Learning objectives: Explain how the binomial model can be altered to price options on: ... currencies, and futures. Define and calculate delta of a stock option.

Questions:

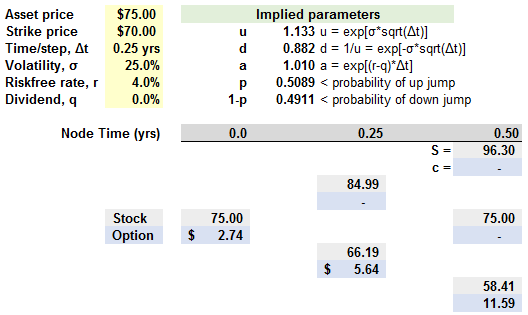

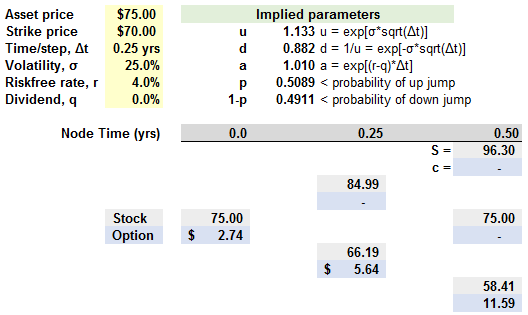

813.1. Below is illustrated the two-step binomial tree implied by the following assumptions for a six-month put option: S(0) = $75.00, K = $70.00, volatility (σ) = 25.0% per annum, risk-free rate = 4.0%. The two-step model (i.e., Δt 0.50 years/2 = 0.25) returns an price of $2.74 for this out-of-the-money put:

Which of the following are nearest to, respectively, the option's delta (i) over the first time step, and (ii) over the second time step if there is a downward movement in the first step? note: this is equivalent to asking, what is the option's delta at, respectively, node(0,0) and node(1,0)?

a. -0.30 and -0.70

b. -0.50 and -1.00

c. -0.65 and -0.85

d. +0.33 and +0.67

813.2. The Euro is currently worth $1.20 U.S. dollars and this exchange rate (i.e., $1.20 EURUSD) has a volatility of 34.0%. The Euro's risk-free rate is 5.0% and the U.S. risk-free rate is 4.0%. If we use a three-step binomial tree to value an American-style call option with a strike price of $1.00 and a maturity of three months (0.25 years), which is nearest to the value of the option? (based on Hull's Example 13.2)

a. $0.2130

b. $0.3690

c. $0.4077

d. $0.5240

813.3. A futures price is currently $25.00 and has a volatility of 40.0%. The risk-free rate is 3.0%. If we use a three-step tree to value a nine (9) month put option with a strike price of $20.00 on the futures contract, which is nearest to the value of the option? (based on Hull's Example 13.3)

a. $0.54

b. $1.02

c. $3.65

d. $9.87

Answers here:

Questions:

813.1. Below is illustrated the two-step binomial tree implied by the following assumptions for a six-month put option: S(0) = $75.00, K = $70.00, volatility (σ) = 25.0% per annum, risk-free rate = 4.0%. The two-step model (i.e., Δt 0.50 years/2 = 0.25) returns an price of $2.74 for this out-of-the-money put:

Which of the following are nearest to, respectively, the option's delta (i) over the first time step, and (ii) over the second time step if there is a downward movement in the first step? note: this is equivalent to asking, what is the option's delta at, respectively, node(0,0) and node(1,0)?

a. -0.30 and -0.70

b. -0.50 and -1.00

c. -0.65 and -0.85

d. +0.33 and +0.67

813.2. The Euro is currently worth $1.20 U.S. dollars and this exchange rate (i.e., $1.20 EURUSD) has a volatility of 34.0%. The Euro's risk-free rate is 5.0% and the U.S. risk-free rate is 4.0%. If we use a three-step binomial tree to value an American-style call option with a strike price of $1.00 and a maturity of three months (0.25 years), which is nearest to the value of the option? (based on Hull's Example 13.2)

a. $0.2130

b. $0.3690

c. $0.4077

d. $0.5240

813.3. A futures price is currently $25.00 and has a volatility of 40.0%. The risk-free rate is 3.0%. If we use a three-step tree to value a nine (9) month put option with a strike price of $20.00 on the futures contract, which is nearest to the value of the option? (based on Hull's Example 13.3)

a. $0.54

b. $1.02

c. $3.65

d. $9.87

Answers here:

Last edited by a moderator: