Learning outcomes: Identify the main sources of transactions liquidity risk. Calculate the expected transactions cost and the 99 percent spread risk factor for a transaction. Calculate the liquidity-adjusted VaR for a position to be liquidated over a number of trading days.

Questions:

511.1. Each of the following is a source (i.e., cause) of transactions liquidity risk EXCEPT which is not?

a. Inventory management by dealers

b. Adverse selection

c. Depth of resiliency

d. Differences of opinion

511.2. The bid-ask spread is USD 0.350 on an asset with a current price of USD 50.00 per share. The spread itself is normally distributed with mean of zero and volatility of 20 basis points (0.20%). Which is nearest to the 99 percent confidence interval on the transaction costs?

a. $0.08510

b. $0.29130

c. $1.05560

d. $3.82400

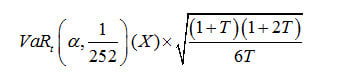

511.3. Let's define liquidity-adjusted value at risk (VaR) for a position that can be liquidated over (T) days as given by:

Let's assume an equity position with a value of one million dollars ($1,000,000) and a volatility of 34.0% per annum. If there are 250 trading days in a year and returns are normal i.i.d., which is nearest to the 99.0% liquidity-adjusted VaR if we estimate the position will require five (5) trading days to liquidate?

a. $50,000

b. $74,200

c. $98,900

d. $111,840

Answers here:

Questions:

511.1. Each of the following is a source (i.e., cause) of transactions liquidity risk EXCEPT which is not?

a. Inventory management by dealers

b. Adverse selection

c. Depth of resiliency

d. Differences of opinion

511.2. The bid-ask spread is USD 0.350 on an asset with a current price of USD 50.00 per share. The spread itself is normally distributed with mean of zero and volatility of 20 basis points (0.20%). Which is nearest to the 99 percent confidence interval on the transaction costs?

a. $0.08510

b. $0.29130

c. $1.05560

d. $3.82400

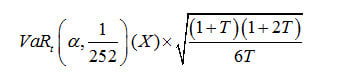

511.3. Let's define liquidity-adjusted value at risk (VaR) for a position that can be liquidated over (T) days as given by:

Let's assume an equity position with a value of one million dollars ($1,000,000) and a volatility of 34.0% per annum. If there are 250 trading days in a year and returns are normal i.i.d., which is nearest to the 99.0% liquidity-adjusted VaR if we estimate the position will require five (5) trading days to liquidate?

a. $50,000

b. $74,200

c. $98,900

d. $111,840

Answers here: