Learning outcomes: Define and calculate expected loss (EL). Define and calculate unexpected loss (UL). Calculate UL for a portfolio and the risk contribution of each asset.

Questions:

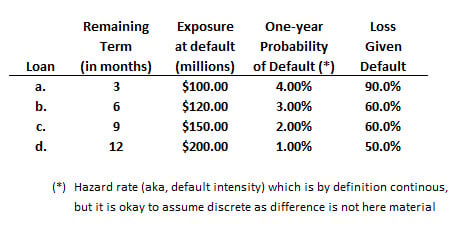

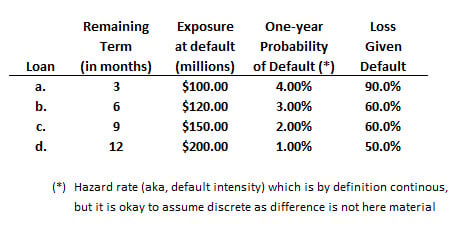

506.1. Consider the following four short-term loans held by a bank:

Which loan has the highest expected loss in dollar terms? (this question is a variation on FRM Handbook Example 24.3)

a. Loan (a)

b. Loan (b)

c. Loan (c)

d. Loan (d)

506.2. A bank's credit exposure to a customer consists of the following:

a. $2.48 million

b. $3.29 million

c. $4.50 million

d. $7.75 million

506.3. A bank has extended two loans to customers in the same industry. Both loans are have an exposure amount (EA) of $50.0 million, default probability (PD) of 2.0%, loss rate (LR) of 50.0%, and standard deviation of loss rate of 60.0% such that each loan has an expected loss of $500,000 and an unexpected loss of $5.5 million. In this way, the bank's credit portfolio consists of these two credit assets; and the default correlation between the two loans is 28.0%. Which is nearest to the risk contribution of each asset to the portfolio's unexpected loss?

a. $3.33 million

b. $4.40 million

c. $5.37 million

d. $5.50 million

Answers here:

Questions:

506.1. Consider the following four short-term loans held by a bank:

Which loan has the highest expected loss in dollar terms? (this question is a variation on FRM Handbook Example 24.3)

a. Loan (a)

b. Loan (b)

c. Loan (c)

d. Loan (d)

506.2. A bank's credit exposure to a customer consists of the following:

- Exposure amount (EA) is $50.0 million

- Probability of default (PD) is 2.0%

- Loss rate (LR; aka, loss given default) is 50.0%

- Standard deviation of loss rate is 40.0%

a. $2.48 million

b. $3.29 million

c. $4.50 million

d. $7.75 million

506.3. A bank has extended two loans to customers in the same industry. Both loans are have an exposure amount (EA) of $50.0 million, default probability (PD) of 2.0%, loss rate (LR) of 50.0%, and standard deviation of loss rate of 60.0% such that each loan has an expected loss of $500,000 and an unexpected loss of $5.5 million. In this way, the bank's credit portfolio consists of these two credit assets; and the default correlation between the two loans is 28.0%. Which is nearest to the risk contribution of each asset to the portfolio's unexpected loss?

a. $3.33 million

b. $4.40 million

c. $5.37 million

d. $5.50 million

Answers here: