Concept: These on-line quiz questions are not specifically linked to AIMs, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical AIM-by-AIM question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

412.1. A deeply out-of-the-money European call option with a one-year maturity has a strike price of $35.00 while the asset price is $20.00. The non-dividend-paying asset has a volatility of 40.0% per annum while the risk-free rate is 4.0% per annum with continuous compounding. You want to value the option with a four-step binomial (each step is three months) and, per the Cox, Ross, Rubinstein model, the magnitude of each up jump (u) is given by (u) = exp[σ*sqrt(Δt)]. You realize that although there are 16 different possible paths to maturity, due to the high strike price only one path (i.e., four consecutive up jumps) produces a path where the option has intrinsic value at maturity. Recall that a = exp[r*Δt] and p = (a-d)/(u-d). Which is nearest to the value of this option?

a. $0.550

b. $0.930

c. $1.141

d. $2.255

412.2. Consider a binomial tree with 12 steps where each time step is one month such that an option matures in one year. The underlying asset volatility is 28.0% per annum which implies the magnitude of an up jump is approximately 50%; i.e., u = exp[σ*sqrt(Δt)] = exp[0.28*sqrt(1/12)] = 1.1503. If the riskless rate is 4.0%, the probability of an up jump (p) is about 50%; i.e., p = [exp(0.04*1/12) - exp[-0.28*sqrt(0.25)]/(u - d) = 0.5008, which we will round to 0.50. Which is nearest to the probability that the asset price finishes the year, at T = 1.0 on the binomial tree, at the same price it started the year?

a. 9.3%

b. 17.5%

c. 22.6%

d. 33.3%

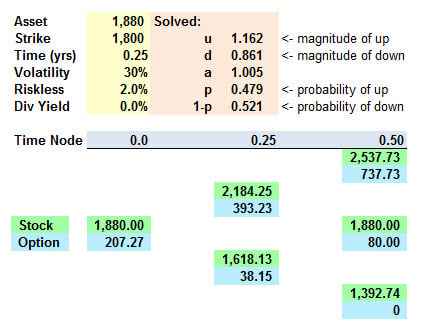

412.3. The snapshot below displays the value of six-month European call option on the S&P 500 Index, as prepared by your colleague Peter. The call option is in-the-money (ITM) as the strike price is 1800 while the Index price is 1880. According to this two-step binomial tree, the price of the option is $207.27.

However, you realize the dividend yield should be 2.0%. What is the impact of changing the dividend yield input from zero to 2.0%?

a. The future stock prices decrease which lowers the current option price

b. The probability of an up (p) decreases which lowers the current option price

c. The magnitude of an up (u) decreases which lowers the current option price

d. No impact on the current option price of $207.27 because the option holder does not receive dividends

Answers here:

Questions:

412.1. A deeply out-of-the-money European call option with a one-year maturity has a strike price of $35.00 while the asset price is $20.00. The non-dividend-paying asset has a volatility of 40.0% per annum while the risk-free rate is 4.0% per annum with continuous compounding. You want to value the option with a four-step binomial (each step is three months) and, per the Cox, Ross, Rubinstein model, the magnitude of each up jump (u) is given by (u) = exp[σ*sqrt(Δt)]. You realize that although there are 16 different possible paths to maturity, due to the high strike price only one path (i.e., four consecutive up jumps) produces a path where the option has intrinsic value at maturity. Recall that a = exp[r*Δt] and p = (a-d)/(u-d). Which is nearest to the value of this option?

a. $0.550

b. $0.930

c. $1.141

d. $2.255

412.2. Consider a binomial tree with 12 steps where each time step is one month such that an option matures in one year. The underlying asset volatility is 28.0% per annum which implies the magnitude of an up jump is approximately 50%; i.e., u = exp[σ*sqrt(Δt)] = exp[0.28*sqrt(1/12)] = 1.1503. If the riskless rate is 4.0%, the probability of an up jump (p) is about 50%; i.e., p = [exp(0.04*1/12) - exp[-0.28*sqrt(0.25)]/(u - d) = 0.5008, which we will round to 0.50. Which is nearest to the probability that the asset price finishes the year, at T = 1.0 on the binomial tree, at the same price it started the year?

a. 9.3%

b. 17.5%

c. 22.6%

d. 33.3%

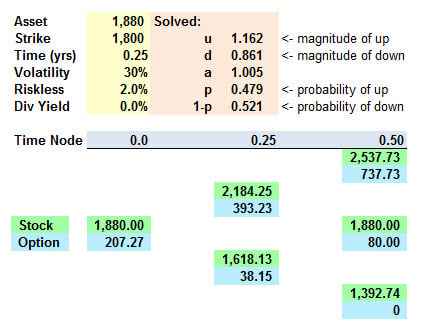

412.3. The snapshot below displays the value of six-month European call option on the S&P 500 Index, as prepared by your colleague Peter. The call option is in-the-money (ITM) as the strike price is 1800 while the Index price is 1880. According to this two-step binomial tree, the price of the option is $207.27.

However, you realize the dividend yield should be 2.0%. What is the impact of changing the dividend yield input from zero to 2.0%?

a. The future stock prices decrease which lowers the current option price

b. The probability of an up (p) decreases which lowers the current option price

c. The magnitude of an up (u) decreases which lowers the current option price

d. No impact on the current option price of $207.27 because the option holder does not receive dividends

Answers here: