Learning objectives: Describe and calculate the stressed VaR introduced in Basel 2.5 and calculate the market risk capital charge. Explain the process of calculating the incremental risk capital charge for positions held in a bank’s trading book. Describe the comprehensive risk (CR) capital charge for portfolios of positions that are sensitive to correlations between default risks. Define in the context of Basel III and calculate where appropriate: Tier 1 capital and its components; Tier 2 capital and its components; Required Tier 1 equity capital, total Tier 1 capital and total capital

Questions:

20.9.1. A bank is using the VaR and stressed VaR (SVaR) market risk framework according to the Basel 2.5 guidelines. The bank’s internal models for market risk have generated the following risk measures for the current trading book positions (VaR and SVaR are in USD millions):

The supervisor has set both multiplication factors, m and m(S), to 3.0. What is the correct capital requirement for general market risk for the bank under Basel 2.5? (note: this question inspired by Question 42 of GARP's 2020 Part 2 Practice Exam).

a. $630.0 million

b. $810.0 million

c. $1,230.0 million

d. $2,154.0 million

20.9.2. In regard to the incremental risk charge (IRC) in Basel 2.5, each of the following is true EXCEPT which is false?

a. The incremental risk charge (IRC) is calculated as the one-year 99.9% confident value at risk (VaR) to credit instrument losses in the trading book

b. The incremental risk charge (IRC) is designed to account for correlation risks in the correlation book, which includes securitizations and re-securitizations

c. The incremental risk charge (IRC, itself an amended IDRC) was motivated by a reaction to regulatory arbitrage; consequently required capital in the trading book is the greater of market risk capital and banking book capital

d. In addition to default risk, via its rebalancing "constant level of risk" assumption, the incremental risk charge (IRC) provides a measure of credit deterioration (i.e., including ratings downgrade and/or credit spread widening) and/or loss of liquidity

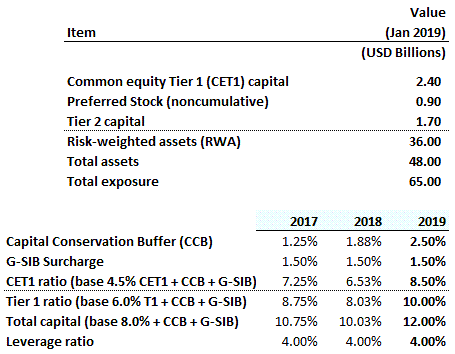

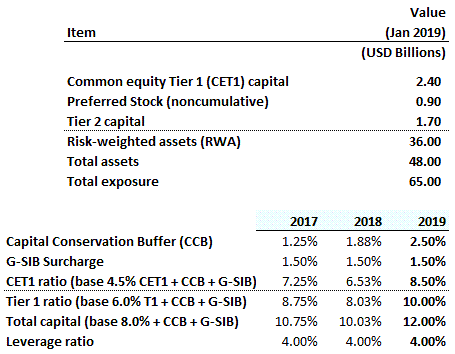

20.9.3. The Chief Risk Officer (CRO) of LGX is preparing a report to the directors on the bank's capital adequacy. In the upper panel below, the bank's most recent key balance sheet accounts (e.g., total assets) and capital accounts (e.g., CET1 capital) are displayed. In the lower panel below, Basel's regulatory capital requirements (for selected items) are displayed; because these regulatory capital requirements were phased in, they are shown for each of the three years ending 2019.

The bank is only concerned with its fully phased-in compliance such that only the regulatory requirements in 2019 are relevant (the bold column, so you can ignore 2017 and 2018, as they are shown merely to illustrate the phase-in concept); e.g., CCB of 2.50%, GIB surcharge of 1.50%. The directors are expecting that the bank is compliant with respect to the following: CET ratio, Tier 1 ratio, total capital ratio, and leverage ratio.

In regard to these four regulatory ratios vis-a-vis the most recent (2019) requirements, for which does the bank meet the minimum requirements? (note: this question inspired by Question 70 of GARP's 2020 Part 2 Practice Exam).

a. Leverage and Total Capital ratio are sufficient, but CET1 and Tier 1 ratios are too low

b. Tier 1 ratio and Leverage are sufficient, but CET1 and Total Capital ratios are too low

c. Only CET1 ratio is sufficient, but the others (Tier 1, Total Capital, and Leverage) are too low

d. All four ratios (including CET1, Tier 1, Total Capital, and Leverage) are sufficient

Answers here:

Questions:

20.9.1. A bank is using the VaR and stressed VaR (SVaR) market risk framework according to the Basel 2.5 guidelines. The bank’s internal models for market risk have generated the following risk measures for the current trading book positions (VaR and SVaR are in USD millions):

The supervisor has set both multiplication factors, m and m(S), to 3.0. What is the correct capital requirement for general market risk for the bank under Basel 2.5? (note: this question inspired by Question 42 of GARP's 2020 Part 2 Practice Exam).

a. $630.0 million

b. $810.0 million

c. $1,230.0 million

d. $2,154.0 million

20.9.2. In regard to the incremental risk charge (IRC) in Basel 2.5, each of the following is true EXCEPT which is false?

a. The incremental risk charge (IRC) is calculated as the one-year 99.9% confident value at risk (VaR) to credit instrument losses in the trading book

b. The incremental risk charge (IRC) is designed to account for correlation risks in the correlation book, which includes securitizations and re-securitizations

c. The incremental risk charge (IRC, itself an amended IDRC) was motivated by a reaction to regulatory arbitrage; consequently required capital in the trading book is the greater of market risk capital and banking book capital

d. In addition to default risk, via its rebalancing "constant level of risk" assumption, the incremental risk charge (IRC) provides a measure of credit deterioration (i.e., including ratings downgrade and/or credit spread widening) and/or loss of liquidity

20.9.3. The Chief Risk Officer (CRO) of LGX is preparing a report to the directors on the bank's capital adequacy. In the upper panel below, the bank's most recent key balance sheet accounts (e.g., total assets) and capital accounts (e.g., CET1 capital) are displayed. In the lower panel below, Basel's regulatory capital requirements (for selected items) are displayed; because these regulatory capital requirements were phased in, they are shown for each of the three years ending 2019.

The bank is only concerned with its fully phased-in compliance such that only the regulatory requirements in 2019 are relevant (the bold column, so you can ignore 2017 and 2018, as they are shown merely to illustrate the phase-in concept); e.g., CCB of 2.50%, GIB surcharge of 1.50%. The directors are expecting that the bank is compliant with respect to the following: CET ratio, Tier 1 ratio, total capital ratio, and leverage ratio.

In regard to these four regulatory ratios vis-a-vis the most recent (2019) requirements, for which does the bank meet the minimum requirements? (note: this question inspired by Question 70 of GARP's 2020 Part 2 Practice Exam).

a. Leverage and Total Capital ratio are sufficient, but CET1 and Tier 1 ratios are too low

b. Tier 1 ratio and Leverage are sufficient, but CET1 and Total Capital ratios are too low

c. Only CET1 ratio is sufficient, but the others (Tier 1, Total Capital, and Leverage) are too low

d. All four ratios (including CET1, Tier 1, Total Capital, and Leverage) are sufficient

Answers here:

Last edited by a moderator: