Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

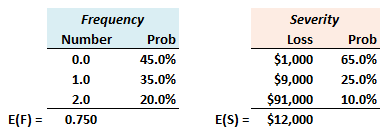

704.1. Newzone International employs the loss distribution approach (LDA) to characterize the operational loss distribution over a one-year horizon. Under LDA, the loss frequency distribution is tabulated (aka, statistical convolution) with the loss severity distribution. For Newzone, the frequency and severity distributions are independent from one another and given by:

In this way, the expected frequency, E(F), is a probability weighted-average of 0.750 loss events per year, and the expected severity, E(S), is $12,000 which is equal to ($1,000 * 65.0%) + ($9,000 * 25.0%) + ($91,000 * 10.0%). What is the one-year operational unexpected loss (UL) at the 99.0% confidence level, which we could also refer to as the one-year relative (as opposed to absolute) operational value at risk (OpVaR) at the 99.0% confidence level?

a. $91,000

b. $100,000

c. $141,000

d. $182,000

704.2. Sources of EXTERNAL operational loss data include news-based subscription service (for example, IBM Algo FIRST) or Consortium data (for example, ORX). Each of the following is true EXCEPT which is unlikely?

a. Subscription service (e.g., Algo FIRST) is likely to be distorted by reporting or availability bias

b. A combination of ORX (consortium data) and FIRST (subscription service) data provides a complete data set for a bank to use for benchmarking

c. The Consortium data will probably contain a higher percentage (than the news-based service) of losses in the Execution, Delivery and Process Management (EDPM) event type category

d. The Consortium data will probably contain a higher percentage (than the news-based service) of losses in the External Fraud event type category

704.3. In March 2016, the Basel Committee on Banking Supervision proposed the Standardized Measurement Approach (SMA) to operational risk regulatory capital. The proposal has been controversial. Consider the following five summary statements about the proposed SMA:

I. SMA proposes to eliminate the Advanced measurement approach (AMA) which currently (previously) allowed for the estimation of regulatory capital to be based on a diverse range of INTERNAL models

II. The SMA multiplies a Business Indicator (BI) Component by a Loss Multiplier (LM)

III. The SMA's Business Indicator (BI) replaces the current (previous) Gross Income (GI) used in Basel's BIA and STA approaches; the BI

IV. The Business Indicator (BI) consists of profit and loss (P&L) items that are mostly also found in the composition of Gross Income (GI)

V. The Loss Multiplier (LM) is calculated based on the bank's own historical, internal operational loss data and the LM is meant to improve the risk sensitivity of the SMA

Which of the above statements is (are) TRUE?

a. None of the statements is accurate

b. II. and IV. only

c. I., III., and V. only

d. All five statements are true.

Answers here:

Questions:

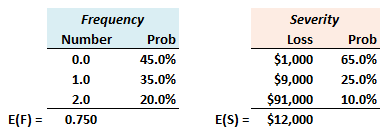

704.1. Newzone International employs the loss distribution approach (LDA) to characterize the operational loss distribution over a one-year horizon. Under LDA, the loss frequency distribution is tabulated (aka, statistical convolution) with the loss severity distribution. For Newzone, the frequency and severity distributions are independent from one another and given by:

In this way, the expected frequency, E(F), is a probability weighted-average of 0.750 loss events per year, and the expected severity, E(S), is $12,000 which is equal to ($1,000 * 65.0%) + ($9,000 * 25.0%) + ($91,000 * 10.0%). What is the one-year operational unexpected loss (UL) at the 99.0% confidence level, which we could also refer to as the one-year relative (as opposed to absolute) operational value at risk (OpVaR) at the 99.0% confidence level?

a. $91,000

b. $100,000

c. $141,000

d. $182,000

704.2. Sources of EXTERNAL operational loss data include news-based subscription service (for example, IBM Algo FIRST) or Consortium data (for example, ORX). Each of the following is true EXCEPT which is unlikely?

a. Subscription service (e.g., Algo FIRST) is likely to be distorted by reporting or availability bias

b. A combination of ORX (consortium data) and FIRST (subscription service) data provides a complete data set for a bank to use for benchmarking

c. The Consortium data will probably contain a higher percentage (than the news-based service) of losses in the Execution, Delivery and Process Management (EDPM) event type category

d. The Consortium data will probably contain a higher percentage (than the news-based service) of losses in the External Fraud event type category

704.3. In March 2016, the Basel Committee on Banking Supervision proposed the Standardized Measurement Approach (SMA) to operational risk regulatory capital. The proposal has been controversial. Consider the following five summary statements about the proposed SMA:

I. SMA proposes to eliminate the Advanced measurement approach (AMA) which currently (previously) allowed for the estimation of regulatory capital to be based on a diverse range of INTERNAL models

II. The SMA multiplies a Business Indicator (BI) Component by a Loss Multiplier (LM)

III. The SMA's Business Indicator (BI) replaces the current (previous) Gross Income (GI) used in Basel's BIA and STA approaches; the BI

IV. The Business Indicator (BI) consists of profit and loss (P&L) items that are mostly also found in the composition of Gross Income (GI)

V. The Loss Multiplier (LM) is calculated based on the bank's own historical, internal operational loss data and the LM is meant to improve the risk sensitivity of the SMA

Which of the above statements is (are) TRUE?

a. None of the statements is accurate

b. II. and IV. only

c. I., III., and V. only

d. All five statements are true.

Answers here:

Last edited by a moderator: