Learning objectives: Relate key rates, partial ’01s and forward-bucket ’01s, and calculate the forward-bucket ’01 for a shift in rates in one or more buckets. Construct an appropriate hedge for a position across its entire range of forward-bucket exposures. Apply key rate and multi-factor analysis to estimating portfolio volatility given a correlation for each pair of key rates.

Questions:

913.1. Rebecca is a Senior Risk Analyst who has been asked by her firm's Risk Committee to build a multi-factor fixed-income risk model for her firm's largest fixed-income portfolio. As a good student of Bruce Tuckman, she has three candidate approaches: key-rate exposures, partial '01s, and forward-buckets. At the same time, the Risk Committee has expressed certain preferences about the approach used. Based on the stated preference, which statement below is TRUE?

a. Because the Risk Committee prefers to use the fewest number of securities possible, she should favor partial '01s

b. Because the Risk Committee prefers the quickest method to identify hedges, she should favor forward-bucket '01s

c. Because the Risk Committee prefers a method that is easiest to communicate to the Board (i.e., is relatively intuitive), she should favor partial '01s

d. Because the Risk Committee prefers a method that only shifts the rate of a fitting security while generally allowing for zero shifts in the neighboring par (or money market) rates, she should favor partial '01s

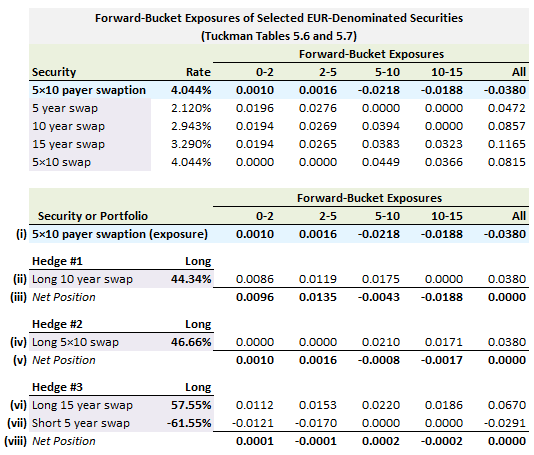

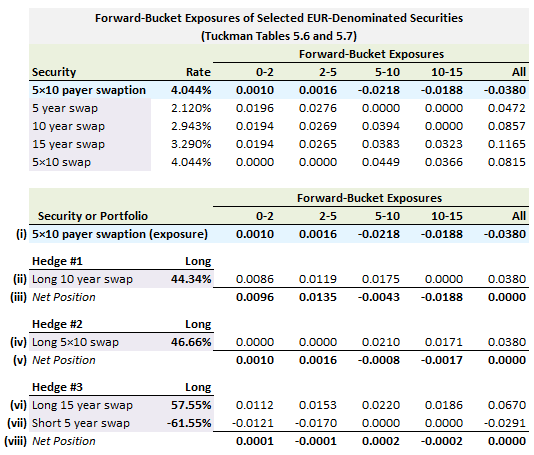

913.2. The exhibit below combines Tuckman's Tables 5.6 and 5.7. The situation starts with the underlying trade: a 5×10 payer swaption struck at 4.044% (which gives the buyer the right to buy a fixed rate of 4.044% on a 10-year EUR swap in five years such that the underlying security in this option is a 10-year swap). This initial swaption trade is highlighted in light blue below. Additionally, the forward-bucket exposures of four swaps are shown in the upper panel. The lower panel highlights three different hedges (discussed in Tuckman) and their respective implied net positions:

Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011)

About these hedges, which of the following statements is TRUE?

a. Hedge #1 is exposed to the risk of a steepening

b. Hedge #2 is exposed to the risk of a steepening

c. Hedge #3 is the best hedge

d. As rates increase, the value of the initial swaption (i.e., by itself without hedges) decreases

913.3. A bond portfolio with a face value of $7.0 million is exposed to the following two key rates:

a. $159,500

b. $170,100

c. $182,700

d. $219,300

Answers here:

Questions:

913.1. Rebecca is a Senior Risk Analyst who has been asked by her firm's Risk Committee to build a multi-factor fixed-income risk model for her firm's largest fixed-income portfolio. As a good student of Bruce Tuckman, she has three candidate approaches: key-rate exposures, partial '01s, and forward-buckets. At the same time, the Risk Committee has expressed certain preferences about the approach used. Based on the stated preference, which statement below is TRUE?

a. Because the Risk Committee prefers to use the fewest number of securities possible, she should favor partial '01s

b. Because the Risk Committee prefers the quickest method to identify hedges, she should favor forward-bucket '01s

c. Because the Risk Committee prefers a method that is easiest to communicate to the Board (i.e., is relatively intuitive), she should favor partial '01s

d. Because the Risk Committee prefers a method that only shifts the rate of a fitting security while generally allowing for zero shifts in the neighboring par (or money market) rates, she should favor partial '01s

913.2. The exhibit below combines Tuckman's Tables 5.6 and 5.7. The situation starts with the underlying trade: a 5×10 payer swaption struck at 4.044% (which gives the buyer the right to buy a fixed rate of 4.044% on a 10-year EUR swap in five years such that the underlying security in this option is a 10-year swap). This initial swaption trade is highlighted in light blue below. Additionally, the forward-bucket exposures of four swaps are shown in the upper panel. The lower panel highlights three different hedges (discussed in Tuckman) and their respective implied net positions:

Source: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011)

About these hedges, which of the following statements is TRUE?

a. Hedge #1 is exposed to the risk of a steepening

b. Hedge #2 is exposed to the risk of a steepening

c. Hedge #3 is the best hedge

d. As rates increase, the value of the initial swaption (i.e., by itself without hedges) decreases

913.3. A bond portfolio with a face value of $7.0 million is exposed to the following two key rates:

- The 2-year key rate, KR01(2-year) is equal to $0.030 per 100 face amount and has a daily volatility, σ(bps), of 12.0 basis points

- The 5-year key rate, KR01(5-year) is equal to $0.090 per 100 face amount and has a daily volatility, σ(bps), of 25.0 basis points

a. $159,500

b. $170,100

c. $182,700

d. $219,300

Answers here: