Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

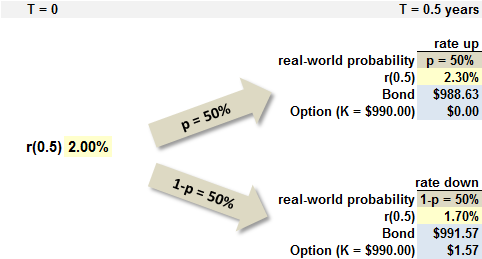

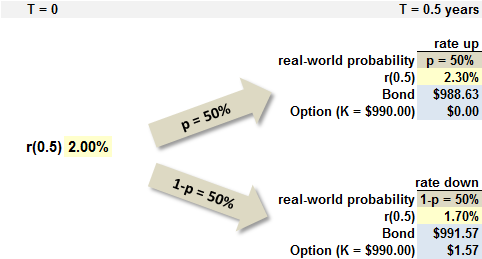

705.1. Assume that the six-month and one-year spot rates are 2.00% and 2.10% with semi-annual compounding. Consequently, a six-month zero-coupon bond with a face value of $1,000 has a price of $990.10 and a one-year zero-coupon bond has a price of $979.326. A simple one-step binomial determines the possible evolution of the six-month rate: with a real-world probability of 50.0% it will increase 30 basis points to 2.30%, and with a real-world probability of 50.0% it will decrease 30 basis points to 1.70%. Following Tuckman's (Chapter 7) example, we are interested in the price of a call option on a zero-coupon bond, where the call option has a strike price of $990.00 and matures in six months; and the zero-coupon bond matures in one year. The situation is illustrated below.

In the scenario where the six-month rate jumps down, from 2.00% to 1.70% with real-world (aka, true) probability of 50.0%, the zero-coupon bond will have a remaining maturity of six months and its price will therefore increase to $991.57 = $1,000/(1+1.70%/2). The option can be exercised for a gain of $1.57 = max($991.57 - $990.00.0). If the current (T = 0) no-arbitrage price of the option is $0.260, then which is nearest the risk-neutral probability, p, of an jump to the up state?

a. 11.91%

b. 33.33%

c. 50.00%

d. 83.27%

705.2. A hedge fund manager is evaluating interest rate term structure models and she has the following two criteria.

a. Vasicek or Ho-Lee

b. Cox-Ingersoll-Ross (CIR)

a. Model Three (3)

b. Model Three (3) but special case of multiplying volatility by exp(-α*t); i.e., exponential decay of volatility

705.3. A hedge fund manager is evaluating interest rate term structure models and she has the following four criteria.

a. Model One (1)

b. Model Two (2)

c. Ho-Lee

d. Vasicek

Answers here:

Questions:

705.1. Assume that the six-month and one-year spot rates are 2.00% and 2.10% with semi-annual compounding. Consequently, a six-month zero-coupon bond with a face value of $1,000 has a price of $990.10 and a one-year zero-coupon bond has a price of $979.326. A simple one-step binomial determines the possible evolution of the six-month rate: with a real-world probability of 50.0% it will increase 30 basis points to 2.30%, and with a real-world probability of 50.0% it will decrease 30 basis points to 1.70%. Following Tuckman's (Chapter 7) example, we are interested in the price of a call option on a zero-coupon bond, where the call option has a strike price of $990.00 and matures in six months; and the zero-coupon bond matures in one year. The situation is illustrated below.

In the scenario where the six-month rate jumps down, from 2.00% to 1.70% with real-world (aka, true) probability of 50.0%, the zero-coupon bond will have a remaining maturity of six months and its price will therefore increase to $991.57 = $1,000/(1+1.70%/2). The option can be exercised for a gain of $1.57 = max($991.57 - $990.00.0). If the current (T = 0) no-arbitrage price of the option is $0.260, then which is nearest the risk-neutral probability, p, of an jump to the up state?

a. 11.91%

b. 33.33%

c. 50.00%

d. 83.27%

705.2. A hedge fund manager is evaluating interest rate term structure models and she has the following two criteria.

- First, she wants to model "mean revision" by specifying a long-run value (aka, central tendency, call it theta, Θ) for the short-term rate

- Second, she believes that assuming independence between the short rate's basis-point volatility and its level is unrealistic: volatility tends to be higher when the level of rates is higher (e.g., during inflation periods) and, on the other hand, when rate levels are low, volatility is limited by the zero bound

a. Vasicek or Ho-Lee

b. Cox-Ingersoll-Ross (CIR)

a. Model Three (3)

b. Model Three (3) but special case of multiplying volatility by exp(-α*t); i.e., exponential decay of volatility

705.3. A hedge fund manager is evaluating interest rate term structure models and she has the following four criteria.

- First, she wants to model "mean revision" by specifying a long-run value (aka, central tendency, call it theta, Θ) for the short-term rate; this is a related to her preference to avoid a so-called time-dependent volatility model and, in particular, those time-dependent models that imply a flat term structure.

- Second, she wants to be able to parse the true long-run value (aka, interest rate expectation) from a risk premium

- Third, she wants to keep the model relatively simple by assuming the basis-point volatility of the short rate is both constant and independent of the level of the rate.

- Fourth, she prefers the convenience of assuming the terminal distribution of the short-rate is normally distributed.

a. Model One (1)

b. Model Two (2)

c. Ho-Lee

d. Vasicek

Answers here: