Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

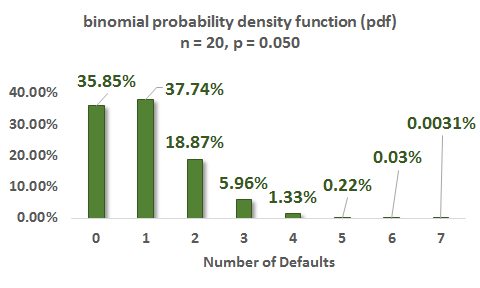

711.1. Suppose there are twenty (20) credits in a portfolio. Each credit has the same default probability of 5.0% and the (pairwise) default correlations are all zero; that is, as defaults are i.i.d. the portfolio is characterized by a binomial distribution, as displayed below. For example, the probability of exactly five defaults is equal to C(20,5)*0.050^5*0.950^15 = 0.0022446 = 0.22%.

If the par value of each position is $100.0 million such that the total portfolio value is $2.0 billion, and we assume the loss given default (LGD) is always 100.0%, then what is the 95.0% credit value at risk (CVaR) of the portfolio?

a. Zero

b. $100.0 million

c. $200.0 million

d. $300.0 million

711.2. Consider a pair of credits, one B+ and the other B-rated, with default probability π(1) = 0.070 and π(2) = 0.110. If the defaults are uncorrelated, then the joint default probability π(12) = 0.070*0.110 = 0.00770. If however, the default correlation is 0.20, then which is nearest to the corresponding INCREASE in the joint default probability? (inspired by Malz' Example 8.1)

a. Zero: default correlation does not impact joint default probability

b. +0.00154 or 0.154% (to 0.924%)

c. +0.0160 or 1.60% (to 2.3667%)

d. +0.3800 or 38.0% (to 38.770%)

711.3. Structured credit products (aka, portfolio credit products) are backed by credit-sensitive (risky!) loans or bonds and tend to be characterized by the sequential distribution of credit losses via tranches which can be categorized into three groups: equity, junior and senior. The "waterfall" refers to the rules about how the cash flows from the collateral are distributed to the various securities in the capital structure. According to Malz' analysis, each of the following is true about structured credit risk EXCEPT which is false?

a. An increase in granularity implies a decrease in concentration risk and tends to decreases securitization risks (i.e., risk at all tranches)

b. An increase in default correlation increases the credit value at risk (credit VaR) of all three tranches (Equity, Mezzanine and Senior bond)

c. An increase in default correlation increases the value (and IRR) of the equity tranche, but decrease the value (and IRR) of the senior tranche

d. A well-diversified credit portfolio eliminates systematic risk by minimizing default correlations and consequently renders the senior bond approximately risk-free

Answers here:

Questions:

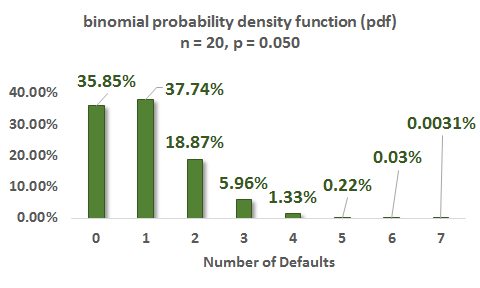

711.1. Suppose there are twenty (20) credits in a portfolio. Each credit has the same default probability of 5.0% and the (pairwise) default correlations are all zero; that is, as defaults are i.i.d. the portfolio is characterized by a binomial distribution, as displayed below. For example, the probability of exactly five defaults is equal to C(20,5)*0.050^5*0.950^15 = 0.0022446 = 0.22%.

If the par value of each position is $100.0 million such that the total portfolio value is $2.0 billion, and we assume the loss given default (LGD) is always 100.0%, then what is the 95.0% credit value at risk (CVaR) of the portfolio?

a. Zero

b. $100.0 million

c. $200.0 million

d. $300.0 million

711.2. Consider a pair of credits, one B+ and the other B-rated, with default probability π(1) = 0.070 and π(2) = 0.110. If the defaults are uncorrelated, then the joint default probability π(12) = 0.070*0.110 = 0.00770. If however, the default correlation is 0.20, then which is nearest to the corresponding INCREASE in the joint default probability? (inspired by Malz' Example 8.1)

a. Zero: default correlation does not impact joint default probability

b. +0.00154 or 0.154% (to 0.924%)

c. +0.0160 or 1.60% (to 2.3667%)

d. +0.3800 or 38.0% (to 38.770%)

711.3. Structured credit products (aka, portfolio credit products) are backed by credit-sensitive (risky!) loans or bonds and tend to be characterized by the sequential distribution of credit losses via tranches which can be categorized into three groups: equity, junior and senior. The "waterfall" refers to the rules about how the cash flows from the collateral are distributed to the various securities in the capital structure. According to Malz' analysis, each of the following is true about structured credit risk EXCEPT which is false?

a. An increase in granularity implies a decrease in concentration risk and tends to decreases securitization risks (i.e., risk at all tranches)

b. An increase in default correlation increases the credit value at risk (credit VaR) of all three tranches (Equity, Mezzanine and Senior bond)

c. An increase in default correlation increases the value (and IRR) of the equity tranche, but decrease the value (and IRR) of the senior tranche

d. A well-diversified credit portfolio eliminates systematic risk by minimizing default correlations and consequently renders the senior bond approximately risk-free

Answers here: