Learning outcomes: Describe and contrast the major elements of the three options available for the calculation of credit risk: Standardised Approach, Foundation IRB Approach and Advanced IRB Approach

Questions:

517.1. Consider the following four statements which attempt to summarize the approach to credit risk capital under Basel II: https://forum.bionicturtle.com/tags/credit+risk+capital/

Which of the above is (are) accurate?

a. None are accurate

b. Only I. and II.

c. Only I. and IV.

d. All are accurate

517.2. About the treatment of collateral in the calculation of credit risk under the STANDARDIZED (not IRB) approach Basel II, Hull explains, "there are two ways banks can adjust risk weights for collateral. The first is termed the simple approach and is similar to an approach used in Basel I. The second is termed the comprehensive approach. Banks have a choice as to which approach is used in the banking book, but must use the comprehensive approach to calculate capital for counterparty credit risk in the trading book.

a. $7.0 million

b. $15.0 million

c. $20.0 million

d. $33.0 million

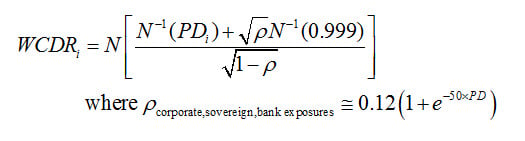

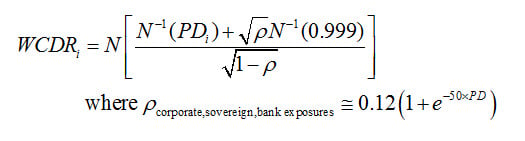

517.3. Under the internal ratings-based (IRB) approach to credit risk, Hull explains that the credit value at risk is calculated using a one-factor Gaussian copula model of time to default. If we assume that a bank has a very large number of obligors and the i-th obligor has a one-year probability of default, PD(i), and the copula correlation between each pair of obligors is given by rho (ρ), then the worst-case probability of default, WCDR(i), is defined as follows:

Suppose that the assets of a bank consist of $100.0 million of loans to A-rated corporations. The probability of default (PD) for the corporations is estimated as 0.90% and the LGD is 75%. The average maturity of loans is 2.50 years such that the maturity adjustment is 1.270. Which is nearest to the exposure's risk-weighted asset under the IRB approach?

a. $66.0 million

b. $85.5 million

c. $148.0 million

d. $368.9 million

Answers here:

Questions:

517.1. Consider the following four statements which attempt to summarize the approach to credit risk capital under Basel II: https://forum.bionicturtle.com/tags/credit+risk+capital/

I. For credit risk, Basel II specified three approaches: The Standardized Approach, The Foundation Internal Ratings Based (IRB) Approach, and The Advanced IRB Approach

II. For the internal ratings-based (IRB) approach, regulators base the capital requirement on the value at risk calculated using a one-year time horizon and a 99.9% confidence level; they recognize that expected losses are usually covered by the way a financial institution prices its products. The capital required is, therefore, the value at risk minus the expected loss

III. Under the Foundation IRB approach, banks supply PD while LGD, EAD, and M are supervisory values set by the Basel Committee. PD is subject to a floor of 0.03% for bank and corporate exposures. LGD is set at 45% for senior claims and 75% for subordinated claims. When there is eligible collateral, in order to correspond to the comprehensive approach, LGD is reduced by the ratio of the adjusted value of the collateral to the adjusted value of the exposure, both calculated using the comprehensive approach. The EAD is calculated in a manner similar to the credit equivalent amount in Basel I and includes the impact of netting. M is set at 2.5 in most circumstances.

IV. Under the advanced IRB approach, banks supply their own estimates of the PD, LGD, EAD, and M for corporate, sovereign, and bank exposures. The PD can be reduced by credit mitigants such as credit triggers. (As in the case of the Foundation IRB approach, it is subject to a floor of 0.03% for bank and corporate exposures.) The two main factors influencing the LGD are the seniority of the debt and the collateral. In calculating EAD, banks can with regulatory approval use their own estimates of credit conversion factors

Which of the above is (are) accurate?

a. None are accurate

b. Only I. and II.

c. Only I. and IV.

d. All are accurate

517.2. About the treatment of collateral in the calculation of credit risk under the STANDARDIZED (not IRB) approach Basel II, Hull explains, "there are two ways banks can adjust risk weights for collateral. The first is termed the simple approach and is similar to an approach used in Basel I. The second is termed the comprehensive approach. Banks have a choice as to which approach is used in the banking book, but must use the comprehensive approach to calculate capital for counterparty credit risk in the trading book.

- Under the simple approach, the risk weight of the counterparty is replaced by the risk weight of the collateral for the part of the exposure covered by the collateral. (The exposure is calculated after netting.) For any exposure not covered by the collateral, the risk weight of the counterparty is used. The minimum level for the risk weight applied to the collateral is 20%.10 A requirement is that the collateral must be revalued at least every six months and must be pledged for at least the life of the exposure.

- Under the comprehensive approach, banks adjust the size of their exposure upward to allow for possible increases in the exposure and adjust the value of the collateral downward to allow for possible decreases in the value of the collateral.11 (The adjustments depend on the volatility of the exposure and the collateral.) A new exposure equal to the excess of the adjusted exposure over the adjusted value of the collateral is calculated and the counterparty’s risk weight is applied to this exposure." (Source: John Hull, Risk Management and Financial Institutions, 5th Edition (New York: John Wiley & Sons, 2018))

a. $7.0 million

b. $15.0 million

c. $20.0 million

d. $33.0 million

517.3. Under the internal ratings-based (IRB) approach to credit risk, Hull explains that the credit value at risk is calculated using a one-factor Gaussian copula model of time to default. If we assume that a bank has a very large number of obligors and the i-th obligor has a one-year probability of default, PD(i), and the copula correlation between each pair of obligors is given by rho (ρ), then the worst-case probability of default, WCDR(i), is defined as follows:

Suppose that the assets of a bank consist of $100.0 million of loans to A-rated corporations. The probability of default (PD) for the corporations is estimated as 0.90% and the LGD is 75%. The average maturity of loans is 2.50 years such that the maturity adjustment is 1.270. Which is nearest to the exposure's risk-weighted asset under the IRB approach?

a. $66.0 million

b. $85.5 million

c. $148.0 million

d. $368.9 million

Answers here:

Last edited: