anastasia0908

New Member

Could anyone help me with the following questions regarding the credit risk?

1. Copula model and default rate

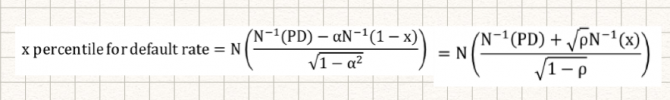

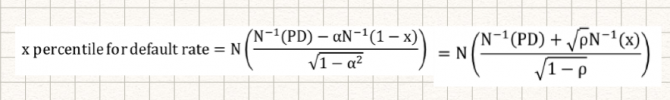

In copula model, U is a one factor model such that U=α*F+sqr(1-α^2)*Z, where F is the systematic factor, and Z is idiosyncratic factor. The example in StudyNote p.21 (Vasicek Model to estimate default rate) confused me a bit. Given PD, α, x-percentile, the portfolio default rate is N(Z), explicitly,

, then the capital requirement is (WCDR-PD)*LGD*EAD

, then the capital requirement is (WCDR-PD)*LGD*EAD

My questions are:

2. Unexpected Loss (UL)= EAD* sqr(PD* var(LGD)+LGD^2 * var(PD)). How could we derive this equation?

In my understanding, the UL is the standard deviation of the loss, where std(Loss)=EAD*LGD*sqr(PD*(1-PD))=EAD*LGD*std(PD). The UL formula above tells me it is different from the standard deviation of the loss.

Thanks in advance,

Anastasia

1. Copula model and default rate

In copula model, U is a one factor model such that U=α*F+sqr(1-α^2)*Z, where F is the systematic factor, and Z is idiosyncratic factor. The example in StudyNote p.21 (Vasicek Model to estimate default rate) confused me a bit. Given PD, α, x-percentile, the portfolio default rate is N(Z), explicitly,

, then the capital requirement is (WCDR-PD)*LGD*EAD

, then the capital requirement is (WCDR-PD)*LGD*EADMy questions are:

- What do we call N(Z) portfolio default rate? How to understand the formula?

- Why do we use correlation rho to replace the α?

- What does (WCDR-PD) mean?

- (Math question) For x-percentile, why the inverse normal cdf (1-x) instead of inverse cdf (x)?

2. Unexpected Loss (UL)= EAD* sqr(PD* var(LGD)+LGD^2 * var(PD)). How could we derive this equation?

In my understanding, the UL is the standard deviation of the loss, where std(Loss)=EAD*LGD*sqr(PD*(1-PD))=EAD*LGD*std(PD). The UL formula above tells me it is different from the standard deviation of the loss.

Thanks in advance,

Anastasia