Learning objectives: Define and calculate the delinquency ratio, default ratio, monthly payment rate (MPR), debt service coverage ratio (DSCR), the weighted average coupon (WAC), the weighted average maturity (WAM), and the weighted average life (WAL) for relevant securitized structures. Explain the prepayment forecasting methodologies and calculate the constant prepayment rate (CPR) and the Public Securities Association (PSA) rate. Explain the decline in demand in the new-issue securitized finance products market following the 2007 financial crisis.

Questions:

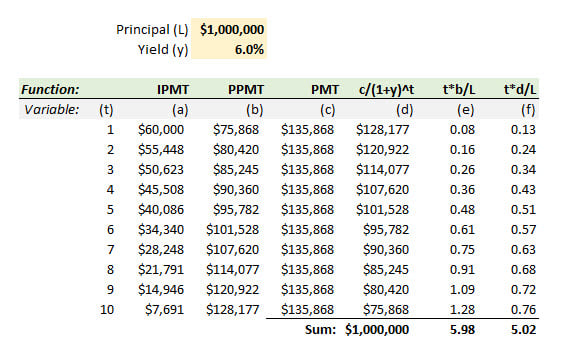

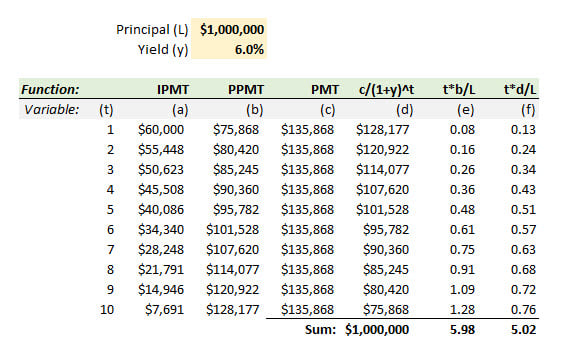

612.1. Consider the following amortization schedule for a $1.0 million mortgage loan that fully amortizes in ten years:

Each of the following statements is true EXCEPT which is false?

a. The Macaulay duration is 5.02 years

b. If the yield increases to 7.0%, the Macaulay duration will increase to 5.09 years

c. The weighted average life (WAL) is 5.98 years

d. If the yield increases to 7.0%, the WAL will increase to 6.05 years

612.2. Consider a mortgage-backed security (MBS) with a principal of $600.0 million. The original mortgage pool has a weighted average maturity (WAM) of 30.0 years and weighted average coupon (WAC) equal to 6.50%. The pass through security pays a coupon equal to 6.0%; i.e., lower than the average coupon rate of the mortgage pool in order to ensure available cash flow for investors in addition to compensation for the issuer. If we assume a PSA rate of 200%, the value of the security is $634.76 and its duration is 5.83 years. Which of the following statements is TRUE?

a. An increase in the PSA rate assumption to 250% will increase the value of the security

b. An increase in the PSA rate assumption to 250% will increase the duration of the security

c. An increase in the PSA rate assumption to 250% will increase the weighted average life (WAL) of the security

d. On month 30, the single monthly mortality rate (SMM) is equal to about 1.06% which equals 1-(1-200%*6%)^(1/12)

612.3. In his book Structured Credit Products, Moorad Choudhry says the securitization market exacerbated the global financial crisis: "As recounted in the Prologue, following rapid growth in volumes during 2002–2006, in 2007 the securitisation market came to a virtual standstill as a direct impact of the sub-prime mortgage default and the crash in asset-backed commercial paper trading. Investors lost confidence in a wide range of parameters. The liquidity crunch in money markets led to the credit crunch in the economy and worldwide recession. Globalisation and integrated banking combined with the widespread investment in structured credit products to transmit the effects of US mortgage defaults worldwide. Economic growth collapsed, which suggests that the securitisation market, in the form of ABS such as collateralised debt obligations (CDOs), was a major contributor in magnifying the impact of poor-quality lending in the US mortgage market." (Source: Moorad Choudhry, Structured Credit Products: Credit Derivatives & Synthetic Sercuritisation, 2nd Edition (New York: John Wiley & Sons, 2010))

According to Choudhry, there has been a decline in demand in the new-issue securitized finance products market following the 2007 financial crisis. Specifically, he asserts that EACH of the following factors was a contributor to a decline in the market's confidence EXCEPT which does he not cite?

a. The shadow banking system detaches borrower from lenders

b. The credit rating agencies were neither correct nor understood

c. The securitization technique itself is fundamentally flawed

d. The high degree of leverage and relative lack of product transparency

Answers here:

Questions:

612.1. Consider the following amortization schedule for a $1.0 million mortgage loan that fully amortizes in ten years:

Each of the following statements is true EXCEPT which is false?

a. The Macaulay duration is 5.02 years

b. If the yield increases to 7.0%, the Macaulay duration will increase to 5.09 years

c. The weighted average life (WAL) is 5.98 years

d. If the yield increases to 7.0%, the WAL will increase to 6.05 years

612.2. Consider a mortgage-backed security (MBS) with a principal of $600.0 million. The original mortgage pool has a weighted average maturity (WAM) of 30.0 years and weighted average coupon (WAC) equal to 6.50%. The pass through security pays a coupon equal to 6.0%; i.e., lower than the average coupon rate of the mortgage pool in order to ensure available cash flow for investors in addition to compensation for the issuer. If we assume a PSA rate of 200%, the value of the security is $634.76 and its duration is 5.83 years. Which of the following statements is TRUE?

a. An increase in the PSA rate assumption to 250% will increase the value of the security

b. An increase in the PSA rate assumption to 250% will increase the duration of the security

c. An increase in the PSA rate assumption to 250% will increase the weighted average life (WAL) of the security

d. On month 30, the single monthly mortality rate (SMM) is equal to about 1.06% which equals 1-(1-200%*6%)^(1/12)

612.3. In his book Structured Credit Products, Moorad Choudhry says the securitization market exacerbated the global financial crisis: "As recounted in the Prologue, following rapid growth in volumes during 2002–2006, in 2007 the securitisation market came to a virtual standstill as a direct impact of the sub-prime mortgage default and the crash in asset-backed commercial paper trading. Investors lost confidence in a wide range of parameters. The liquidity crunch in money markets led to the credit crunch in the economy and worldwide recession. Globalisation and integrated banking combined with the widespread investment in structured credit products to transmit the effects of US mortgage defaults worldwide. Economic growth collapsed, which suggests that the securitisation market, in the form of ABS such as collateralised debt obligations (CDOs), was a major contributor in magnifying the impact of poor-quality lending in the US mortgage market." (Source: Moorad Choudhry, Structured Credit Products: Credit Derivatives & Synthetic Sercuritisation, 2nd Edition (New York: John Wiley & Sons, 2010))

According to Choudhry, there has been a decline in demand in the new-issue securitized finance products market following the 2007 financial crisis. Specifically, he asserts that EACH of the following factors was a contributor to a decline in the market's confidence EXCEPT which does he not cite?

a. The shadow banking system detaches borrower from lenders

b. The credit rating agencies were neither correct nor understood

c. The securitization technique itself is fundamentally flawed

d. The high degree of leverage and relative lack of product transparency

Answers here:

Last edited by a moderator: