Learning objectives: Explain how to measure time-varying factor exposures and their use in style analysis. Describe issues that arise when measuring alphas for nonlinear strategies. Compare the volatility anomaly and beta anomaly, and analyze evidence of each anomaly. Describe potential explanations for the risk anomaly.

Questions:

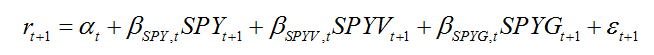

706.1. In order to evaluate the performance of its funds, the Risk Committee at your investment firm currently uses the three-factor Fama-French benchmark as a basis for static factor regressions. There has been a proposal to consider conducting "style analysis." In a presentation to the Committee, the following style-based benchmark is given as an illustration (Andrew Ang Formula 10.14):

The Committee members discuss the various advantages and disadvantages of shifting from a static benchmark to a style-based benchmark. Each of the following drawbacks/advantages mentioned is true EXCEPT which is false?

a. A drawback of style analysis (relative to static benchmarks) is that we cannot introduce short positions into the benchmark

b. A drawback of style analysis (relative to static benchmarks) is that it is harder to detect statistical significance due to larger standard errors

c. An advantage of style analysis is that factor loadings can vary over time, as reflected in factor loadings denoted by β(SPY,t) rather than β(SPY)

d. An advantage of style analysis is the ability to use actual tradeable funds in the factor benchmark, such as for example SPDR ("spider") exchange-traded funds (ETFs)

706.2. The Investment Committee at your firm has a longstanding practice of weighing alpha, among other factors and criteria, in its evaluation of external managers. However, recently, a member voiced concern about the reliability of alpha in the context of certain strategies with known non-linear payoffs. For example, some of the firm's external managers are effectively placing short volatility bets. The Committee wants to better evaluate manager alpha in light of these non-linear strategies. However, as they are highly influenced by Andrew Ang's work, they do want their benchmarks to meet Ang's criteria for an ideal benchmark: 1. Well defined, 2. Tradeable, 3. Replicable, and 4.Risk-adjusted. Which of the following solutions or approaches to this problem is the most viable?

a. One approach to accounting for nonlinear payoffs is to include tradeable non-linear factors

b. One approach to accounting for non-linear payoffs is to conduct a joint hypothesis test where the null involves a simultaneous determination of alpha and the benchmark

c. The easiest way to compute tradeable alpha in the case of non-linear payoffs is to include non-linear terms, in particular quadratic terms, on the right-hand side of the factor regression; for example, r^2(t) or max[r(t),0]

d. It is actually not a problem! The Committee's concerns about measuring static alpha in the case of non-linear payoffs are exaggerated because alpha (along with the information ratio and the Sharpe ratio) is a commonly used metric for many various strategies and it is inherently well-suited to return distributions of any shape

706.3. Which of the following statements about the risk anomaly is TRUE?

a. The primary argument against the risk anomaly, with respect to either low volatility or low beta, is that economists have generally demonstrated that markets are efficient; i.e., efficient market hypothesis (EMH) is true

b. Due to time-varying reality, it is theoretically intractable (ie, not possible) to create a reproducible benchmark for either the low beta or low volatility risk anomalies such that empirical tests of the risk anomalies are not robust and the discussion remains "largely theoretical"

c. The risk anomaly might be explained by investors who are leveraged constrained (i.e., who cannot borrow so instead bid up high beta stocks) and/or have an "agency problem" created by a need to minimize tracking error with the benchmark (e.g., they cannot short low volatility or short low beta)

d. The presence of the low-risk anomaly (aka, low-risk effect) in several different contexts--including U.S. equities, international stock markets, Treasury bonds, corporate bonds (across credit rating classes), commodity, option and foreign exchange markets--is compelling evidence that "data mining" almost surely creates an illusion of a relationship between idiosyncratic return volatility (IVOL) and future returns because diversification generally eliminates the impact of IVOL

Answers here:

Questions:

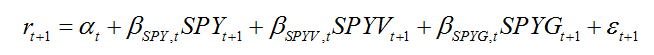

706.1. In order to evaluate the performance of its funds, the Risk Committee at your investment firm currently uses the three-factor Fama-French benchmark as a basis for static factor regressions. There has been a proposal to consider conducting "style analysis." In a presentation to the Committee, the following style-based benchmark is given as an illustration (Andrew Ang Formula 10.14):

The Committee members discuss the various advantages and disadvantages of shifting from a static benchmark to a style-based benchmark. Each of the following drawbacks/advantages mentioned is true EXCEPT which is false?

a. A drawback of style analysis (relative to static benchmarks) is that we cannot introduce short positions into the benchmark

b. A drawback of style analysis (relative to static benchmarks) is that it is harder to detect statistical significance due to larger standard errors

c. An advantage of style analysis is that factor loadings can vary over time, as reflected in factor loadings denoted by β(SPY,t) rather than β(SPY)

d. An advantage of style analysis is the ability to use actual tradeable funds in the factor benchmark, such as for example SPDR ("spider") exchange-traded funds (ETFs)

706.2. The Investment Committee at your firm has a longstanding practice of weighing alpha, among other factors and criteria, in its evaluation of external managers. However, recently, a member voiced concern about the reliability of alpha in the context of certain strategies with known non-linear payoffs. For example, some of the firm's external managers are effectively placing short volatility bets. The Committee wants to better evaluate manager alpha in light of these non-linear strategies. However, as they are highly influenced by Andrew Ang's work, they do want their benchmarks to meet Ang's criteria for an ideal benchmark: 1. Well defined, 2. Tradeable, 3. Replicable, and 4.Risk-adjusted. Which of the following solutions or approaches to this problem is the most viable?

a. One approach to accounting for nonlinear payoffs is to include tradeable non-linear factors

b. One approach to accounting for non-linear payoffs is to conduct a joint hypothesis test where the null involves a simultaneous determination of alpha and the benchmark

c. The easiest way to compute tradeable alpha in the case of non-linear payoffs is to include non-linear terms, in particular quadratic terms, on the right-hand side of the factor regression; for example, r^2(t) or max[r(t),0]

d. It is actually not a problem! The Committee's concerns about measuring static alpha in the case of non-linear payoffs are exaggerated because alpha (along with the information ratio and the Sharpe ratio) is a commonly used metric for many various strategies and it is inherently well-suited to return distributions of any shape

706.3. Which of the following statements about the risk anomaly is TRUE?

a. The primary argument against the risk anomaly, with respect to either low volatility or low beta, is that economists have generally demonstrated that markets are efficient; i.e., efficient market hypothesis (EMH) is true

b. Due to time-varying reality, it is theoretically intractable (ie, not possible) to create a reproducible benchmark for either the low beta or low volatility risk anomalies such that empirical tests of the risk anomalies are not robust and the discussion remains "largely theoretical"

c. The risk anomaly might be explained by investors who are leveraged constrained (i.e., who cannot borrow so instead bid up high beta stocks) and/or have an "agency problem" created by a need to minimize tracking error with the benchmark (e.g., they cannot short low volatility or short low beta)

d. The presence of the low-risk anomaly (aka, low-risk effect) in several different contexts--including U.S. equities, international stock markets, Treasury bonds, corporate bonds (across credit rating classes), commodity, option and foreign exchange markets--is compelling evidence that "data mining" almost surely creates an illusion of a relationship between idiosyncratic return volatility (IVOL) and future returns because diversification generally eliminates the impact of IVOL

Answers here:

Last edited by a moderator: