Learning objectives: Evaluate the impact of changes in the credit spread and recovery rate assumptions on CVA. Explain how netting can be incorporated into the CVA calculation.

Questions:

915.1. Strongcore Financial Corporation has purchased a long-term at-the-money (ATM) call option from a risky counterparty. The option's stock and strike price are $25.00 million. The underlying asset's volatility, σ, is estimated to be 20.0% while the risk-free rate is 3.0% per annum. The European-style option matures in 3.0 years. In regard to the standard normal cumulative distribution function, in this scenario N(d1) equals 0.66750 and N(d2) equals 0.53450.

With respect to its counterparty risk, Strongcore assigns a hazard rate estimate of 6.0% and believes its counterparty could default at any time during the three-year option period; i.e., the cumulative default probability is relevant for this approximation. Further, if its counterparty defaults, Strongcore assigns a conservative recovery rate estimate of 30.0%.

In summary, the assumptions are: S = K = $25.0 million, σ = 20.0%, Rf = 3.0%, T = 3.0 years; λ (i.e., hazard rate) = 6.0%, and LGD = 70.0%.

In this situation, Strongcore does NOT want to compute the standard credit value adjustment (CVA) formula which is the summation of discounted expected exposures, EE(t), over multiple future periods. Instead, Strongcore wants to rely on the simpler "semi-analytical method" that produces an estimate as a function of the position's current value, the cumulative default probability, PD(0,T), and the loss given default, LGD. Under this simpler approximation, which of the following is nearest to the CVA charge for the long option position?

a. $15,600

b. $90,000

c. $516,000

d. $1.1 million

915.2. Assume we utilize Gregory's credit value adjustment (CVA) formula as shown below:

(Source: Jon Gregory, The xVA Challenge: Counterparty Credit Risk, Funding, Collateral, and Capital, 3rd edition (West Sussex, UK: John Wiley & Sons, 2015))

If we apply this CVA formula to a position in a plain vanilla interest rate swap, which of the following statements is TRUE?

a. CVA has a linear relationship with credit spread

b. Due to high jump-to-default risk, especially at inception, the CVA is an exponential function of the credit spread

c. For a given cumulative default probability, the CVA is invariant to (i.e., does not depend on) the shape of the credit curve

d. If we assume that settled(LGD) equals actual(LGD), then changing this LGD parameter has a small (aka, modest) effect on CVA

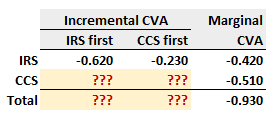

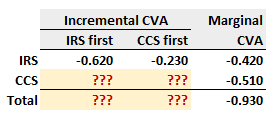

915.3. Consider a single netting set that includes only the following two derivative positions:

In regard to this netting set, each of the following statements is true EXCEPT which is false?

a. Incremental CVA must be less than marginal CVA

b. The netting set's total CVA is -0.930 regardless of whether IRS is first or CCS is first

c. Depending on the sequence, the incremental CVA of the CCS position is either -0.310 or -0.700

d. The sum of the stand-alone CVAs is LESS THAN or equal to -0.930; i.e., CVA(IRS) + CVA(CCS) ≤ -0.930

Answers here:

Questions:

915.1. Strongcore Financial Corporation has purchased a long-term at-the-money (ATM) call option from a risky counterparty. The option's stock and strike price are $25.00 million. The underlying asset's volatility, σ, is estimated to be 20.0% while the risk-free rate is 3.0% per annum. The European-style option matures in 3.0 years. In regard to the standard normal cumulative distribution function, in this scenario N(d1) equals 0.66750 and N(d2) equals 0.53450.

With respect to its counterparty risk, Strongcore assigns a hazard rate estimate of 6.0% and believes its counterparty could default at any time during the three-year option period; i.e., the cumulative default probability is relevant for this approximation. Further, if its counterparty defaults, Strongcore assigns a conservative recovery rate estimate of 30.0%.

In summary, the assumptions are: S = K = $25.0 million, σ = 20.0%, Rf = 3.0%, T = 3.0 years; λ (i.e., hazard rate) = 6.0%, and LGD = 70.0%.

In this situation, Strongcore does NOT want to compute the standard credit value adjustment (CVA) formula which is the summation of discounted expected exposures, EE(t), over multiple future periods. Instead, Strongcore wants to rely on the simpler "semi-analytical method" that produces an estimate as a function of the position's current value, the cumulative default probability, PD(0,T), and the loss given default, LGD. Under this simpler approximation, which of the following is nearest to the CVA charge for the long option position?

a. $15,600

b. $90,000

c. $516,000

d. $1.1 million

915.2. Assume we utilize Gregory's credit value adjustment (CVA) formula as shown below:

(Source: Jon Gregory, The xVA Challenge: Counterparty Credit Risk, Funding, Collateral, and Capital, 3rd edition (West Sussex, UK: John Wiley & Sons, 2015))

If we apply this CVA formula to a position in a plain vanilla interest rate swap, which of the following statements is TRUE?

a. CVA has a linear relationship with credit spread

b. Due to high jump-to-default risk, especially at inception, the CVA is an exponential function of the credit spread

c. For a given cumulative default probability, the CVA is invariant to (i.e., does not depend on) the shape of the credit curve

d. If we assume that settled(LGD) equals actual(LGD), then changing this LGD parameter has a small (aka, modest) effect on CVA

915.3. Consider a single netting set that includes only the following two derivative positions:

- An interest rate swap (IRS), and

- A cross-currency swap (CCS)

In regard to this netting set, each of the following statements is true EXCEPT which is false?

a. Incremental CVA must be less than marginal CVA

b. The netting set's total CVA is -0.930 regardless of whether IRS is first or CCS is first

c. Depending on the sequence, the incremental CVA of the CCS position is either -0.310 or -0.700

d. The sum of the stand-alone CVAs is LESS THAN or equal to -0.930; i.e., CVA(IRS) + CVA(CCS) ≤ -0.930

Answers here: