Learning objectives: Explain the motivations for revising the Basel III framework and the goals and impacts of the December 2017 reforms to the Basel III framework. Summarize the December 2017 revisions to the Basel III framework in the following areas: The standardized approach to credit risk; The internal ratings-based (IRB) approaches for credit risk; The CVA risk framework; The operational risk framework; and the leverage ratio framework. Describe the revised output floor introduced as part of the Basel III reforms and approaches to be used when calculating the output floor.

Questions:

20.11.1. In December 2017 the Basel Committee (BCBS) made several revisions to the Basel III framework. This included revisions to both the standardized approach to credit risk ("Credit risk accounts for the bulk of most banks’ risk-taking activities and hence their regulatory capital requirements. The standardized approach is used by the majority of banks around the world, including in non-Basel Committee jurisdictions," wrote the Committee) and the internal ratings-based (IRB) approaches to credit risk ("The financial crisis highlighted a number of shortcomings related to the use of internally modeled approaches for regulatory capital, including the IRB approaches to credit risk. These shortcomings include the excessive complexity of the IRB approaches, the lack of comparability in banks’ internally modeled IRB capital requirements and the lack of robustness in modelling certain asset classes," wrote the Committee).

In regard to these December 2017 revisions to credit risk approaches in Basel III, which of the following statements is TRUE?

a. In the standardized approach (SA) for residential real estate exposures, the risk weights are lower if the loan-to-value (LTV) falls into a lower band

b. The standardized approach (SA) eliminated the treatment of unrated exposures because all exposures are required to have an external credit rating

c. The internal ratings-based (IRB) approach removed the option to use the foundation IRB (F-IRB) because the advanced IRB (A-IRB) must be used for all asset classes

d. The internal ratings-based (IRB) approach removed the parameter input floors (in the case of PD, LGD, and EAD) to increase RWA variability across different banks

20.11.2. The December 2017 revisions to the Basel III framework included revisions in several areas including credit risk approaches, counterparty (CVA) risk, operational risk, the leverage ratio, and a revised output floor. In regard to these 2017 Basel III revisions, each of the following is true EXCEPT which is false?

a. For counterparty credit risk, the CVA framework was revised to enhance its risk security, strengthen its robustness, and improve its consistency

b. For operational risk, the previous standardized approaches (e.g., BIA, SA) and internal approach (i.e., AMA) were replaced by a single risk-sensitive standardized approach (SMA) to be used by all banks

c. For operational risk, the new SMA approach eliminated the bank's historical, internal loss experience as an input because it was observed to be uncorrelated to actual operational losses

d. With respect to the revised output floor, a bank's risk-weighted assets (RWA) under internal models cannot be lower than 72.5% of the total RWA calculated using only the standardized approaches

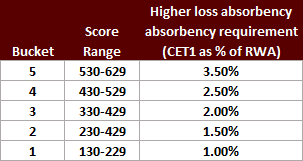

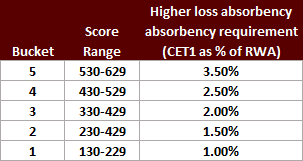

20.11.3. The Basel Committee developed a methodology for assigning global systemically important banks (G-SIBs) to one of five buckets:

The above table and latest information can be found at https://www.bis.org/bcbs/gsib/index.htm. As of November 2019, Bank of America (ticker: BAC) was a $2.4 trillion G-SIB assigned to Bucket 2. There were no banks in Bucket 5, and JP Morgan Chase was the only bank in Bucket 4.

According to Basel III, if we include the buffer requirements due to its status as a G-SIB, what is Bank of America's minimum common equity tier 1 (CET1) risk-weighted ratio, and its minimum leverage ratio (excluding the countercyclical buffer, CCyB, which can anyhow be zero)?

a. BAC requires a minimum CET1 risk-weighted ratio of 7.00% and a minimum leverage ratio of 3.00%

b. BAC requires a minimum CET1 risk-weighted ratio of 8.50% and a minimum leverage ratio of 3.75%

c. BAC requires a minimum CET1 risk-weighted ratio of 10.50% and a minimum leverage ratio of 4.50%

d. BAC requires a minimum CET1 risk-weighted ratio of 10.50% and a minimum leverage ratio of 5.25%

Answers here:

Questions:

20.11.1. In December 2017 the Basel Committee (BCBS) made several revisions to the Basel III framework. This included revisions to both the standardized approach to credit risk ("Credit risk accounts for the bulk of most banks’ risk-taking activities and hence their regulatory capital requirements. The standardized approach is used by the majority of banks around the world, including in non-Basel Committee jurisdictions," wrote the Committee) and the internal ratings-based (IRB) approaches to credit risk ("The financial crisis highlighted a number of shortcomings related to the use of internally modeled approaches for regulatory capital, including the IRB approaches to credit risk. These shortcomings include the excessive complexity of the IRB approaches, the lack of comparability in banks’ internally modeled IRB capital requirements and the lack of robustness in modelling certain asset classes," wrote the Committee).

In regard to these December 2017 revisions to credit risk approaches in Basel III, which of the following statements is TRUE?

a. In the standardized approach (SA) for residential real estate exposures, the risk weights are lower if the loan-to-value (LTV) falls into a lower band

b. The standardized approach (SA) eliminated the treatment of unrated exposures because all exposures are required to have an external credit rating

c. The internal ratings-based (IRB) approach removed the option to use the foundation IRB (F-IRB) because the advanced IRB (A-IRB) must be used for all asset classes

d. The internal ratings-based (IRB) approach removed the parameter input floors (in the case of PD, LGD, and EAD) to increase RWA variability across different banks

20.11.2. The December 2017 revisions to the Basel III framework included revisions in several areas including credit risk approaches, counterparty (CVA) risk, operational risk, the leverage ratio, and a revised output floor. In regard to these 2017 Basel III revisions, each of the following is true EXCEPT which is false?

a. For counterparty credit risk, the CVA framework was revised to enhance its risk security, strengthen its robustness, and improve its consistency

b. For operational risk, the previous standardized approaches (e.g., BIA, SA) and internal approach (i.e., AMA) were replaced by a single risk-sensitive standardized approach (SMA) to be used by all banks

c. For operational risk, the new SMA approach eliminated the bank's historical, internal loss experience as an input because it was observed to be uncorrelated to actual operational losses

d. With respect to the revised output floor, a bank's risk-weighted assets (RWA) under internal models cannot be lower than 72.5% of the total RWA calculated using only the standardized approaches

20.11.3. The Basel Committee developed a methodology for assigning global systemically important banks (G-SIBs) to one of five buckets:

The above table and latest information can be found at https://www.bis.org/bcbs/gsib/index.htm. As of November 2019, Bank of America (ticker: BAC) was a $2.4 trillion G-SIB assigned to Bucket 2. There were no banks in Bucket 5, and JP Morgan Chase was the only bank in Bucket 4.

According to Basel III, if we include the buffer requirements due to its status as a G-SIB, what is Bank of America's minimum common equity tier 1 (CET1) risk-weighted ratio, and its minimum leverage ratio (excluding the countercyclical buffer, CCyB, which can anyhow be zero)?

a. BAC requires a minimum CET1 risk-weighted ratio of 7.00% and a minimum leverage ratio of 3.00%

b. BAC requires a minimum CET1 risk-weighted ratio of 8.50% and a minimum leverage ratio of 3.75%

c. BAC requires a minimum CET1 risk-weighted ratio of 10.50% and a minimum leverage ratio of 4.50%

d. BAC requires a minimum CET1 risk-weighted ratio of 10.50% and a minimum leverage ratio of 5.25%

Answers here:

Last edited by a moderator: