the historical simulation approach, and its expected shortfall. Which are, respectively, the portfolio's 95.0% value at risk (VaR) and 95.0% expected shortfall (ES)?

a. 95% VaR is either {3.0, 5.0, or 7.0} and 95% ES is 3.0

b. 95% VaR is either {2.0, 3.0, or 2.5} and 95% ES is 8.0

c. 95% VaR is either {2.0 or 3.0} and 95% ES is either {7.0 or 8.0}

d. 95% VaR is 3.0 and 95% ES is either {7.0, 8.0 or 9.3}

409.2. A $100.0 million equity portfolio contains two equally-weighted and uncorrelated (i.e., correlation equals zero) positions. The positions' volatilities are 30.0% and 40.0% per annum. If their returns are i.i.d. normal, which is nearest to the 10-day 95.0% value at risk (VaR) if we assume 250 trading days per year?

a. $4.93 million

b. $6.58 million

c. $8.22 million

d. $17.41 million

409.3. The following table shows the sorted worst six (6) returns, sorted, among a trailing window of 100 returns. For example, the worst return was -13.00% and it happened 14 days prior. The weights under simple historical simulation (HS) are compared to the weights under exponentially weighted moving average (EWMA) where lambda parameter is set equal to 0.920. For example, 20 days prior the return was -11.00% and this return is assigned a weight of (1-0.920)*0.920^(20-1)/(1-0.920)^100 = 1.64%.

If we assume that "1/2 of a given return’s weight is to the right and 1/2 to the left of the actual observation" and "the required VaR level is a linearly interpolated return, where the distance to the two adjacent cumulative weights determines the return," which is nearest to the 95.0% value at risk (VaR) under the hybrid approach?

a. 95% Hybrid VaR is about 9.00%

b. 95% Hybrid VaR is about 10.00%

c. 95% Hybrid VaR is about 11.00%

d. 95% Hybrid VaR is about 11.50%

Answers here: