Learning objectives: Describe how hedging activities take place in practice, and describe how scenario analysis can be used to formulate expected gains and losses with option positions. Describe how portfolio insurance can be created through option instruments and stock index futures

Questions:

821.1. On Monday, a bank's position (the underlying portfolio) on the dollar-euro exchange rate has an initial position delta of 11,300 and a position gamma of -25,000. The exchange rate is EURUSD $0.860; i.e., per the currency priority convention, Euro is the base currency. By the end of the week, on Friday, the exchange rate had jumped by +$0.050 to $0.910. The bank entered two trades:

a. Long 11,300 Euros on Monday, then short an additional 565 Euros on Friday

b. Long 11,300 Euros on Monday, then unwind (purchase) 565 Euros on Friday

c. Short 25,000 Euros on Monday, then short an additional 2,250 Euros on Friday

d. Short 25,000 Euros on Monday, then unwind (purchase) 1,250 Euros on Friday

821.2. Ozerholding Financial is a market maker who engaged in the following three option trades. All three trades are options on the same equity index and a single contract is for 100 options.

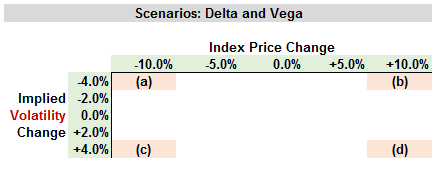

Ozerholding then conducts a scenario analysis to estimate the possible gain/loss on the portfolio that consists of all three option positions. The scenario analysis contemplates five possible changes to each of the index price and its implied volatility, as below:

In which quadrant is the greatest potential LOSS to Ozerholding located?

a. The upper-left where both the index price and implied volatility decrease

b. The upper-right where the index price increases but the implied volatility decreases

c. The lower-left where the index price decreases but the implied volatility increases

d. The lower-right where both the index price and implied volatility increase

821.3. A fund manager has a well-diversified portfolio that mirrors the performance of the S&P 500 equity index and is worth $100.0 million. The value of the S&P 500 index is 2,800 and the portfolio manager would like to buy insurance against a reduction of more than 5.0% in the value of the portfolio over the next nine months. The risk-free interest rate is 5.0% per annum. The dividend yield on both the portfolio and the S&P 500 is 2.0%, and the volatility of the index is 22.0% per annum. If the fund manager were to insure by buying traded European put options, the cost of insurance would be about $4,238,870 = $118.69 * ($100,000,000 / 2,800) where $118.69 is the price of a put option with S(0) = 2,800, K = 2,660, σ = 22.0%, riskfree rate = 5.0%, dividend yield = 2.0%, and T = 0.75 years. The delta of the put is given by exp(-q*T)*[N(d1) - 1] = exp(-0.020*0.75)*[0.68530 - 1] = -0.3100.

Instead, the fund manager decides to provide insurance by using one-year (T = 1.0 year) index futures. Which of the following is nearest to the index futures trade that synthetically creates the put options in order to insure the portfolio? Please note: this question is difficult and is inspired by Hull's example 19.10 and his EOC Problem 18.16.

a. Short 43 index futures contracts

b. Short 125 index futures contracts

c. Short 190 index futures contracts

d. Short 300 index futures contracts

Answers here:

Questions:

821.1. On Monday, a bank's position (the underlying portfolio) on the dollar-euro exchange rate has an initial position delta of 11,300 and a position gamma of -25,000. The exchange rate is EURUSD $0.860; i.e., per the currency priority convention, Euro is the base currency. By the end of the week, on Friday, the exchange rate had jumped by +$0.050 to $0.910. The bank entered two trades:

- On Monday, while the exchange rate is EURUSD $0.860, the bank's first trade neutralized delta; aka, makes the net position "delta neutral"

- On Friday, after the exchange rate had increased to EURUSD $0.910, the bank's second trade re-established the net position's delta neutrality

a. Long 11,300 Euros on Monday, then short an additional 565 Euros on Friday

b. Long 11,300 Euros on Monday, then unwind (purchase) 565 Euros on Friday

c. Short 25,000 Euros on Monday, then short an additional 2,250 Euros on Friday

d. Short 25,000 Euros on Monday, then unwind (purchase) 1,250 Euros on Friday

821.2. Ozerholding Financial is a market maker who engaged in the following three option trades. All three trades are options on the same equity index and a single contract is for 100 options.

- Long 100 option contracts where the percentage (per option) delta is +0.620 and the percentage (per option) vega is +31.50

- Short 100 option contracts where the percentage (per option) delta is -0.450 and the percentage (per option) vega is +20.00

- Short 100 option contracts where the percentage (per option) delta is -0.530 and the percentage (per option) vega is +17.00

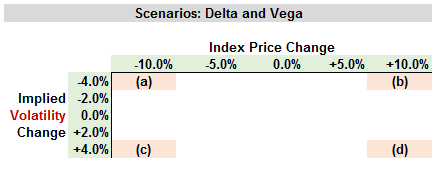

Ozerholding then conducts a scenario analysis to estimate the possible gain/loss on the portfolio that consists of all three option positions. The scenario analysis contemplates five possible changes to each of the index price and its implied volatility, as below:

In which quadrant is the greatest potential LOSS to Ozerholding located?

a. The upper-left where both the index price and implied volatility decrease

b. The upper-right where the index price increases but the implied volatility decreases

c. The lower-left where the index price decreases but the implied volatility increases

d. The lower-right where both the index price and implied volatility increase

821.3. A fund manager has a well-diversified portfolio that mirrors the performance of the S&P 500 equity index and is worth $100.0 million. The value of the S&P 500 index is 2,800 and the portfolio manager would like to buy insurance against a reduction of more than 5.0% in the value of the portfolio over the next nine months. The risk-free interest rate is 5.0% per annum. The dividend yield on both the portfolio and the S&P 500 is 2.0%, and the volatility of the index is 22.0% per annum. If the fund manager were to insure by buying traded European put options, the cost of insurance would be about $4,238,870 = $118.69 * ($100,000,000 / 2,800) where $118.69 is the price of a put option with S(0) = 2,800, K = 2,660, σ = 22.0%, riskfree rate = 5.0%, dividend yield = 2.0%, and T = 0.75 years. The delta of the put is given by exp(-q*T)*[N(d1) - 1] = exp(-0.020*0.75)*[0.68530 - 1] = -0.3100.

Instead, the fund manager decides to provide insurance by using one-year (T = 1.0 year) index futures. Which of the following is nearest to the index futures trade that synthetically creates the put options in order to insure the portfolio? Please note: this question is difficult and is inspired by Hull's example 19.10 and his EOC Problem 18.16.

a. Short 43 index futures contracts

b. Short 125 index futures contracts

c. Short 190 index futures contracts

d. Short 300 index futures contracts

Answers here:

Last edited by a moderator: