Learning objectives: Compare illiquidity risk premiums across and within asset categories. Evaluate portfolio choice decisions on the inclusion of illiquid assets.

Questions:

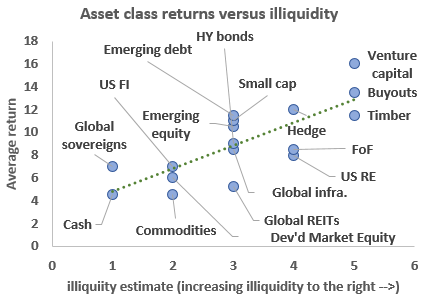

708.1. In order to identify the presence of illiquidity risk premium(s), Andrew Ang references data presented by Antti Ilmanen in his well-known reference Expected Returns (An Investor's Guide to Harvesting Market Rewards). This data is displayed below as a scatterplot where the y-axis is the long-run average return return of the asset class and the x-asset is an index of illiquidity. A higher index (ie, to the right) implies less liquidity. For example, the venture capital as an asset class is assigned to the least liquid (most illiquid) asset class but it also plots the highest long-run average return.

In regard to the illiquidity risk premium, which of the following statements it TRUE?

a. In general illiquid asset classes offer high risk-adjusted returns

b. These charts demonstrate that there do exists large illiquidity risk premiums ACROSS asset classes

c. There do exist large illiquidity risk premiums WITHIN many asset classes, but not ACROSS asset classes

d. Illiquid equities earn the same returns as liquid equities; and illiquid bonds earn the same returns as liquid bonds

708.2. Illiquidity risk premiums compensate investors for the inability to access capital immediately and/or for the market's withdrawal of liquidity during a crisis. Andrew Ang details four different ways that an investor (asset owner) might capture or "harvest" the illiquidity premium. However, among these four, which is the simplest to implement and has the greatest impact on portfolio returns?

a. Dynamic rebalancing at the aggregate level

b. Market making at the individual security level

c. Holding less liquid securities within asset classes

d. Holding passive allocations to illiquid asset classes

708.3. You are consulting to a large endowment fund that is in the process of determining its asset allocation budget. An important sub-project in this process is a recommendation for the definition of, target allocation to, and hurdle rates associated with, illiquid assets. In short, you need to help develop the endowment's Portfolio Choice Model for illiquid assets. In regard to this sub-project, members of your staff (Phillip, Debra, Peter, and Mary) makes suggestions that include the following four assertions. According to Ang, each of these is true EXCEPT which is probably false?

a. Phillip says: The longer the time between liquidity events for an asset--ie, the less liquid the asset--the LOWER its optimal allocation in the portfolio

b. Debra says: The longer we need to wait to exit an investment--ie, the later the arrival of liquidity events--the HIGHER should be our illiquidity hurdle rate

c. Peter says: Due to the nature of factor risk and idiosyncratic risk in illiquid markets, to the extend we allocate to illiquid assets, it is really important for us to assign (or delegate to) genuinely skilled investors to this asset class

d. Mary says: It's actually not very important that we identify skill in the illiquid asset class because we can rather easily benchmark against tradeable indexes which will allow us to separate factor risk from manager skill (aka, alpha)

Answers here:

Questions:

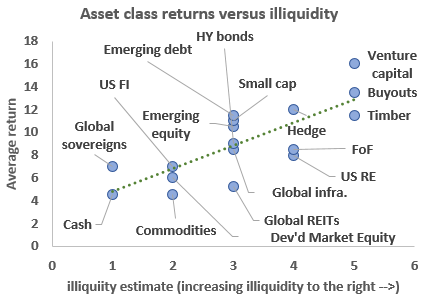

708.1. In order to identify the presence of illiquidity risk premium(s), Andrew Ang references data presented by Antti Ilmanen in his well-known reference Expected Returns (An Investor's Guide to Harvesting Market Rewards). This data is displayed below as a scatterplot where the y-axis is the long-run average return return of the asset class and the x-asset is an index of illiquidity. A higher index (ie, to the right) implies less liquidity. For example, the venture capital as an asset class is assigned to the least liquid (most illiquid) asset class but it also plots the highest long-run average return.

In regard to the illiquidity risk premium, which of the following statements it TRUE?

a. In general illiquid asset classes offer high risk-adjusted returns

b. These charts demonstrate that there do exists large illiquidity risk premiums ACROSS asset classes

c. There do exist large illiquidity risk premiums WITHIN many asset classes, but not ACROSS asset classes

d. Illiquid equities earn the same returns as liquid equities; and illiquid bonds earn the same returns as liquid bonds

708.2. Illiquidity risk premiums compensate investors for the inability to access capital immediately and/or for the market's withdrawal of liquidity during a crisis. Andrew Ang details four different ways that an investor (asset owner) might capture or "harvest" the illiquidity premium. However, among these four, which is the simplest to implement and has the greatest impact on portfolio returns?

a. Dynamic rebalancing at the aggregate level

b. Market making at the individual security level

c. Holding less liquid securities within asset classes

d. Holding passive allocations to illiquid asset classes

708.3. You are consulting to a large endowment fund that is in the process of determining its asset allocation budget. An important sub-project in this process is a recommendation for the definition of, target allocation to, and hurdle rates associated with, illiquid assets. In short, you need to help develop the endowment's Portfolio Choice Model for illiquid assets. In regard to this sub-project, members of your staff (Phillip, Debra, Peter, and Mary) makes suggestions that include the following four assertions. According to Ang, each of these is true EXCEPT which is probably false?

a. Phillip says: The longer the time between liquidity events for an asset--ie, the less liquid the asset--the LOWER its optimal allocation in the portfolio

b. Debra says: The longer we need to wait to exit an investment--ie, the later the arrival of liquidity events--the HIGHER should be our illiquidity hurdle rate

c. Peter says: Due to the nature of factor risk and idiosyncratic risk in illiquid markets, to the extend we allocate to illiquid assets, it is really important for us to assign (or delegate to) genuinely skilled investors to this asset class

d. Mary says: It's actually not very important that we identify skill in the illiquid asset class because we can rather easily benchmark against tradeable indexes which will allow us to separate factor risk from manager skill (aka, alpha)

Answers here:

Last edited by a moderator: