Learning objectives: Compare and contrast generalized extreme value and POT. Evaluate the tradeoffs involved in setting the threshold level when applying the GP distribution. Explain the importance of multivariate EVT for risk management.

Questions:

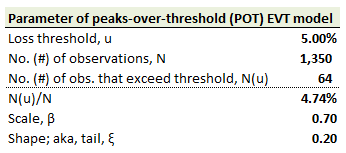

805.1. Robert the Risk Analyst is employing the peaks-over-threshold (POT) methodology for estimating value at risk (VaR) and expected shortfall (ES) for his firm's active positions. His initial model makes the following assumptions:

He wants to experiment with tweaks to his model. First, he increases the threshold from u = 5.0% to 6.0%; consequently, he observes the 99.0% expected shortfall (ES) increase from 7.47% to 8.47%. After reverting the threshold back to 5.0%, he experiments with a series of additional changes to the model, but only one at a time so that each change is ceteris paribus.

Each of the following changes, ceteris paribus, will increase the 99.0% expected shortfall (ES) EXCEPT which of the following changes will decrease the ES?

a. Increase the confidence from 99.0% ES to 99.9% ES

b. Increase the scale parameter only (ceteris paribus) from β = 0.70 to β = 0.85.

c. Double the tail index (aka, shape) only (ceteris paribus) from ξ = 0.20 to ξ = 0.40

d: Increase the number of observations from N = 1,350 to N = 1,500, but without any additional N(u), such that N(u)/N is reduced

805.2. Barbara the Risk Manager is trying to select a threshold in her peaks-over-threshold (POT) extreme value theory (EVT) model. Because she is a certified Financial Risk Manager (FRM) she realizes that her choice of the threshold, in Dowd's words, "is the weak spot of POT theory: it is inevitably arbitrary and therefore judgmental." (Source: Kevin Dowd, Measuring Market Risk, 2nd Edition (West Sussex, England: John Wiley & Sons, 2005))

Her data set contains 1,000 observations. At its current calibration, the threshold implies 50 losses such that N(u)/N = 50/1,000 = 5.0%. In regard to adjusting the threshold, which of the following statements is TRUE?

a. If she increases the threshold, the bias increases

b. If she increases the threshold, the variance decreases

c. She should employ the maximum likelihood estimation (MLE) method in order to determine the objectively optimal threshold

d. If she increases the threshold for the same dataset, she should expect N(u)/N to decrease but with unclear effect on VaR and ES (they may increase or decrease)

805.3. Sally the Risk Analyst is comparing the generalized extreme value (GEV) method to the peaks-over-threshold (POT) method as she aspires to characterize the distribution of extreme losses in her firm's loss database. Her assumptions and/or preference include the following:

I. The losses are probably independent and identically distributed (i.i.d)

II. However it is possible there is some "time dependency" in the loss data

III. She does not actually know the character of the parent's distribution, F(x)

IV. She prefers to avoid calibrating either the scale (β or σ) or tail index (ξ) parameters

V. She may need to assume multivariate extremes

In terms of a direct comparison (and contrast) between GEV versus POT, which of the above factors by itself suggests that she should choose POT over GEV; i.e., by itself favors POT over GEV?

a. None

b. II. only (time dependency suggests POT is better than GEV)

c. IV only (POT avoids shape and tail, requiring only threshold selection)

d. All of them

Answers here:

Questions:

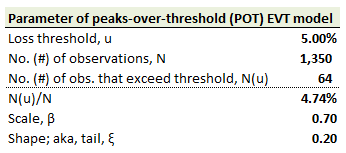

805.1. Robert the Risk Analyst is employing the peaks-over-threshold (POT) methodology for estimating value at risk (VaR) and expected shortfall (ES) for his firm's active positions. His initial model makes the following assumptions:

He wants to experiment with tweaks to his model. First, he increases the threshold from u = 5.0% to 6.0%; consequently, he observes the 99.0% expected shortfall (ES) increase from 7.47% to 8.47%. After reverting the threshold back to 5.0%, he experiments with a series of additional changes to the model, but only one at a time so that each change is ceteris paribus.

Each of the following changes, ceteris paribus, will increase the 99.0% expected shortfall (ES) EXCEPT which of the following changes will decrease the ES?

a. Increase the confidence from 99.0% ES to 99.9% ES

b. Increase the scale parameter only (ceteris paribus) from β = 0.70 to β = 0.85.

c. Double the tail index (aka, shape) only (ceteris paribus) from ξ = 0.20 to ξ = 0.40

d: Increase the number of observations from N = 1,350 to N = 1,500, but without any additional N(u), such that N(u)/N is reduced

805.2. Barbara the Risk Manager is trying to select a threshold in her peaks-over-threshold (POT) extreme value theory (EVT) model. Because she is a certified Financial Risk Manager (FRM) she realizes that her choice of the threshold, in Dowd's words, "is the weak spot of POT theory: it is inevitably arbitrary and therefore judgmental." (Source: Kevin Dowd, Measuring Market Risk, 2nd Edition (West Sussex, England: John Wiley & Sons, 2005))

Her data set contains 1,000 observations. At its current calibration, the threshold implies 50 losses such that N(u)/N = 50/1,000 = 5.0%. In regard to adjusting the threshold, which of the following statements is TRUE?

a. If she increases the threshold, the bias increases

b. If she increases the threshold, the variance decreases

c. She should employ the maximum likelihood estimation (MLE) method in order to determine the objectively optimal threshold

d. If she increases the threshold for the same dataset, she should expect N(u)/N to decrease but with unclear effect on VaR and ES (they may increase or decrease)

805.3. Sally the Risk Analyst is comparing the generalized extreme value (GEV) method to the peaks-over-threshold (POT) method as she aspires to characterize the distribution of extreme losses in her firm's loss database. Her assumptions and/or preference include the following:

I. The losses are probably independent and identically distributed (i.i.d)

II. However it is possible there is some "time dependency" in the loss data

III. She does not actually know the character of the parent's distribution, F(x)

IV. She prefers to avoid calibrating either the scale (β or σ) or tail index (ξ) parameters

V. She may need to assume multivariate extremes

In terms of a direct comparison (and contrast) between GEV versus POT, which of the above factors by itself suggests that she should choose POT over GEV; i.e., by itself favors POT over GEV?

a. None

b. II. only (time dependency suggests POT is better than GEV)

c. IV only (POT avoids shape and tail, requiring only threshold selection)

d. All of them

Answers here:

Last edited by a moderator: