Learning Objective: Provide examples of trade compression of derivative positions, calculate net notional exposure amount, and identify the party holding the net contract position in a trade compression.

Questions:

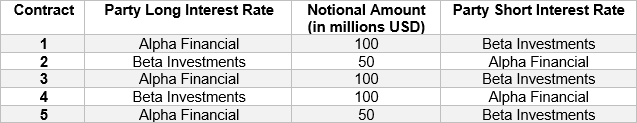

24.27.1. Alpha Financial and Beta Investments have multiple interest rate swap contracts against each other, all with the same maturity of 5 years. These swaps were entered into to hedge interest rate exposures. As part of a clearinghouse initiative, both firms participate in a trade compression session aimed at reducing operational and credit risk by netting off-setting positions.

Here are the details of their swap contracts before compression:

After the trade compression session, which of the following best represents the net notional exposure amount and the party holding the net contract position for these 5-year maturity swaps?

a. Net Notional: $100m favoring Alpha Financial, Net Contract Position: Alpha Financial holds the net long position.

b. Net Notional: $100m favoring Beta Investments Net Contract Position: Beta Investments holds the net long position.

c. Net Notional: 50 million USD favoring Alpha Financial, Net Contract Position: Alpha Financial holds the net long position.

d. Net Notional: None (positions are perfectly netted) Net Contract Position: No net contract position.

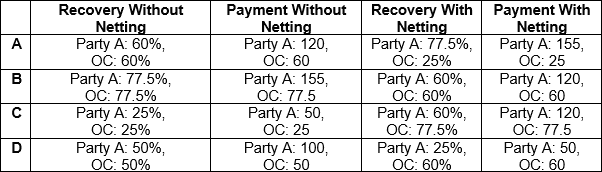

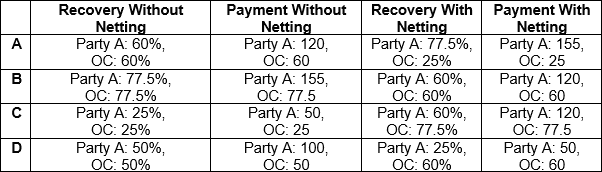

24.27.2. Party A (a derivative creditor) and Other Creditors (OC), Party B defaults with total assets of 180 units, split between 140 units from derivative contracts and 40 units from other assets. Party B has total liabilities of 300 units, consisting of 200 units due to derivative contracts and 100 units due to other creditors. The vignette explores the financial outcomes with and without the application of bilateral netting in the derivatives contracts.

After Party B defaults, netting is applied to the derivative contracts held by Party A. Calculate the impact on the recovery rates for both Party A and Other Creditors (OC) and identify how the redistribution of values occurs due to netting. Choose the option that correctly represents the recovery rates and payments with and without netting.

a. Row A

b. Row B

c. Row C

d. Row D

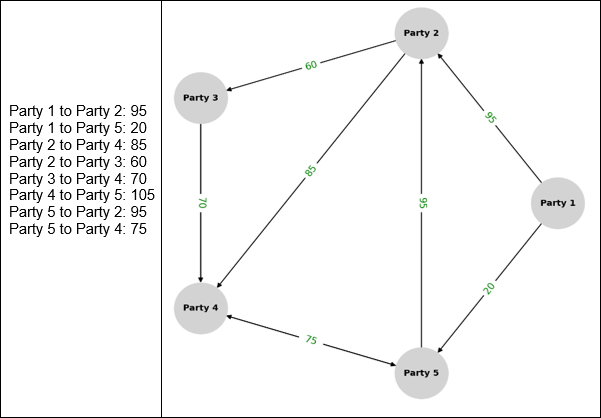

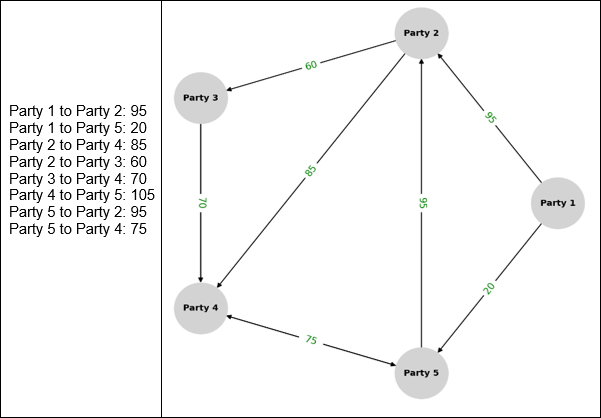

24.27.3. In an interbank OTC swap arrangement involving five counterparties, the firms undertake a trade compression session to reduce their total gross notional exposures while preserving each party's net exposure. We are tasked to evaluate, from Party 4’s perspective, how compression affects their financial balances against other parties.

Original Positions:

Compression Outcome:

After the compression session, the following changes occurred:

a. Net Notional: 65 favoring Party 4; Net Contract Position: Party 4 holds the net long position.

b. Net Notional: 0 (positions are perfectly netted); Net Contract Position: No net contract position.

c. Net Notional: 10 favoring Party 3; Net Contract Position: Party 3 holds the net long position.

d. Net Notional: 95 favoring Party 2; Net Contract Position: Party 2 holds the net long position.

Answers here:

Questions:

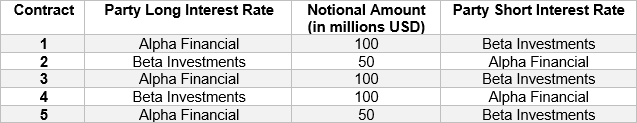

24.27.1. Alpha Financial and Beta Investments have multiple interest rate swap contracts against each other, all with the same maturity of 5 years. These swaps were entered into to hedge interest rate exposures. As part of a clearinghouse initiative, both firms participate in a trade compression session aimed at reducing operational and credit risk by netting off-setting positions.

Here are the details of their swap contracts before compression:

After the trade compression session, which of the following best represents the net notional exposure amount and the party holding the net contract position for these 5-year maturity swaps?

a. Net Notional: $100m favoring Alpha Financial, Net Contract Position: Alpha Financial holds the net long position.

b. Net Notional: $100m favoring Beta Investments Net Contract Position: Beta Investments holds the net long position.

c. Net Notional: 50 million USD favoring Alpha Financial, Net Contract Position: Alpha Financial holds the net long position.

d. Net Notional: None (positions are perfectly netted) Net Contract Position: No net contract position.

24.27.2. Party A (a derivative creditor) and Other Creditors (OC), Party B defaults with total assets of 180 units, split between 140 units from derivative contracts and 40 units from other assets. Party B has total liabilities of 300 units, consisting of 200 units due to derivative contracts and 100 units due to other creditors. The vignette explores the financial outcomes with and without the application of bilateral netting in the derivatives contracts.

After Party B defaults, netting is applied to the derivative contracts held by Party A. Calculate the impact on the recovery rates for both Party A and Other Creditors (OC) and identify how the redistribution of values occurs due to netting. Choose the option that correctly represents the recovery rates and payments with and without netting.

a. Row A

b. Row B

c. Row C

d. Row D

24.27.3. In an interbank OTC swap arrangement involving five counterparties, the firms undertake a trade compression session to reduce their total gross notional exposures while preserving each party's net exposure. We are tasked to evaluate, from Party 4’s perspective, how compression affects their financial balances against other parties.

Original Positions:

Compression Outcome:

After the compression session, the following changes occurred:

- The direct transaction between Party 2 and Party 3 was eliminated.

- The position between Party 4 and Party 3 was reduced from 70 to 10.

a. Net Notional: 65 favoring Party 4; Net Contract Position: Party 4 holds the net long position.

b. Net Notional: 0 (positions are perfectly netted); Net Contract Position: No net contract position.

c. Net Notional: 10 favoring Party 3; Net Contract Position: Party 3 holds the net long position.

d. Net Notional: 95 favoring Party 2; Net Contract Position: Party 2 holds the net long position.

Answers here: