Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

712.1. Your firm has been retained to evaluate a roster of hedge fund managers, all of whom claim to be successful market timers. Each of the following is a valid hypothesis with respect to at least some apparent successful market timing by the manger and its associated methodology for the determination of successful market timing EXCEPT which of these is the LEAST LIKELY to to be an effective (hypothesis and) test of successful timing?

a. The market timing manager implicitly holds a call option on the market: we can use an option-pricing model to assign a dollar value to perfect timing ability

b. The market timing manager implicitly shifts from low- to high-risk regimes: we can test for this timing by comparing sub-period Sharpe ratios to the cumulative (all periods) Sharpe ratio

c. The security characteristic line (SCL) is non-linear with beta as an increasing function of the market's excess return: this can be tested by adding a quadratic term to the usual index model

d. The security characteristic line (SCL) has a bend (aka, kink) with a larger beta value when the market outperforms: this can be tested by adding a dummy variable to the usual index model

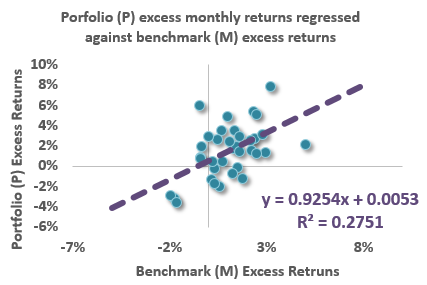

712.2. A hedge fund manager's monthly returns (over the last three years) are regressed against the benchmark, with the high-level results shown below:

As shown per the regression intercept, the observed monthly alpha (α) is +53.0 basis points. Not displayed on the chart is the standard error of the regression (SER) which represents the residual-based tracking error; in this regression, this tracking error value (TE; or SER) is 2.250%. This implies an residual-based information ratio of 0.00530/0.02250 = 0.23556.

If we wanted to demonstrate that this manager's alpha is significant with 99.0% confidence, which of the below is nearest length of the sample required?

a. 7.5 months

b. 13 months

c. 3.5 years

d. Ten years

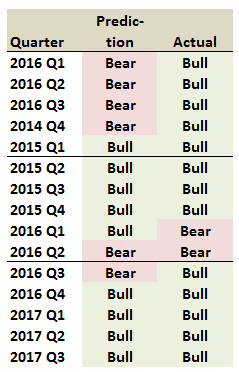

712.3. Over the last 15 quarters, a macroeconomic analyst made a bullish forecast 60.0% of the time (9 out of 15 quarters), but the market was up fully 86.7% of the periods (13 out of 15 quarters). Each of the 15 quarters is shown below both the analyst's prediction and the actual quarter's performance:

One simple measure of market timing ability is Bodie's forecasting measure given by P(1) + P(2) - 1.0, where P(1) is the proportion of correct forecasts of bull markets and P(2) is the proportion for bear markets. Under the measure, a perfect forecaster would score 1.0. Which is nearest to the macroeconomic analyst's score over the 15 quarter period?

a. Zero

b. 0.115

c. 0.333

d. 0.467

Answers here:

Questions:

712.1. Your firm has been retained to evaluate a roster of hedge fund managers, all of whom claim to be successful market timers. Each of the following is a valid hypothesis with respect to at least some apparent successful market timing by the manger and its associated methodology for the determination of successful market timing EXCEPT which of these is the LEAST LIKELY to to be an effective (hypothesis and) test of successful timing?

a. The market timing manager implicitly holds a call option on the market: we can use an option-pricing model to assign a dollar value to perfect timing ability

b. The market timing manager implicitly shifts from low- to high-risk regimes: we can test for this timing by comparing sub-period Sharpe ratios to the cumulative (all periods) Sharpe ratio

c. The security characteristic line (SCL) is non-linear with beta as an increasing function of the market's excess return: this can be tested by adding a quadratic term to the usual index model

d. The security characteristic line (SCL) has a bend (aka, kink) with a larger beta value when the market outperforms: this can be tested by adding a dummy variable to the usual index model

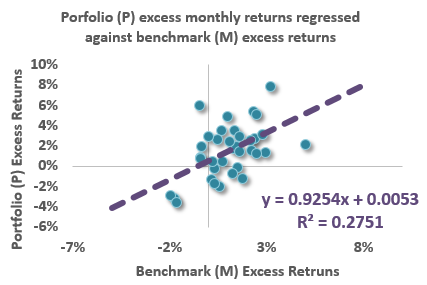

712.2. A hedge fund manager's monthly returns (over the last three years) are regressed against the benchmark, with the high-level results shown below:

As shown per the regression intercept, the observed monthly alpha (α) is +53.0 basis points. Not displayed on the chart is the standard error of the regression (SER) which represents the residual-based tracking error; in this regression, this tracking error value (TE; or SER) is 2.250%. This implies an residual-based information ratio of 0.00530/0.02250 = 0.23556.

If we wanted to demonstrate that this manager's alpha is significant with 99.0% confidence, which of the below is nearest length of the sample required?

a. 7.5 months

b. 13 months

c. 3.5 years

d. Ten years

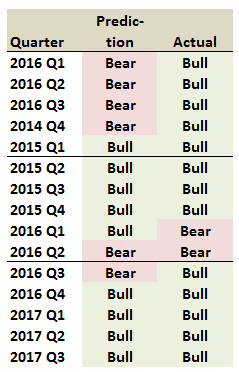

712.3. Over the last 15 quarters, a macroeconomic analyst made a bullish forecast 60.0% of the time (9 out of 15 quarters), but the market was up fully 86.7% of the periods (13 out of 15 quarters). Each of the 15 quarters is shown below both the analyst's prediction and the actual quarter's performance:

One simple measure of market timing ability is Bodie's forecasting measure given by P(1) + P(2) - 1.0, where P(1) is the proportion of correct forecasts of bull markets and P(2) is the proportion for bear markets. Under the measure, a perfect forecaster would score 1.0. Which is nearest to the macroeconomic analyst's score over the 15 quarter period?

a. Zero

b. 0.115

c. 0.333

d. 0.467

Answers here: