Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

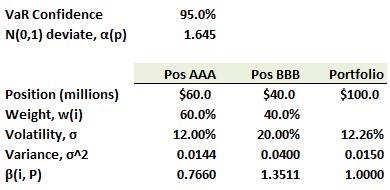

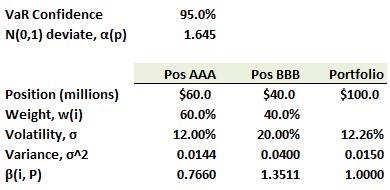

710.1. Consider a $100.0 million portfolio with two positions, Position AAA and Position BBB. The weights, volatilities, and betas are shown below; please note that the betas, β(i,P), represent the position betas with respect to the portfolio:

Which is nearest to the 95.0% component value at risk (VaR) of Position BBB?

a. $7.01

b. $8.33

c. $10.90

d. $13.16

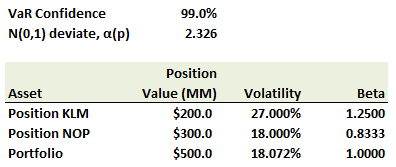

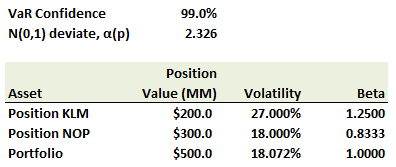

710.2. Consider a $500.0 million portfolio with two positions, Position KLM and Position NOP. The weights, volatilities, and betas are shown below; please note that the betas, β(i,P), represent the position betas with respect to the portfolio:

Each of the following statements is true EXCEPT which is false?

a. The 99.0% marginal VaR of Position NOP is about 0.350

b. The 99.0% component VaR of Position KLM is about $90.4 million

c. The 99.0% incremental VaR of Position KLM is about $84.6 million

d. The 99.0% incremental VaR of Position NOP is about $84.6 million

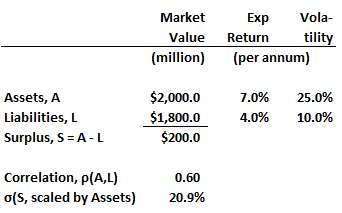

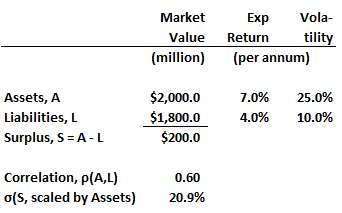

710.3. At the beginning of the year, a pension fund has $2.00 billion in assets and $1.80 billion in liabilities. The expected return and volatility, respectively of assets and liabilities are shown below:

The return correlation is 0.60. Which is nearest to the pension's 99.0% one-year worst expected shortfall (note that a shortfall is when liabilities are greater than assets; or equivalently, negative surplus)?

a. zero

b. $268.0 million

c. $417.6 million

d. $703.5 million

Answers here:

Questions:

710.1. Consider a $100.0 million portfolio with two positions, Position AAA and Position BBB. The weights, volatilities, and betas are shown below; please note that the betas, β(i,P), represent the position betas with respect to the portfolio:

Which is nearest to the 95.0% component value at risk (VaR) of Position BBB?

a. $7.01

b. $8.33

c. $10.90

d. $13.16

710.2. Consider a $500.0 million portfolio with two positions, Position KLM and Position NOP. The weights, volatilities, and betas are shown below; please note that the betas, β(i,P), represent the position betas with respect to the portfolio:

Each of the following statements is true EXCEPT which is false?

a. The 99.0% marginal VaR of Position NOP is about 0.350

b. The 99.0% component VaR of Position KLM is about $90.4 million

c. The 99.0% incremental VaR of Position KLM is about $84.6 million

d. The 99.0% incremental VaR of Position NOP is about $84.6 million

710.3. At the beginning of the year, a pension fund has $2.00 billion in assets and $1.80 billion in liabilities. The expected return and volatility, respectively of assets and liabilities are shown below:

The return correlation is 0.60. Which is nearest to the pension's 99.0% one-year worst expected shortfall (note that a shortfall is when liabilities are greater than assets; or equivalently, negative surplus)?

a. zero

b. $268.0 million

c. $417.6 million

d. $703.5 million

Answers here: