Learning objective: Describe the different types and structures of credit derivatives including ... first-to default put, total return swaps (TRS), asset-backed credit-linked note (CLN), and their applications.

Questions:

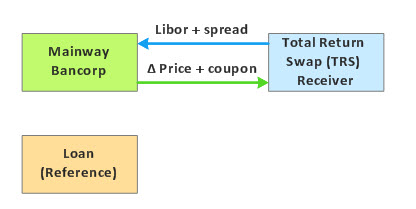

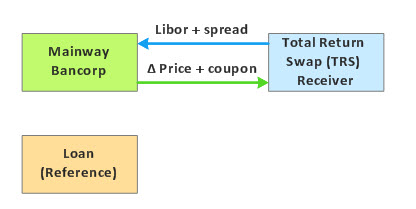

608.1. Mainway Bancrop has a long cash position in a $500.0 million loan that pays a fixed rate of 5.0% per annuam payable semiannually. Mainway hedges this loan, as the TRS payer, by entering into a total return swap (TRS) with a notional value equal to the full par value of the loan. As the TRS payer, Mainway will pay the interest on the loan plus the change in marked-to-mark value of the loan. In exchange, Mainway will receive LIBOR + 300 basis points. The swap settles semiannually.

On the next settlement date, Libor is unchanged at 1.0% per annum but the mark-to-market value of the loan drops by 4.0%. Excluding the position (and coupon cash flows) associated with the underlying (reference) loan, what is the net cash flow on this settlement date for Mainway with respect to only their total return swap (TRS) derivative position?

a. Outflow of 15.0 million

b. Outflow of $2.5 million

c. Inflow of $9.0 million

d. Inflow of $17.5 million

608.2. A first-to-default credit default swap (1TD CDS) references a portfolio of five (5) high-yield loans, each with a nominal value of $10.0 million and a probability of default of 3.0%. Their recovery rate is 60.0%. Assume the spread on the CDS is given by the product of the default probability and the loss given default (LGD); i.e., assume the useful approximation is accurate: PD ~= (spread)/(1-recovery). If the default correlation spikes from zero to one (100%), what is implied decrease in the spread on the 1TD CDS?

a. Decrease by about 1.50%

b. Decrease by about 2.33%

c. Decrease by about 4.45%

d. Increase by about 3.69%

608.3. Mainway Bancorp arranges a credit-lined note (CLN) with the following structure:

Each of the following is true about this credit-linked note (CLN) structure EXCEPT which is not true?

a. The leveraged yield to investors is 19.0%

b. There will be no margin calls to the investors

c. The maximum downside for investors is $108.0 million

d. The investors are effectively long a credit default swap written by the bank

Answers here:

Questions:

608.1. Mainway Bancrop has a long cash position in a $500.0 million loan that pays a fixed rate of 5.0% per annuam payable semiannually. Mainway hedges this loan, as the TRS payer, by entering into a total return swap (TRS) with a notional value equal to the full par value of the loan. As the TRS payer, Mainway will pay the interest on the loan plus the change in marked-to-mark value of the loan. In exchange, Mainway will receive LIBOR + 300 basis points. The swap settles semiannually.

On the next settlement date, Libor is unchanged at 1.0% per annum but the mark-to-market value of the loan drops by 4.0%. Excluding the position (and coupon cash flows) associated with the underlying (reference) loan, what is the net cash flow on this settlement date for Mainway with respect to only their total return swap (TRS) derivative position?

a. Outflow of 15.0 million

b. Outflow of $2.5 million

c. Inflow of $9.0 million

d. Inflow of $17.5 million

608.2. A first-to-default credit default swap (1TD CDS) references a portfolio of five (5) high-yield loans, each with a nominal value of $10.0 million and a probability of default of 3.0%. Their recovery rate is 60.0%. Assume the spread on the CDS is given by the product of the default probability and the loss given default (LGD); i.e., assume the useful approximation is accurate: PD ~= (spread)/(1-recovery). If the default correlation spikes from zero to one (100%), what is implied decrease in the spread on the 1TD CDS?

a. Decrease by about 1.50%

b. Decrease by about 2.33%

c. Decrease by about 4.45%

d. Increase by about 3.69%

608.3. Mainway Bancorp arranges a credit-lined note (CLN) with the following structure:

- The bank buys $120.0 million of non-investment-grade loans that are assumed to yield Libor + 400 bps, and transfers them to a trust

- The trust issues an asset-backed credit-linked note (CLN) to investors (aka, CLN buyers) for $20.0 million, investing those proceeds into U.S. government securities with a 1.0% coupon

- The bank finances the $120.0 million loans at Libor, and receives from the trust Libor + 100 bps; i.e., net cash flow to the bank is 100 bps which is compensation to cover its default risk beyond the $20.0 million

- The investors receive 1.0% on the collateral of $20.0 million plus 3.0% (300 bps) on the notional amount of $120.00, in addition to any change in value of the loan portfolio

Each of the following is true about this credit-linked note (CLN) structure EXCEPT which is not true?

a. The leveraged yield to investors is 19.0%

b. There will be no margin calls to the investors

c. The maximum downside for investors is $108.0 million

d. The investors are effectively long a credit default swap written by the bank

Answers here:

Last edited by a moderator: